A switch to using market value rates could reduce contribution expense and help improve funding.

Key takeaways

- Market value bond rates

- Stablized rates tied to 25-year averages

Many pension plan sponsors have been calculating their annual minimum contributions the same way for over a decade, so they may not realize they have options that can potentially reduce future cash requirements and improve their reported funding ratios.

Implemented in 2008, the original Pension Protection Act (PPA) defined a 24-month average bond rate as an option for calculating funding target liabilities. Most sponsors adopted this method to help reduce volatility, and because it aligned with PPA’s allowable asset averaging method.

Shortly after, bond rates plunged to historic lows and liabilities based on the 24-month average spiked, driving sponsors to plead for regulatory relief. This relief was granted in a series of laws, the most recent being the Infrastructure Investment and Jobs Act (IIJA) of 2021. A key element of all the relief laws was the creation of the “stabilized” 25-year average bond rate as the basis for funding liabilities.

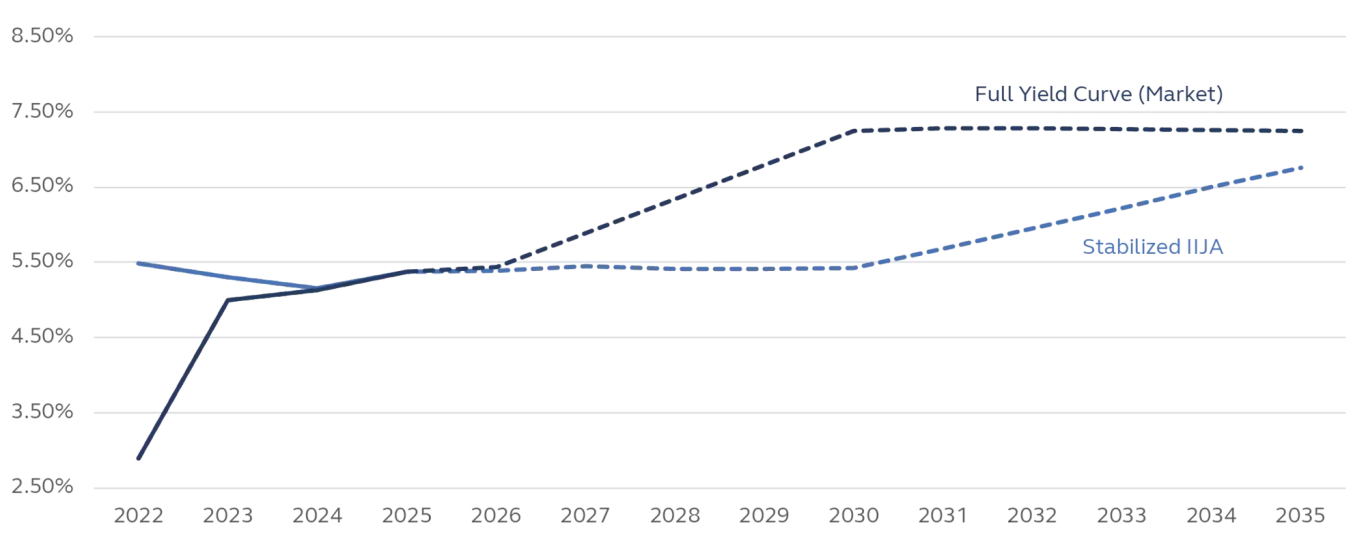

IIJA set a corridor of 5% around the 25-year average rate through 2030. So, if the original PPA rate falls below 95% of the long-term average, the higher relief rate is used. As the chart below shows, this resulted in significantly higher valuation rates and lower contribution requirements through the 2022 plan year.

Since the inflation-driven leap forward for bond rates in 2022, the benefit of IIJA funding relief has decreased rapidly. For the past several years, stabilized and market bond rates have been comparable.

The stabilization that reduced contributions in a low-rate environment could increase them if rates go higher. IIJA’s corridor cuts both ways, so if the original PPA rate exceeds 105% of the 25-year average, the lower stabilized rate is used. If market bond rates move sharply higher, stabilized rates will refuse to follow—and what Congress had originally intended as a floor on valuation rates may ultimately become a cap.

The chart below compares future valuation rates for a hypothetical pension plan assuming market rates increase 0.5% per year through 2030. By 2030, market value rates would be almost 2% higher than stabilized, which translates to a 15%-25% liability reduction for most pension plans. After 2030, the IIJA corridor opens 5% each year to a maximum of 30%, allowing stabilized rates to eventually catch up.

(Note: This scenario was chosen to illustrate the effect of IIJA rate capping and is not a prediction of the movement of future bond rates.)

Fortunately for sponsors, switching from stabilized to market funding is automatically approved by IRS rules, so the change can be made when it is most advantageous. A switch from average to market value assets is also automatically approved. The two changes may be implemented together or individually.

Since a future switch back from market valuations is not automatically approved, plan sponsors should consult with their actuary before making any decision. Factors to consider include:

- Immediate impact on minimum contribution and funding ratio

- Impact of interest rate scenarios (rising, falling, or stable) on future results

- Investment strategies to reduce market funding volatility (aka “liability driven investment” or “LDI”)

- Ability to continually compare market vs. stabilized results between valuation dates if the decision is deferred

With the heavily formulaic nature of PPA funding rules, plan sponsors may be surprised that they have options in measuring their liabilities and assets. A switch to market value funding can potentially save cash, while also better aligning funding results with accounting balance sheets.

Analysis is strongly encouraged before taking the market value plunge, but many sponsors, particularly those already heavily engaged in LDI strategies, may find this unexpected choice to be an easy one.

Projected PPA funding effective interest rates

Rates rise 50 bps per year to 2030

We help simplify the process by providing the services needed to streamline plan administration, manage your plan’s funded position, and execute your long-term pension strategy. Explore our defined benefit pension plan solutions.