Mike Clark

Consulting Actuary

As an unabashed middle school nerd from the early 1980’s, I thoroughly enjoyed the Netflix hit series Stranger Things. Geeky kids riding bikes and playing D&D with zero parental oversight took me back to a slower, simpler time. That is, before all the bad stuff that made Stranger Things the hit it is began happening!

A quick synopsis for the dozens who haven’t seen the show yet: junior-high misfits accidentally stumble upon a portal to another dimension called the “Upside Down” at a secret facility run by evil scientists in lab coats. (They always wear lab coats!) As you’d expect, the Upside Down dimension is the polar opposite of idyllic 80’s suburban life, full of terrifying monsters and creepy ooze where none of the normal rules of the kids’ past experiences apply.

I’ll stop there to avoid spoilers, but as an unabashed middle-aged nerd of the 2020’s, I can’t help but see parallels between the Upside Down and the somewhat frightening scene laid out before pension investors going into 2023.

Investment World Turned Upside Down

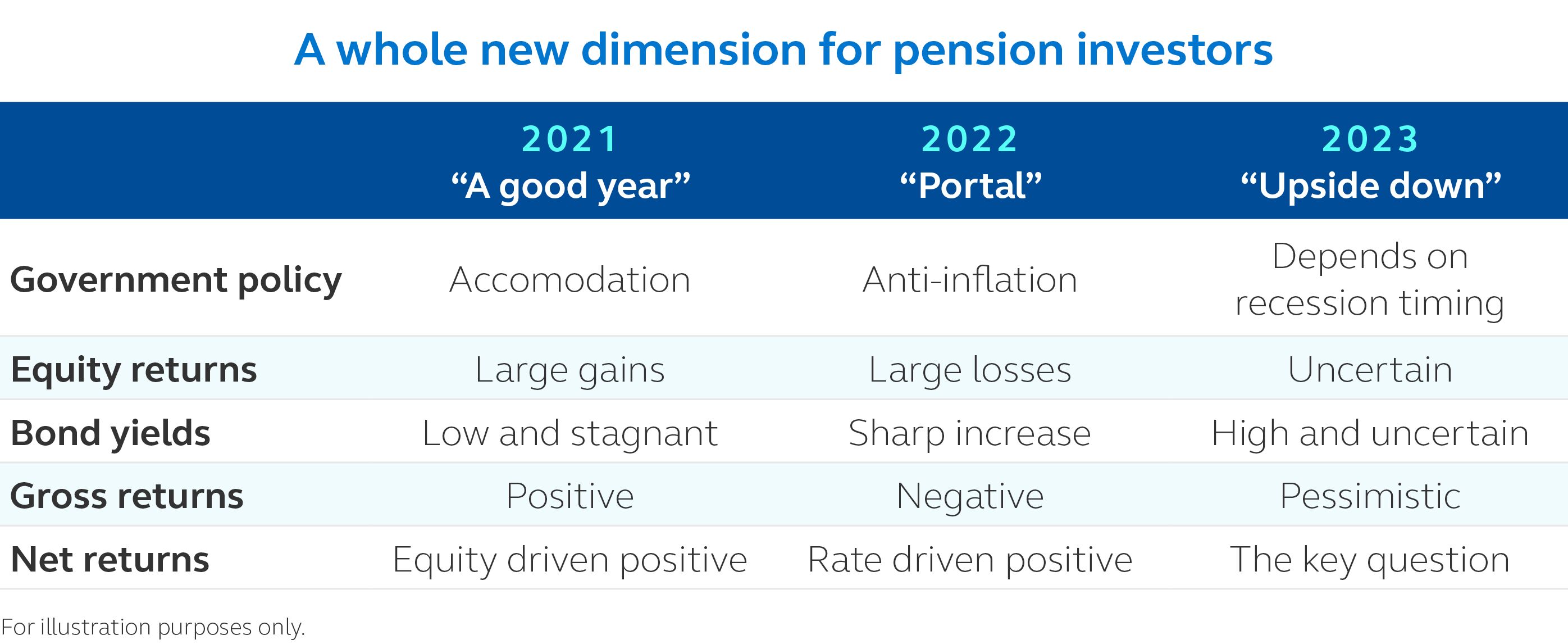

The investment world since the financial crisis through about January 2022 was a relatively safe and predictable place. Minimal inflation, government accommodation and bull equity markets were the norm. The challenge then was historically low interest rates forcing up pension liabilities, causing funding ratio disappointment for many years despite solid investment growth.

Many defined benefit (DB) pension investors had come to grips with this reality, and 2021 even delivered a pleasant surprise for risk seekers. Then the 2022 portal suddenly opened! Intense (some say predictable) inflation roared to life just as COVID-19 was winding down. War amped up international tensions and fouled supply chains. Equities and bonds comprising the majority of most DB portfolios suffered historic losses.

