Insights and strategies to help keep retirements and budgets on track

Retirement in the U.S. is being redefined. Once a predictable milestone, it can now be more fluid—shaped by demographic shifts, personal choice, and financial necessity.

Some employees choose to work past retirement age for personal fulfillment, but many do so because they’re financially unable to retire when planned.

28% The projected increase in the number of employees over the age of 65 by 2033

A comprehensive Principal analysis reveals employers pay an average of

$103,000 per year for each employee working past age 65

This shift in retirement patterns affects both employees and employers. Employees may face increased stress and delays in achieving personal goals, while employers can struggle with workforce planning challenges and rising costs.

Higher salaries

Bonuses

Healthcare premiums

Paid time off

It’s the difference between what an employer pays an employee past their desired retirement age (65) compared to a new hire (age 25).

Desired retirement age varies by job, person, and industry, ranging from as early as 55 to 70 and older. For this analysis, age 65 is used to calculate delayed retirement costs.

On average, delayed retirement costs employers $103,000 per employee per year. Broken down by industry, the costs range from $75,000 to $126,000. The analysis organizes industries into four key categories:

Because delayed retirement costs vary widely by industry, proactive plan design is essential. Leveraging automated features can help manage expenses and help employees stay on track to retire on time.

A powerful way employers can potentially manage the numerous impacts of delayed retirement and help employees retire when they choose is through automated features.

While some may hesitate about the cost of implementing automated features, it can be significantly less than an employee who can’t retire when they choose.

The total employer contributions made over an employee’s entire career costs less than when that employee delays retirement by just one year.

