Amy Friedrich, president of Benefits and Protection at Principal, introducing the Well-Being Index.

2025 Wave 3 of 3

The Principal Financial Well-Being Index is our comprehensive quarterly study of the financial health of U.S. employers. The index score factors in business health, growth, and optimism based on economic outlook. Our research draws insights from business owners, key decision makers, and executive leaders across organizations ranging from small businesses to large enterprises (2–10,000 employees) that offer employee benefits and retirement plans.

Businesses report a significant decline in the growth of the U.S. economy and a modest decline in the growth of their local economy. Recovery from the April 2025 dip still lags for their own business.

“The story of 2025 is that many businesses are primed for growth, but broader conditions haven’t caught up yet. Employers are ready to modernize, engage their teams, and grow, while diligently planning for multiple scenarios amid ongoing uncertainty.”

Amy Friedrich

President, Benefits and Protection, Principal®

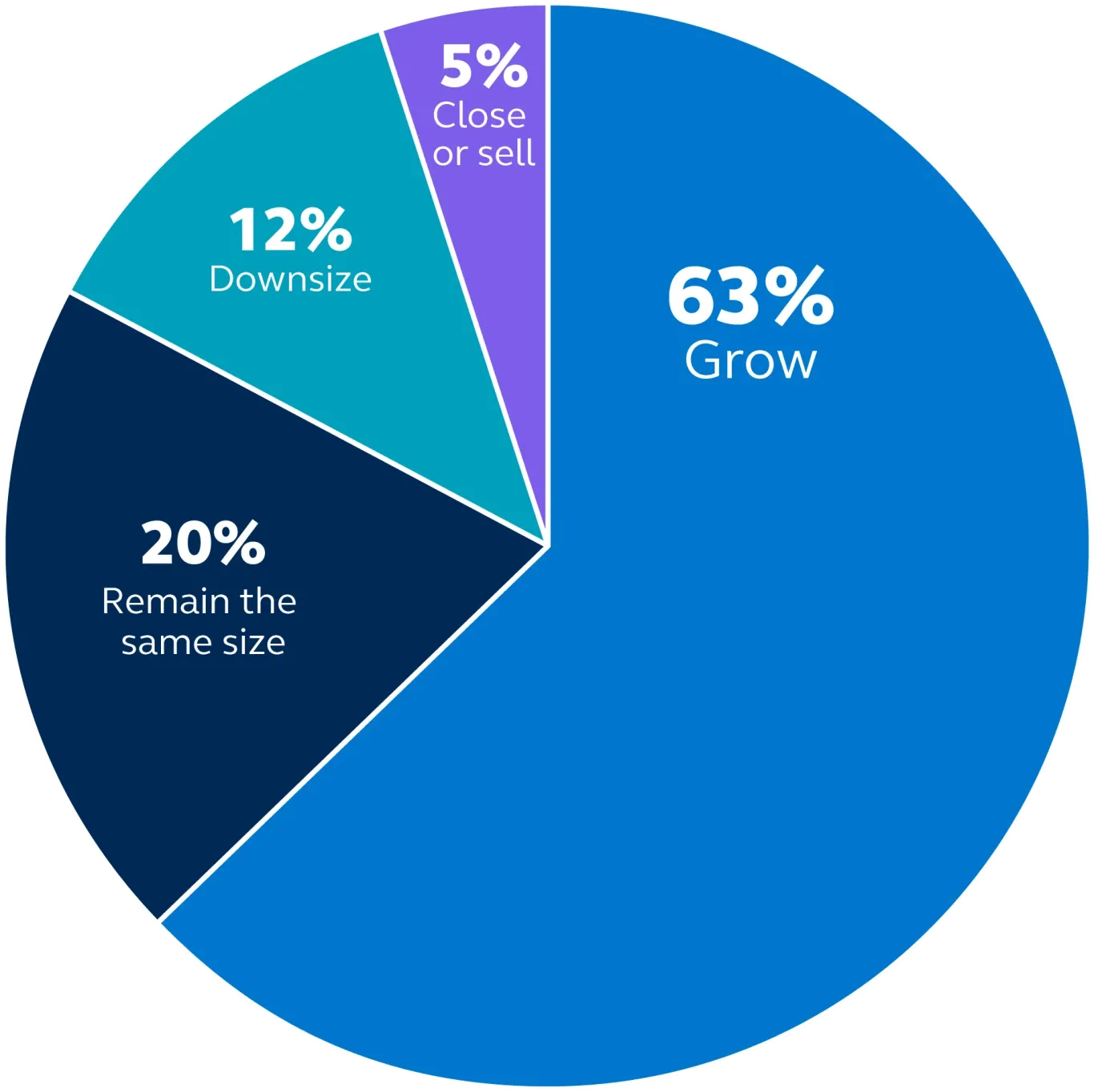

Businesses are looking forward to growth within the next 12 months, with technology and infrastructure upgrades driving areas of growth.

- Increase number of employees

- Invest in expansion

- Expand product or service offerings

- Upgrade technology and/or infrastructure

- Increase marketing and advertising

Those that expect to grow are significantly less likely to decrease staff.

