You’ve opened a retirement account. You’re making regular contributions. You invested with the expectation of making a profit. How do you know your money is working for you?

It’s all about finding your just-right mix of investments (called asset allocation) that balances your tolerance for risk and potential reward for your dollars invested over time.

“Asset allocation works in tandem with your comfort with risk; it helps set the foundation for the success of your investment strategy,” says Heather Winston, financial professional and product director for Retirement and Income Solutions at Principal®.

You don’t need to know all the ins and outs right away but getting comfortable with asset allocation will help you feel more confident in your choices. Here are some steps to help you find a good mix and maintain it over time.

What are asset classes?

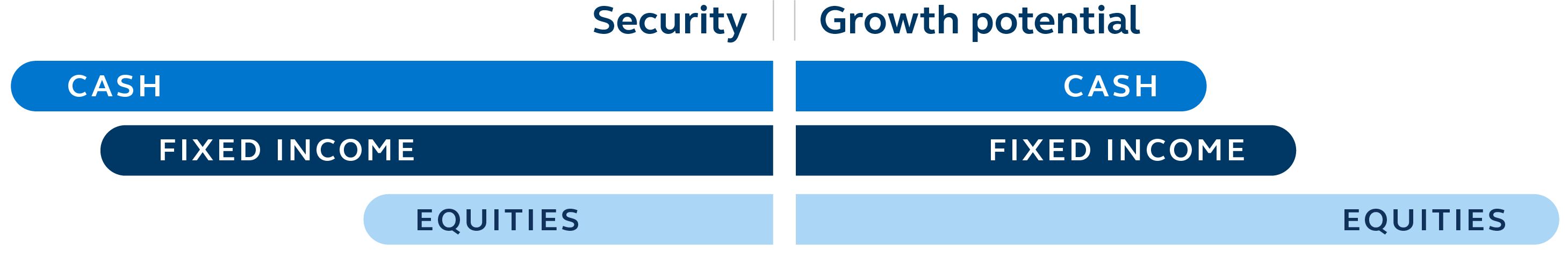

Investors generally work with three basic asset types (called “classes”): cash, fixed income, and equities. Each offers a different mix of risk and return and serves its own purpose in an overall asset allocation plan. The three rarely move in tandem, so holding some of each class helps provide opportunities for growth at any point in time.

Cash

Cash and cash equivalents (like money market funds and certificates of deposit) are the least risky assets. Holding this class in your portfolio enables you to have cash on hand to make purchases and take withdrawals, and it’s not highly correlated to other asset classes. While the most stable of investments, cash holdings offer the lowest potential return.

Fixed income

Bonds are the most common type of fixed income, an investment that can generally provide income at regular, predictable intervals. Fixed income is normally known for being lower risk—just not as low as cash. Investments may experience price fluctuations and lose value if not held to maturity (the intended term of the bond). But with returns typically higher than cash, fixed income can be a stable base for your asset allocation.

Equities

Equities, or stocks, can be the growth engine of an investment portfolio. The return over time tends to come from increases in the price of a stock. Because growth isn’t guaranteed, stocks carry more risk than the other two asset classes; they’ll likely fluctuate and lose value at least some of the time. But they also have the potential for a higher return over long periods.

Learn more:

What is a stock?

What is a bond?

How do you know what allocation is right for you?

Your unique asset allocation—or mix of investments—comes down to several factors:

