Across Singapore, Hong Kong, and Malaysia, people are facing tough choices driven by present-day financial challenges.

4 min read |

In 2022, several countries in Asia stood out in the inaugural release of the Global Financial Inclusion Index (the Index). Singapore topped the list as the most financially inclusive country, with Hong Kong coming in fourth. Malaysia (20th) showed signs of potential rapid development into a mature capital and wealth market.

These findings revealed an opportunity to get a pulse on consumer sentiment amid market pressures such as inflation and the rolling back of financial assistance from the COVID-19 pandemic. Singapore, Hong Kong, and Malaysia provide diverse Asian market representation to draw insights about how these environmental factors are influencing individuals’ levels of security, confidence, and optimism toward financial inclusion.

The results were illuminating, while not entirely surprising. Consumers voiced that the pullback of pandemic-related support and higher inflation are driving increased financial strain. Overall, respondents said that lower levels of savings and higher levels of debt are hampering their ability to work toward and achieve long-term retirement goals.

Methodology:

To assess individuals’ point-in-time perceptions of financial inclusion in Asia, Principal Financial Group® fielded a survey of 1,500 household financial decision makers across Singapore, Hong Kong, and Malaysia (April 26–May 2, 2023).

Explore more of the key findings below.

Overall findings

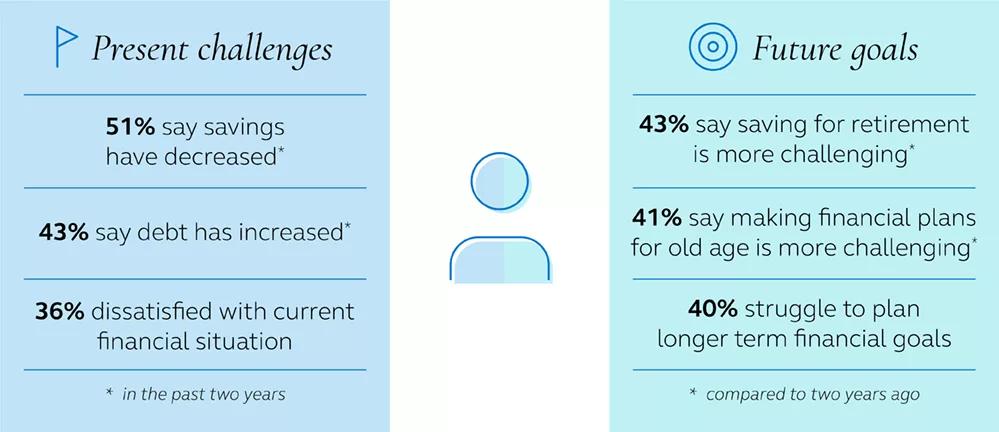

Financial inclusion isn't just about how people feel about their present situation—it's about finding balance between current and future needs. Across all three markets, people are facing tough choices driven by present-day financial challenges. Respondents shared that it’s becoming more difficult, and in some cases impossible, to contribute to emergency and retirement savings.

Many financial responsibilities are harder to afford today than they were two years ago. Wider macroeconomic and social factors are also having a greater negative impact on people’s sense of financial stability. Compared to two years ago:

- Around 1 in 3 people are dissatisfied with their current financial situation, and many feel they’re in a materially worse financial position today.