61%

67%

“We have hit our quarterly goals year over year and are consistently beating our revenue targets. We continue to interview and hire new team members, and we’re actively looking for ways to improve employee retention and satisfaction.”

Management business with 3,000 employees in Virginia

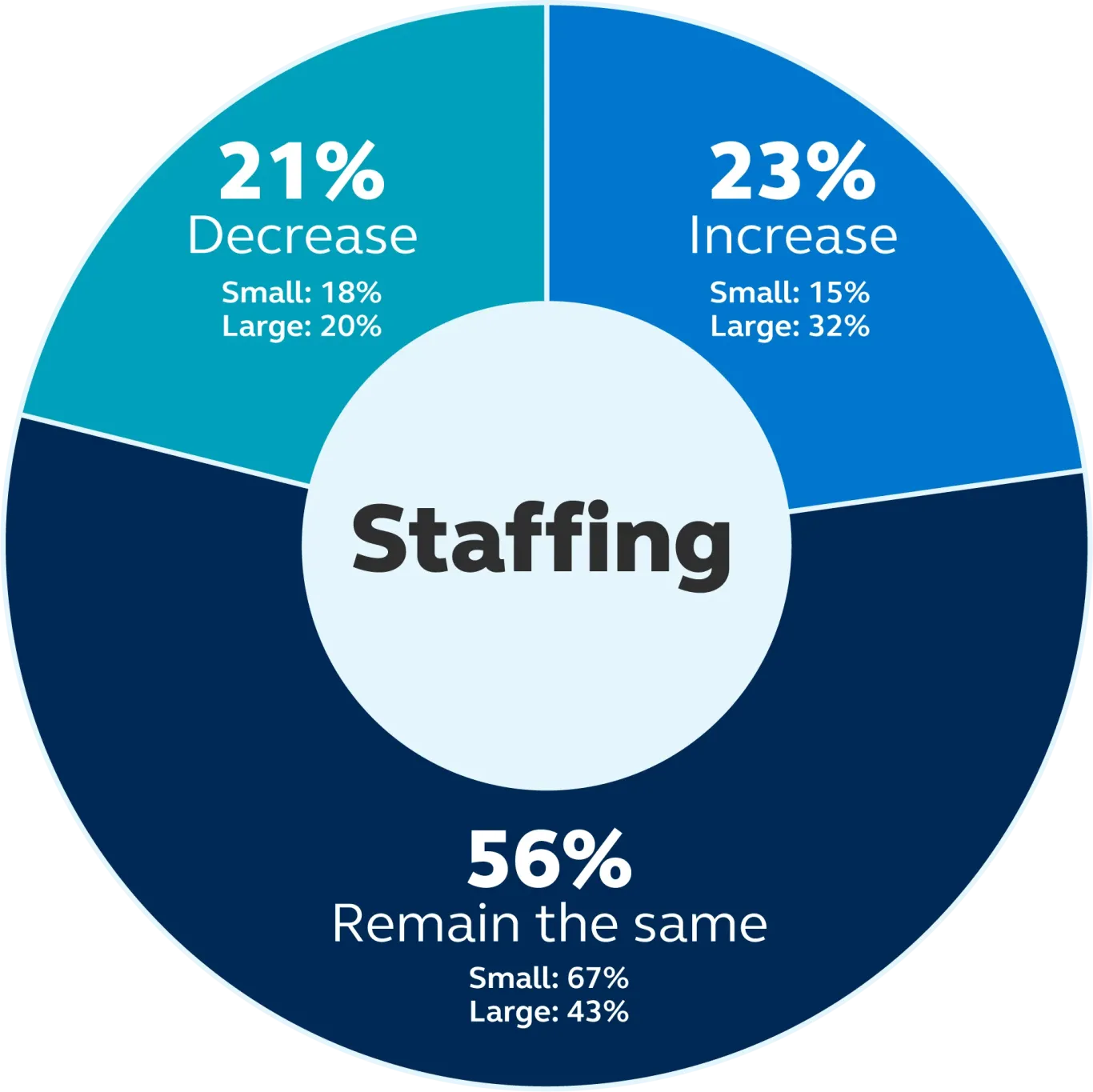

Ninety-one percent of businesses maintained or increased staff in the last three months, which is flat compared to July 2025. And while businesses still have high rates of concern around macroeconomic factors—like inflation, stability of the U.S. economy, and tariffs—concerns around labor costs increased most dramatically.

62% of businesses are concerned about the cost of health care.

53% of businesses are concerned about the cost of offering benefits.

