Keep investing in your future with confidence

A rollover IRA can give you more options to invest your money. Learn how it can help you grow your retirement savings.

What is a rollover IRA?

A rollover IRA is an “Individual Retirement Account” that allows you to invest for retirement, and the account can accept both pre-tax and post-tax money. It’s similar to an employer retirement plan, but when you roll over your savings to an IRA, you control and manage that IRA. It’s not connected to your former employer’s plan features. You can contribute to it and continue to enjoy tax deferred potential growth to help build your retirement savings.

4 key things to know about rollover IRAs

Contributions

In 2024, you can contribute an additional $7,000 per year to your IRA. If you’re over age 50, you can also make a “catch-up” contribution ($1,000 max) in 2024.1,2

Investments

Choose from a wide range of investment options that may meet your risk tolerance and retirement goals, including stocks, bonds, exchange-traded funds (ETFs), and mutual funds.

How IRAs are managed

You can manage your IRA yourself, use your financial advisor to manage it for you, or your IRA provider may offer a digital investment solution that recommends and manages a diversified investment portfolio for you.

How the rollover process typically works

1 - OPEN AN IRA

You’ll need to open an account with an IRA provider.

2 - CONTACT YOUR 401(k) PROVIDER

Initiate the rollover process and provide your IRA account information.

3 - CHECK GETS MAILED

Tell your 401(k) provider where to send the check, which can take 2-3 weeks.

4 - PROCESS IS COMPLETE

Once the money arrives, it will be invested in your IRA.

