A rebound from two years of decline was helped by fintech and other factors—with undercurrents of worry still apparent.

The United States experienced a modest improvement in financial inclusion during 2025, according to the latest

The improvement was primarily driven by a partial rebound in the financial system support pillar, where the U.S. score increased from 70.5 to 72.6. Despite this gain, the U.S. remains below its 2022 peak of 81.3. The recovery was supported by gains in fintech presence and quality, borrower and lender protection rights, and access to credit indicators.

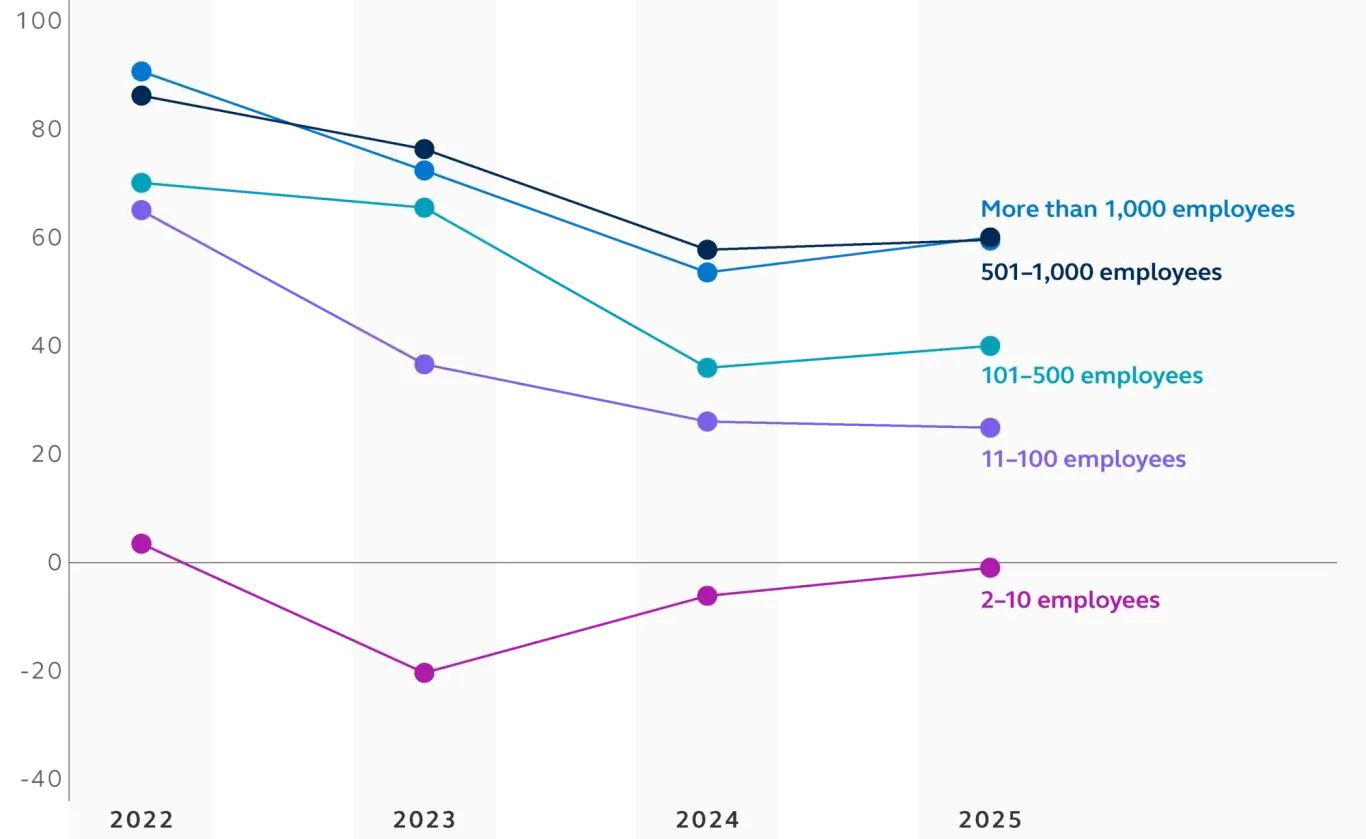

Analysis of U.S. businesses reveals a widening gap between large and small employers in their ability to support financial inclusion. We also conducted a supplemental analysis of U.S. businesses to better understand how they compare to one another in their support of financial inclusion--separate from the global Index data. This size-segment view of U.S. employers shows significant differences in support based on the size of the employer.

Large enterprises (more than 1,000 employees) recorded the highest rise with a 6.2-point improvement, driven by gains in financial guidance provision and pension contributions. However, small to midsized enterprises (11-100 employees), representing roughly 40% of the U.S. labor force, were the only business segment to experience a year-over-year decline, notably in employer insurance and flexible pay initiatives.

Table 1: Employer support scores in the U.S. by business size

Consumer sentiment data mirrors the main index improvements, suggesting measures taken by the government, financial system, and employers are already being felt by individuals. The proportion of U.S. respondents who say they feel financially included rose 6.1 percentage points to 61.8% in 2025, representing a stabilization after two years of declines.

Chris Littlefield, president of Retirement and Income Solutions at Principal, says saving for retirement continues to be challenging for most people.

“Inflation, market volatility, the changing nature of work, the need to work longer, and other personal financial, health, or family challenges make the path to retirement a difficult one,” he says. “The volatility we experienced earlier this year created significant anxiety for Americans working hard to secure their financial futures, with our U.S. plan participant engagement center volume reaching a five-year peak as millions sought reassurance and guidance.”

The volatility we saw at the start of 2025 created significant anxiety for Americans who have been saving for their financial futures.

The research shows while 54% of Americans believe their financial situation will improve over their lifetime, the same proportion worry about running out of savings in retirement. These concerns are particularly acute among those approaching or in retirement, with nearly 70% of Gen Xers (ages 44-59) and 50% of baby boomers (ages 60-78) doubting the sufficiency of their retirement savings.

have access to tools for retirement planning—up 1.7 percentage points from 2024.

say AI is having a positive impact when it comes to personal finances, a 1.7-percentage-point increase. Areas of positive AI impact include loan approvals, data security, fraud reduction, and their general understanding of finances.

However, there are positive signs in the adoption of new and emerging digital tools that support financial inclusion. Sixty-one percent of U.S. consumers report having access to retirement planning tools, up 1.7% from 2024. Additionally, artificial intelligence is playing an increasingly important role, with 46% of consumers saying AI is having a positive impact on their personal finances—a 1.7-percentage-point increase from the previous year. This suggests that as AI adoption accelerates, consumers' overall sense of financial inclusion may continue to improve.

Explore more Global Financial Inclusion Index insights.