Here we look beyond the retirement plan budget to uncover broader funding strategies. Delaying automated features may cost participants potential savings. From rethinking total rewards to leveraging tax incentives, organizations can find ways to implement these plan features without significantly increasing overall costs.

Automated features like automatic (auto) enrollment and auto-increase have consistently proven to boost participation and saving rates in retirement plans, such as:

Yet despite the upside, some employers hesitate to implement automated features because of the perceived costs. But there’s also a potential cost to employees when these features aren’t available. Without a nudge to start saving or increase contributions, some may delay taking action, which can ultimately affect their ability to retire on time.

Paying for these powerful features doesn’t have to come solely from the retirement plan budget. By taking a more holistic view—one that includes total rewards, compensation strategies, and even government incentives—plan sponsors might be able to find creative ways to support automated features without increasing overall spend.

Principal has established these plan design best practices:

In part I of our series, Smart ideas to help fund automated features—looking within the retirement plan, we explore how employers can fund automated features by reallocating dollars to be used within the retirement plan. This includes using strategies such as adjusting matching contributions or redesigning non-elective and profit-sharing allocations. Now, we turn our attention beyond the retirement plan to uncover additional funding opportunities that may exist across the broader total rewards budget.

Reallocate alternative portions of total compensation. To help finance automated features, take a broad look at the budget items that make up the total compensation. Improving one part of the package doesn’t always mean cutting from the same area to pay for it.

Use tax credits and other incentives. The U.S. government offers tax incentives that can help offset the costs of adopting automatic enrollment:

Consider the cost of not adding automated features. When evaluating the cost of adding automated features, it’s important to also consider the hidden and long-term costs of not implementing them. Without these features, employees may not start saving early enough or save too little over the course of their career. Ultimately, employees may need to delay retirements, an outcome few want and one that can carry associated costs to employers.

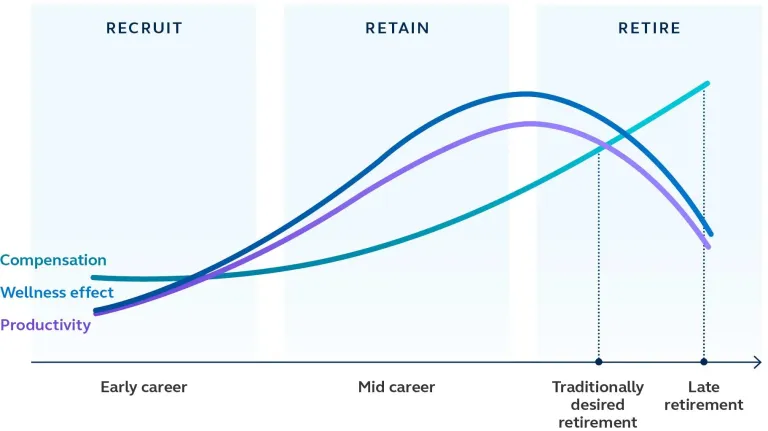

The chart below intentionally omits age markers because the timing of each stage can vary widely based on the job, industry, company, and individual. However, most people take time to reach full productivity when starting a new role as they learn new systems, build relationships, and get acclimated. As their experience grows, so does their productivity, often resulting in greater value returned to the employer.

For illustrative purposes only.

Every employee will eventually reach a point when they are physically, mentally, and/or emotionally ready to retire. But if they are financially incapable of doing so because they didn’t save enough for retirement, productivity can drop. At the same time, total compensation typically continues to grow, outpacing productivity and creating a cost of delayed retirement.

Automated features can help employees start saving earlier and increase their contributions over time. This supports timely retirements, helping employees to retire when they choose, and may also lead to meaningful savings for the employer.

Supporting automated features like auto-enrollment and auto-increase doesn’t always require stretching the retirement plan budget. By taking a broader view, whether through reallocating compensation dollars, adjusting underused perks, or tapping into tax incentives, employers can take practical steps to make automated features possible. And when they do, employees are more likely to build savings early and retire on their own terms, benefiting both the employees and the business.

As businesses explore these opportunities, it helps to partner with a retirement service provider that can offer data-driven insights and design expertise tailored to your workforce and goals. If you’re looking for help implementing automated features, reach out to your Principal® representative.

Get more data-driven insights: The power of automated 401(k) plan features.