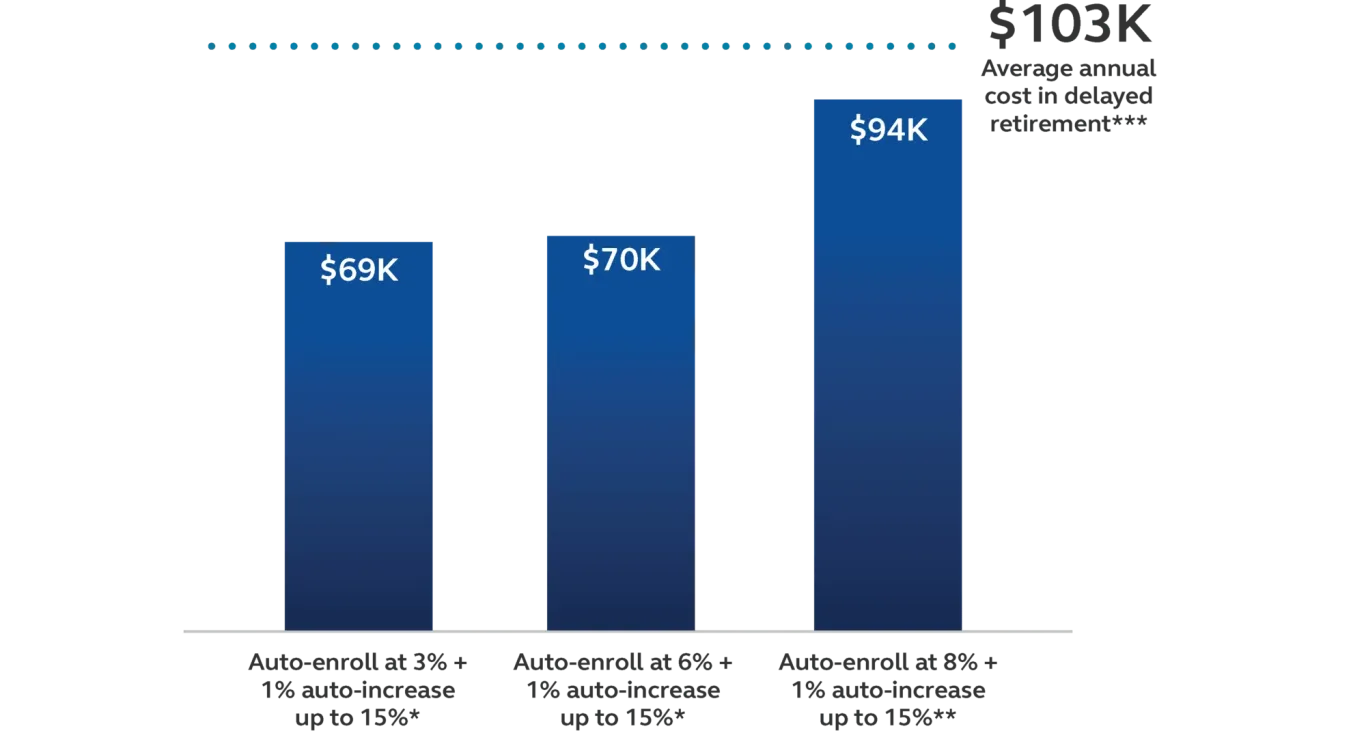

Cost comparison: Adding automated features versus delayed retirement

Total employer contributions (in future dollars without earnings):

The chart illustrates the extra costs in match contributions an employer may incur when adding automated plan features like automatic (auto) enrollment and auto-increase. The scenario assumes that employees would eventually enroll in the retirement plan on their own and the employer would make the necessary amount of matching contributions.

*Assumptions: An individual with a retirement age of 65, starting salary of $50,000 with 3% annual increase, an employer match of 50% up to 6%.

**Assumptions: An individual with a retirement age of 65, starting salary of $50,000 with 3% annual increase, an employer match of 50% up to 8%.

The scenario assumes that an employee would eventually self-enroll into the retirement plan at age 40, contributing enough to receive half of the maximum employer match. At age 50, it’s assumed their contribution amount will exceed the maximum employer match by 3%. The contribution percentage is rounded to the nearest whole percentage to account for plan and recordkeeper limits on partial percentages.

***Data is point in time and based on our calculations. The average annual cost of delayed retirement ($103,000) is based on the difference between total compensation (salaries, bonuses, health insurance premiums), and paid time off paid to an employee who delays retirement beyond the desired retirement age (age 65 for this analysis), compared to the compensation that could have been paid to someone entering the workforce at age 25 after the employer has exhausted the succession process.

For illustrative purposes only.

Delayed retirement impacts industries differently based on job type, compensation, and workforce demographics. Here’s how automated features might be able to help address these challenges and support retirement readiness.

Higher salaries and longer careers can drive up delayed retirement costs.

Potential plan strategies:

- Auto-enrollment at 8–10%

- 1% auto-increase

- Stretch match (e.g., 50% on first 8%)

- Immediate eligibility

Older workers can bring critical expertise, but some roles can be physically demanding.

Potential plan strategies:

- Auto-enrollment at 6%

- 1–2% auto-increase flexibility

- Annual re-enrollment

- Immediate eligibility

Shorter careers and physical demands make early savings essential.

Potential plan strategies:

- Auto-enrollment at 6%

- 1–2% auto-increase flexibility

- Immediate eligibility

- Annual re-enrollment

High mobility and varied wages challenge savings consistency.

Potential plan strategies:

- Dual auto-enrollment structure:

- Career employees: Immediate auto-enrollment at 4%

- Short-term employees: Delayed auto-enrollment (after 6-12 months) at 3%

- Graduated auto-increase options:

- Career track: 1% annual increase up to 10%

- Short-term track: Optional auto-increase after 1 year

- Simple, clear match structure

- Periodic re-enrollment campaigns

For employees it may cause:

- Emotional strain

- Delayed personal goals

- Decreased job satisfaction

For employers it could:

- Stall career progression

- Complicate succession planning

- Limit recruitment opportunities

- Shift workplace culture

Helping employees retire on their own terms supports more than just the bottom line, it helps keep career paths open, morale strong and teams engaged. Employers who integrate automated savings features can make meaningful progress toward both goals.

By making thoughtful plan design changes today, employers can reduce the financial strain of delayed retirements—and help employees step into their next chapter with confidence.

Contact your Principal® representative to learn how automated features can help your organization manage delayed retirement costs within your industry.