Some plan sponsors are concerned that adding automated features could come with additional organization costs. But waiting may cost participants more in potential savings. It’s possible to support these features strategically within the plan’s existing funding structure without compromising the balance sheet.

Automated features like automatic (auto) enrollment and auto-increase in defined contribution plans to help boost employee retirement savings aren’t new. Yet as the chart below shows, there’s still room for many plan sponsors to adopt. For those who haven’t, a common reason is concern about the potential added organization costs. But it’s also important to consider the cost to employees. Without these features, many might start saving too late or not take advantage of opportunities to build long-term financial security.

Learn more about funding automated features in Part II of this series: Looking beyond the retirement plan.

Principal has established these plan design best practices:

The encouraging thing is that it’s possible to implement these features in a budget-friendly way. The cost of sponsoring a retirement plan is simply one portion of the budget. It’s one piece in a much larger ecosystem of employee benefits and total compensation. Sometimes moving dollars from one area to another can result in meaningful improvements for both employees and employers.

Rethink the structure of matching contributions.

Employer matching contributions can be a significant expense in retirement plans. Adjusting the match structure can provide funding for auto-enrollment while still incentivizing participation. Consider:

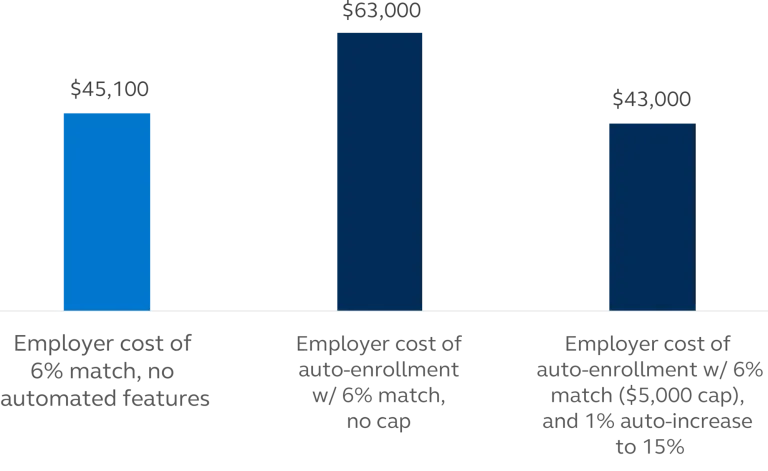

The example below shows how capping the match at 6% helped the employer keep costs of adding auto-enrollment and auto-increase nearly neutral. *

For illustrative purposes only. Snapshot of first year costs only and does not consider employee turnover and/or existing participation rates. Actual plan demographics such as salaries, participation, deferral rates, turnover, etc. will have varying outcomes.

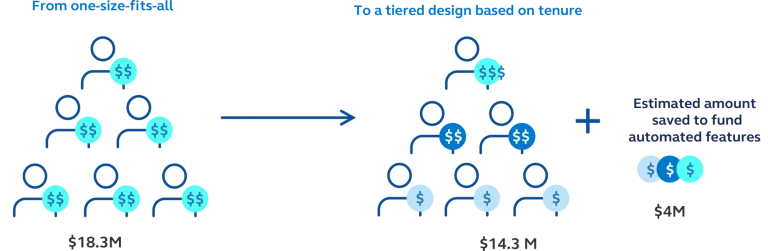

Example of a tiered match structure based on tenure:

Here the plan went from a match of 3% for all employees, to a tiered formula based on tenure.

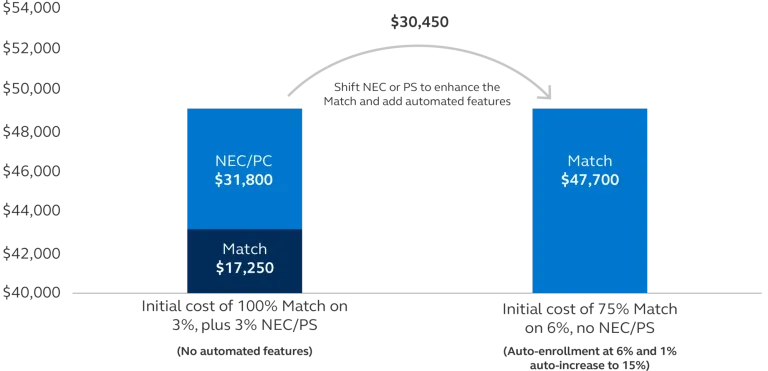

Redesign employer-provided non-elective contributions (NEC) or profit-sharing (PS) allocations that are tied to company performance.

Similarly to rethinking matching contributions, an employer can reallocate a portion of alternative retirement contributions to help pay for the cost of automated features.

Example: The first scenario below (left bar), the employer offers a 3% match and a 3% NEC, resulting in a higher employer cost but lower overall savings for employees. In the second scenario (right bar), the employer eliminates the NEC and redirects those funds to enhance the match (up to 4.5%) and help support automated features. As such, the strategy can be cost-neutral for the employer, while employees save more with auto-enrollment starting at 6% and auto-increasing deferrals up to 15% of eligible pay.

Funding auto-enrollment and auto-increase in a retirement plan requires a strategic approach that balances cost management with employee benefits. By implementing such features, employers can help their employees save for a secure financial future. Doing so might also help plan sponsor pass non-discrimination testing and provide the flexibility needed to implement more custom plan designs.

As businesses evaluate these options, it’s important to work with a retirement service provider who understands and has the expertise to consult on these moves. If you’re looking for help implementing automated features in the plan, reach out to your Principal® representative. They’ll consult on creating a tailored retirement plan that aligns workforce needs using these powerful features. A plan that works with the budget and helps drive participation and improves savings behavior with the goal to facilitate timely retirements.

Get more data-driven insights on automated features: The power of automated 401(k) plan features.