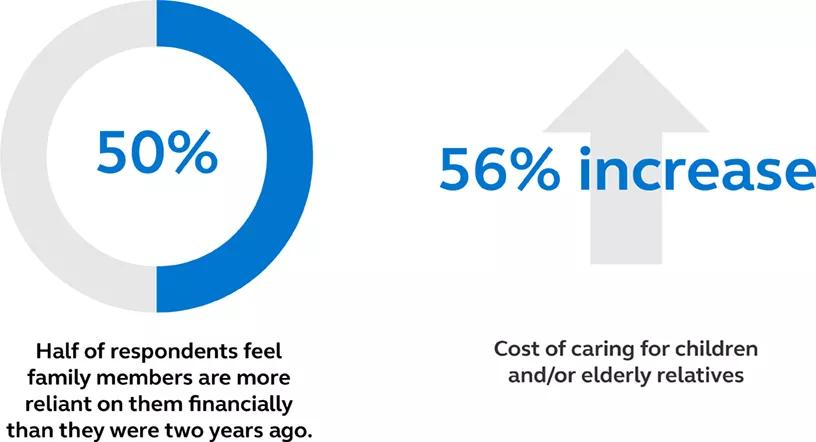

- Half feel family members such as children and elderly relatives are more reliant on them financially.

For many, day-to-day costs like child and elder care are now more of a burden.

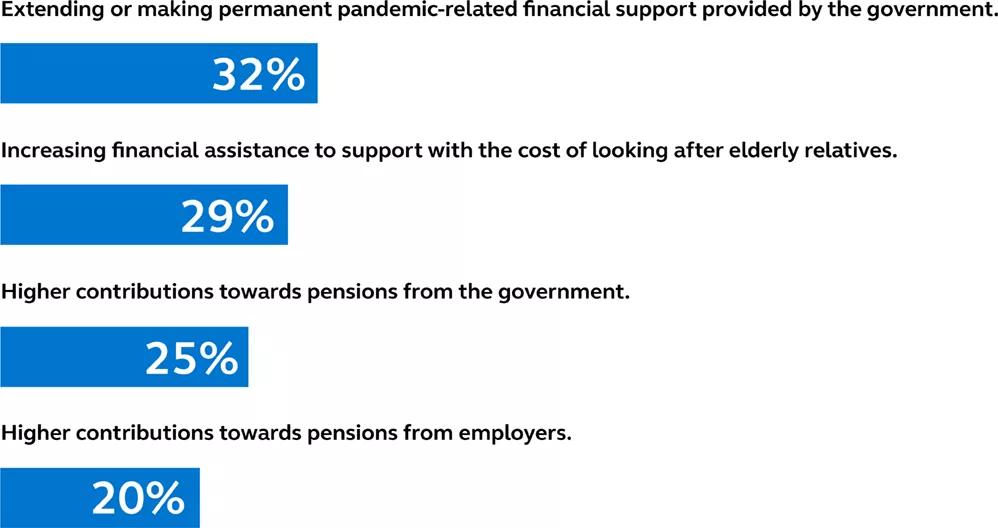

The financial lives of respondents in Singapore, Hong Kong, and Malaysia remain precarious due to the increased global costs of living, despite a high degree of trust in governments, financial institutions, and employers to act in a financially inclusive manner.

- A quarter of respondents say higher contributions toward pensions from the government would be the most useful in helping people feel more financially supported.

- Twenty percent of respondents say higher contributions toward pensions from employers would be the most useful in helping people feel more financially supported.

What kind of support would help people feel more financially included?

The financial lives of respondents in Singapore, Hong Kong, and Malaysia remain precarious due to the increased global costs of living, despite a high degree of trust in governments, financial institutions, and employers to act in a financially inclusive manner.

- A quarter of respondents say higher contributions toward pensions from the government would be the most useful in helping people feel more financially supported.

- Twenty percent of respondents say higher contributions toward pensions from employers would be the most useful in helping people feel more financially supported.

Day-to-day costs like child and elder care are now more of a struggle. In Hong Kong and Singapore, these headwinds have begun to hamper people’s ability to save for retirement, plan for their financial future, and even afford basic but necessary costs such as rent.

- Forty-three percent say saving for retirement is more difficult than it used to be.