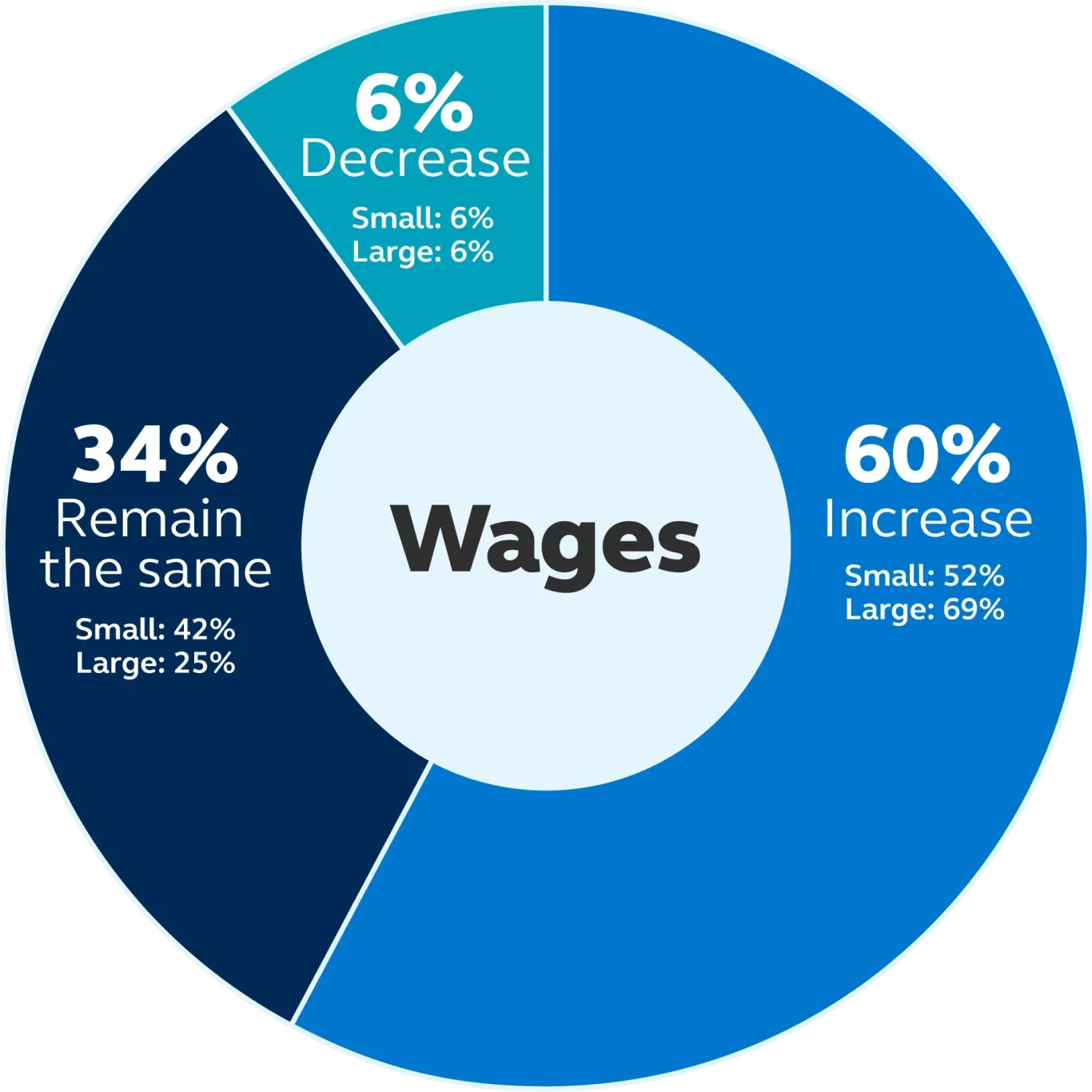

44% of businesses are concerned about wage inflation.

Larger companies are viewing AI as a force for expansion, fueling hiring and higher pay due to productivity gains, while smaller companies are more likely to see AI as an efficiency tool for doing the same with less.

“AI isn’t a trend on the horizon, it’s the force transforming how we work today. Smaller firms lean on it for efficiency, while larger organizations are rewriting the rules. At Principal, we believe the real advantage comes from pairing AI with human potential. The companies that thrive will use tech not just to streamline, but to lift their people higher.”

Kathy Kay

Chief information officer, Principal®

Seventy-two percent of small businesses say they’re unlikely to decrease their number of employees in the next year.

“Employers are realistic about the challenges in the broader economy but still focused on what they can control—building strong balance sheets, supporting their employees, and ultimately positioning their businesses for growth.”

Amy Friedrich

President, Benefits and Protection, Principal®

The Principal Financial Well-Being Index℠ (WBI) Wave 3 (September 26–October 17, 2025) is recurring research used to track sentiment around repeated financial health measures and timely issues relevant to businesses.

Business owner, decision maker, and leader participants who represent companies with 2–10,000 employees (n=1,000) provide information by completing a 15-minute online survey. Access to sample is provided by ROI Rocket, a third-party research panel provider.

In 2025, the WBI added a formal index. The index number in the WBI is calculated by taking responses from six perceptual measures evaluating current financial health, financial comparisons year over year, and projections for business and economic outlook. The percentages of respondents who answered positively for each measure are averaged and standardized to a 0–10 scale, with perceptions of business/company, local economic, and U.S. economic growth weighted 60%, 20%, and 20% respectively within their aggregate measure.

Small businesses = 2–499 employees, Large businesses = 500–10,000 employees