Benchmark benefits you offer for group insurance and retirement plans.

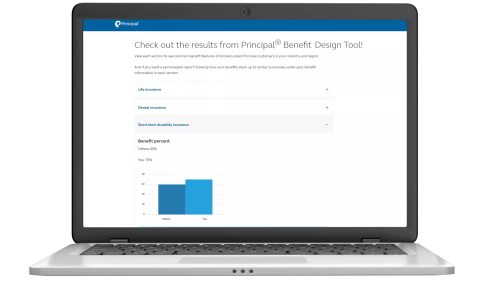

Principal® Benefit Design Tool: Compare these benefits to similarly sized organizations in your industry and region.

Get a report after answering a few questions about your organization.

Remain competitive by offering a benefit package to help attract and retain employees.

For illustrative purposes only.

Employee benefit packages can have a big impact on your employees’ future.

Compare employee benefits with businesses like yours.

Don’t offer benefits and want to learn more?

Group benefits insurance doesn’t need to be complicated.

Get a better understanding of how it works. Learn more about:

Retirement plans can help your employees achieve financial security and save enough for their financial future.

Learn more about: