Scores for governments and/or financial systems improved in 35 out of 42 markets, making up for employers' economic struggles.

As economic uncertainty and business pressures mount, employers outside of the top 10 markets for financial inclusion have been pulling back from their traditional role in promoting financial inclusion, while governments and financial systems are stepping in to fill the void.

The research from the

The pressure on businesses is evident in the employer support pillar of the Index, where scores dropped in 35 of 42 markets, with only seven improving. The declines were generally much steeper than the gains, with an average drop of 4.8 points versus compared to an average gain of just 1.6 points.

However, despite this pullback in employer support, the overall financial inclusion score remained relatively stable year over year. This resilience is attributed to increased support from governments and financial systems, building on significant advances made in recent years.

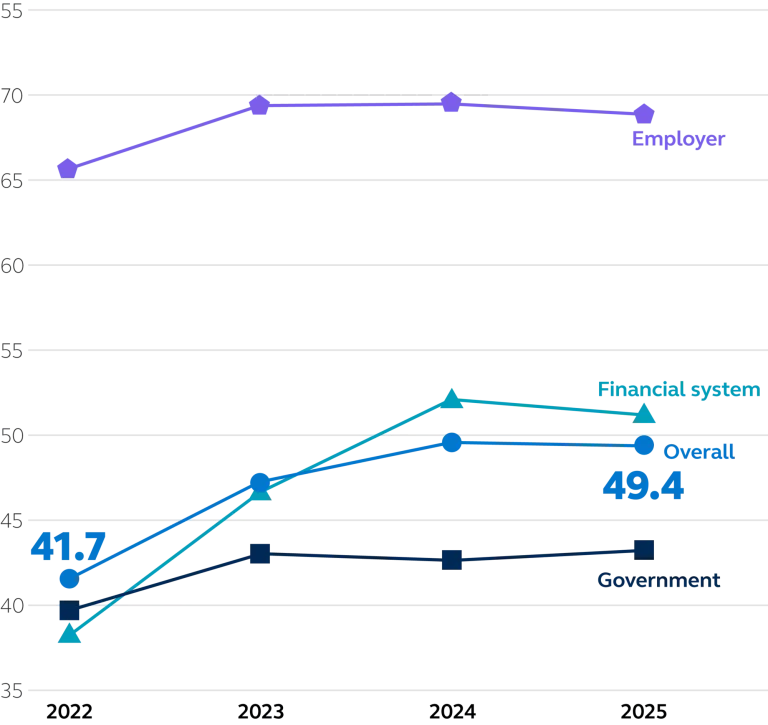

Since the Index's inception in 2022, the overall financial inclusion score globally has risen by 7.7 points, from 41.7 to 49.4, underpinned by:

- Government support increasing by 3.6 points to 43.4 points

- Financial system support rising by 12.9 points to 51.2 points

The data shows this trend playing out across the 42 economies tracked. Government and/or financial system support improved in 35 markets, while 29 of these markets simultaneously experienced declines in employer support scores. This pattern indicates that measures implemented by governments and financial systems are effectively filling gaps as employers pull back.

A deeper analysis reveals that among the 25 markets where government support increased, employer support fell in 20. Similarly, of the 24 markets where financial system support rose, employer support declined in 21. Every market ranked in the top half of the table for overall financial inclusion scores, except Malaysia, which saw its employer support score drop year over year.

“Geopolitical and trade uncertainty led to questions across global markets about the strength of their economic foundations,” says Seema Shah, chief global strategist at Principal Asset Management®. “Our data shows that, as employers pulled back, with some businesses struggling to offer generous benefits and support, governments intervened to help households access the resources, information, and financial assistance they need.”

This pattern mirrors broader economic interventions, with many markets increasing government support through expanded fiscal spending. Notable examples include Germany's constitutional change enabling greater government borrowing, the UK's measures to boost public spending, China's special sovereign bonds issuance, and Japan's package of measures to relieve pressure on households.

The findings suggest a clear progression through what the Index identifies as the three phases of financial inclusion. As economies develop and financial systems become more sophisticated, the reliance on employers as the primary source of financial guidance and support begins to lessen. The rise in government and financial system scores in the majority of markets indicates this evolution is continuing, even in challenging economic conditions.

“If this level of government and financial system support is maintained, and macro conditions tend to improve enough for employers to return to higher support levels, global financial inclusion scores could revert to an upward trajectory in the future,” says Shah.

Explore more Global Financial Inclusion Index insights.