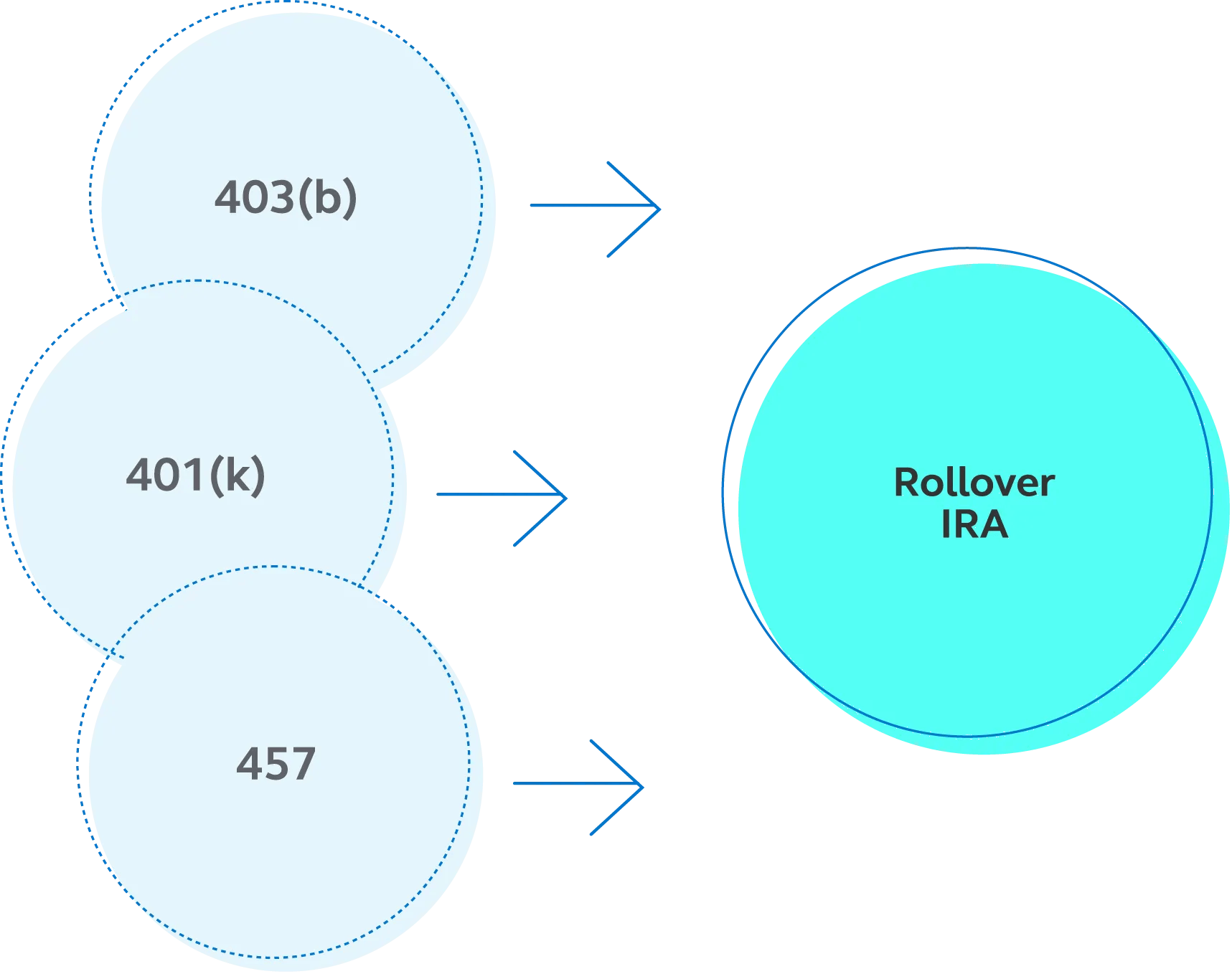

An Individual Retirement Account (IRA) is a tax-advantaged investment account that helps you save for retirement. A rollover IRA is simply an IRA that's used to receive (rollover) your retirement funds from an employer sponsored plan such as a 401(k) or 403(b) account after you leave your job.

This generally depends on the type of money in your original account and your tax situation. It's common to roll your pretax money into a traditional IRA, and post-tax money into a Roth IRA. Your tax adviser can help you think through these considerations.

A Roth Individual Retirement Account (IRA) is an after-tax retirement savings account. Why after tax? You create and add to a Roth IRA with money that's already been taxed. That means that both growth and withdrawals are not taxed when you take a qualified distribution.1 If you think you might be in a higher tax bracket in retirement, saving in a Roth IRA now may be extra advantageous.

1 Your account must be open for 5 years and you must be over 59½ to be eligible for qualified tax-free withdrawals of earnings.

Yes. Once you roll over your retirement savings to an IRA, you can make contributions to your new account. The IRS has a limit on how much you can add to the account. While Roth IRAs have income limits for contributions, traditional IRAs do not. To contribute to a traditional IRA, you must have earned income, but there’s no maximum limit.1

1 Deductibility of contributions is dependent upon coverage by an employer-sponsored retirement plan for you or your spouse and your Modified Adjusted Gross Income (MAGI).

Some institutions charge a processing fee (or other fees) to close your retirement plan account and process the rollover.

In a traditional IRA, you can withdraw contributions and earnings penalty-free at age 59½, or earlier for certain hardships. You have to start taking required minimum distributions after age 73.

In a Roth IRA, you can withdraw contributions at any time, without penalty. You can withdraw earnings penalty-free at age 59½, or earlier for certain hardships, as long as you’ve followed the rules of a Roth IRA.1 You’re not required to withdraw your money at any age.

1 Your account must be open 5 years and you must be over 59½ to be eligible for qualified tax-free withdrawals of earnings.

Every IRA provider is different, but there are generally a few potential costs for an IRA that involve one or more of the following types of expenses:

- Expense ratios. Every mutual fund has an expense ratio because there are general costs associated with managing the fund. This expense is calculated in terms of a percentage. Always review the investment expense for each investment option selected.

- Transaction fee. A fund may have a fee for purchasing, selling or may not have any fee at all. (Sometimes these are known as “loads” of a fund.)

- Account maintenance fee. IRA providers may charge an annual cost for managing the account. Some providers waive the fee for account balances over a certain amount, such as when there’s $10,000 or more the account.

Unless you invest in a bank asset, such as a CD or money market account, there’s no way to guarantee a rate of return on an investment. Most people saving for retirement have their money invested in a fund that’s made up of stocks and bonds. These investments fluctuate in value, but they have the potential to provide higher returns than a bank money market account or CD, for example. Your actual rate of return will depend on the investments you select for your portfolio.

As long as your money stays in an employer retirement plan, there is no deadline for rolling over. However, if you take the money out of your employer plan and have a check sent to you, the IRS gives you 60 days to roll it into another qualified plan.

What that means is you need to deposit all your funds into a new IRA, 401(k) or other qualified retirement account within 60 days of the distribution. If you don’t meet that deadline, your retirement will be subject to income taxes. (And if you’re under age 59½, an early withdrawal penalty may also apply.)

Most rollovers happen electronically with a “direct” rollover, making delays or mistakes less likely. For example, you leave your job and want to rollover your 401(k) to a traditional IRA. You have your 401(k) plan provider directly roll that money over to your new IRA. You can maintain the tax-deferred status of your savings by doing this.

Even with direct rollovers, you should aim to get the funds transferred within the 60-day window.

RMDs are minimum amounts that you, as a traditional IRA owner, must withdraw annually starting with the year you reach 73. You can withdraw more than the minimum, and any withdrawals are part of your taxable income. There’s a formula for determining your RMD, which you can find on the IRS website. Roth IRA owners are not required to withdraw your money at any age.

Roth IRA owners are not required to withdraw your money at any age.

When it comes to investing, there are a lot of terms to understand to help you make confident, informed decisions. Read investment product and account terms to know.

Call our financial professionals and they’ll walk you through the process of an IRA rollover.

Monday – Friday, 7 a.m. – 9 p.m. CT