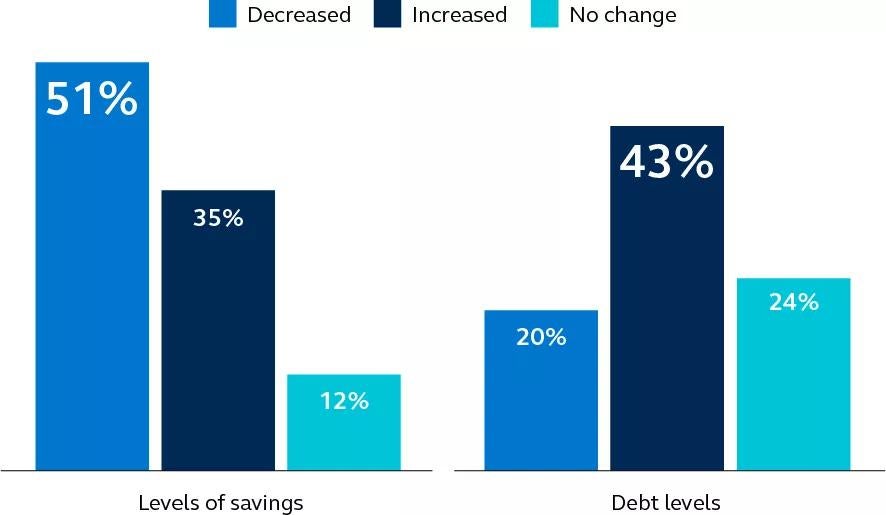

- Fifty-one percent of households say their level of savings has decreased and 43% have seen their level of debt increase.

Falling savings and rising debts put strain on day-to-day costs.

How the following factors have changed within the past two years

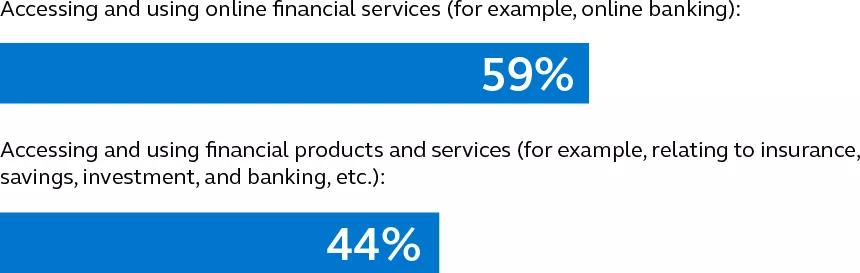

Financial inclusion is about much more than digitalization. Some tools and services are now more readily available than they were two years ago, such as access to online banking, but these Asia-specific findings illustrate a gap and uptake still exists.

- Forty-four percent say accessing and using financial products and services has gotten easier compared to two years ago, while 20% said they had become more difficult to access and use.

- Nearly 60% said that accessing and using online financial services (e.g., online banking) had gotten easier compared to two years ago, while 13.5% said services are more difficult to access and use today.

Access to financial products and services is easier post-pandemic.

% who say the following actions are easier compared to two years ago

Digital financial services are a bright spot.

What kind of support would help people feel more financially included? Respondents in each market share the top three factors that would be the most useful in helping people feel more financially supported and included.

- Singapore

- 32%: Increasing financial assistance to support with the cost of caring for elderly relatives

- 31%: Extending or making permanent the pandemic-related financial support provided by the government

- 28%: Extending or making permanent the flexibility in work location and/or work schedule offered by employers

- Hong Kong

- 30%: Extending or making permanent the pandemic-related financial support provided by the government

- 29%: Higher contributions toward pensions from the government

- 28%: Increasing financial assistance to support with the cost of caring for elderly relatives

- Malaysia

- 34%: Extending or making permanent the pandemic-related financial support provided by the government

- 27%: Extending or making permanent the pandemic-related financial support offered by financial services companies

- 26%: Increasing financial assistance to support the cost of caring for elderly relatives

Access market-specific fact sheets:

What's next?

To learn more about the Global Financial Inclusion Index, visit principal.com/financial-inclusion. Look for the 2023 Global Financial Inclusion Index in fourth quarter this year.