Mike Clark

Consulting Actuary

The original intent of the Pension Protection Act of 2006 (PPA) was to bring “market value pension funding” to the US single employer pension system. For too long, it was said, sponsors had been undervaluing liabilities with overstated expected return rates. Pension obligations are similar to high quality bonds, so the yields on those high-quality bonds are the appropriate way to determine funding ratios and minimum contributions.

That last sentence was a tacit recognition that accounting liabilities and the cost of settling obligations were already moving with market rates. Indeed, a thriving cottage industry of liability driven investments (LDI) had sprouted the previous decade to reduce net investment risk against these liabilities.

Nipped in the Bud

But before market value funding could even begin germinating, a financial crisis and brutal forced march of declining interest rates drove a series of funding relief laws to “stabilize” the rates used for minimum contribution purposes. (The latest of these relief measures was the Infrastructure Investment and Jobs Act of 2021.) For fourteen years, sponsors have benefitted from the higher, less volatile rates that stabilization provided to reduce the level and uncertainty of cash contributions.

This may have led some to assume that stabilization always provides a benefit to plan sponsors, but unfortunately and unexpectedly for 2023, that assumption could be wrong.

Maybe You’ve Heard…

You’ve probably noticed that just about every investment class out there is taking a historic beating so far in 2022. According to the Principal Pension Risk Management Dashboard, a typical traditional 60% equity / 40% core bond portfolio has dumped 20% of its value through September this year. An LDI portfolio of 20% equity / 80% long bonds has shed 28%. Fortunately, the market value liabilities for these plans have also plummeted with the rise in long term bond rates, making the net positions of most plans unexpectedly consistent this year.1

Calm in the Storm

But PPA stabilized funding target liabilities probably won’t be decreasing at all for 2023. In fact, the 25-year average bond rates underlying stabilization are actually going to drive an increase of funding liability next year of about 1% to 2% for most plans.

Like an oblivious patron reading a newspaper in the corner of the saloon during a huge bar fight, the PPA funding target ignores the violence and volatility swirling around it. Equities, bonds, annuity purchase costs, and accounting liabilities can punch, kick, break chairs and fly through swinging doors all they want, the stabilized funding target will remain stable.

Stability a Bad Thing?

Ironically, this stability seems poised to work against plan sponsors for 2023. The refusal of the funding target to adjust to market conditions, which up to now has been a benefit, is now posing a potentially significant challenge for 2023.

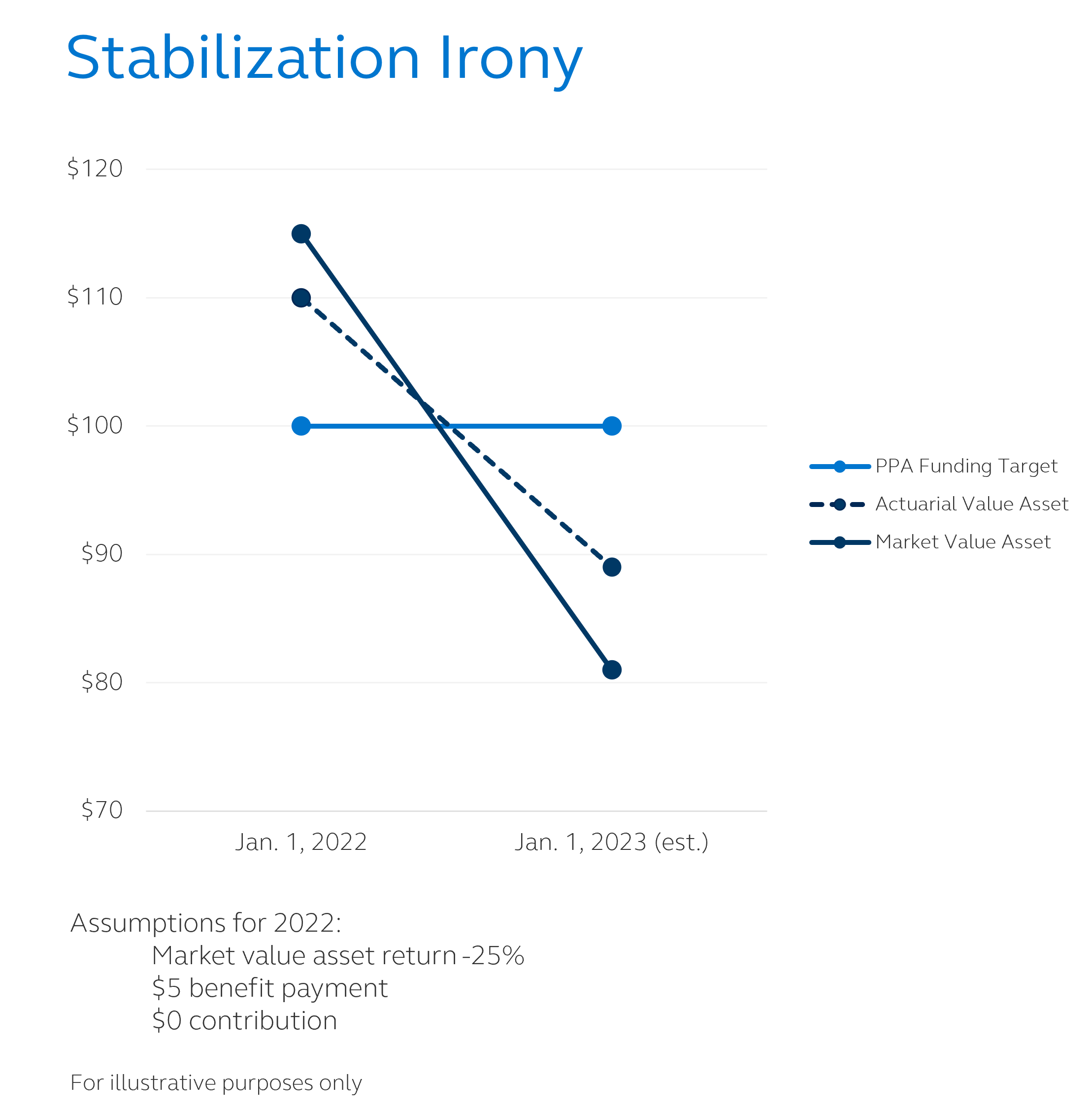

The hypothetical pension plan shown here had a funding surplus of $10 and a funding ratio of 110% for 2022 (based on the “smoothed” actuarial value of assets). [See previous blog: A rough ride for smoothed pension assets in 2023?]. Assuming a 25% investment loss at year end, the same plan is projected to have a funding shortfall of $11 and a funding ratio of 89% for 2023.

PPA minimum funding would require about a $1 contribution on that $11 shortfall, something the sponsor likely didn’t expect earlier this year. They probably also don’t anticipate communicating significantly lower funding ratios to their employees and pensioners in their annual funding notices.

LDI Surprise

These negative consequences may come as a particular shock to heavy LDI users, who have been conditioned to understand that their investments protected against large swings in funding positions. LDI does just that, but only for market value liabilities. LDI has hedged these specifically because both have lost similar value this year.

Alas, the PPA funding target simply doesn’t care. As the remaining scuffles in the bar brawl that is 2022 are settled, stabilized liabilities will calmly finish their drink, fold their paper under their arm, and carefully step over the fallen asset values to walk out the door—totally unchanged by the maelstrom—to deliver unexpectedly poor funding valuation results in 2023.

Surprise!