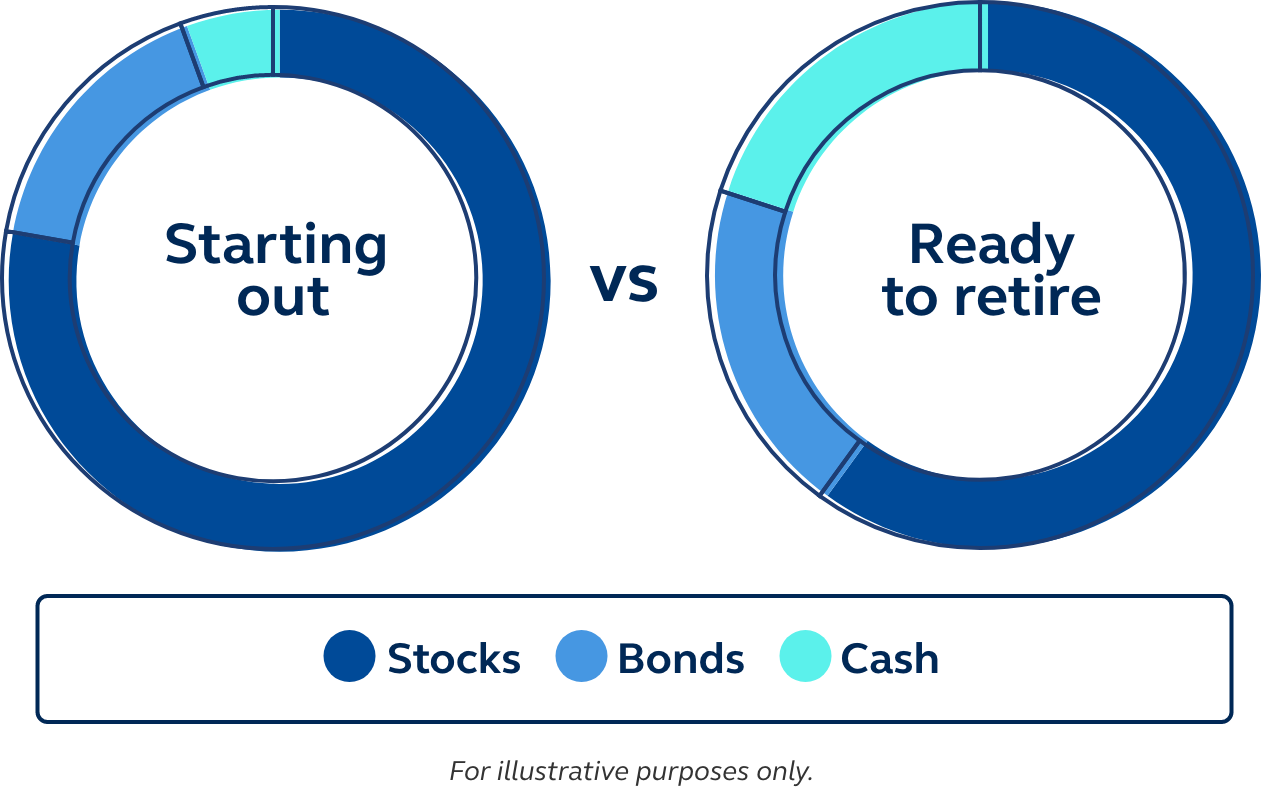

Age and time

Knowing how much time you have can help define how you invest. If you have more time, you might hold higher proportions of equities to capture that additional potential growth. As you get closer to retirement age (or needing to access your money), it’s common to allocate more to fixed income to minimize the risk of losing the growth you’ve had over the earlier years.

Risk tolerance

Some people are comfortable knowing they could lose money in the short run if there’s a possibility for bigger gains in the long run. Others are more conservative, preferring to take less risk with the money. Risk tolerance is the amount of risk you can emotionally handle at any given point in time and can vary depending on your age, lifestyle, goals, needs, and income.

Take our risk tolerance quiz (PDF) to get a taste of your current level of comfort—and know it can change over time.

Goals

Regardless of your goals, investing requires time for assets to grow. But depending on what you’re investing for, your asset allocation can differ.

For example, if you’re saving for a home you want to buy in seven years, you may opt for a more conservative mix of cash and fixed income. If you’re saving for retirement that’s 30 years away, you might create a mix heavy in equities and light in fixed income.

Do you have to create your own asset allocation?

Not necessarily. A financial professional can help you figure out what the right mix of investments is for your age, goals, and risk tolerance.

There are also options in investment products where asset allocation is built in to how they manage your assets. For example, some retirement plans offer what are called target date funds and target risk funds, which take care of asset allocation for you.

Alternatively, you may consider a managed account product for an even deeper level of personalization.

What's next?

What does your asset allocation look like? Log in to principal.com to find out. First time logging in? Get started by creating an account.