The S&P 500 index fell about 20% during the year; tech stocks lost much more on average. The real sea change, however, actually occurred in the bond market. After a multidecade downward march, long bond rates suddenly popped up more than than 200 basis points during the year, unexpectedly reducing the value of many fixed income portfolios between 10% and 30% depending on duration and quality of the holdings.

The Best Worst Year in Memory

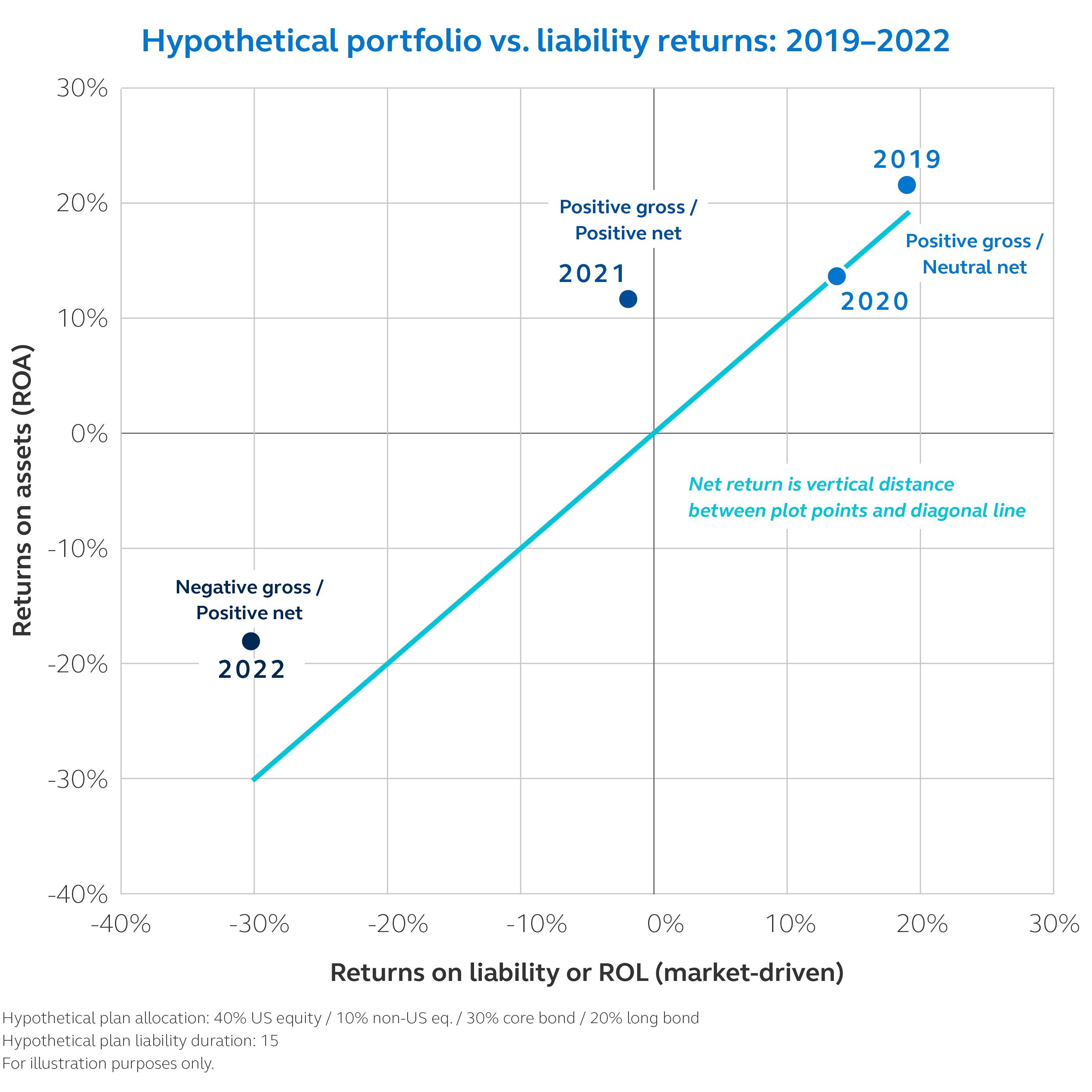

Financial news outlets have already decreed 2022 as the worst investment year since 2008, which is generally accurate from a gross return perspective. But pension liabilities fell even faster than investments as we rocketed through the interdimensional portal of spiking interest rates, so most plans actually experienced positive net returns and improved market value funding ratios last year.

Like the lucky tweens of Stranger Things, pension fiduciaries came through a traumatic transition in fairly good shape. They now find themselves in an Upside Down environment where previous learnings may not apply, and survival may depend on their ability to adapt to its unfamiliar physical laws. Here equity forecasts are bleak, inflation high, and interest rates uncertain, all in sharp contrast with past experience.

Changing Perspective

The most difficult psychological hurdle to clear in this topsy-turvy landscape could be deemphasizing a gross return perspective. After painful losses, traditional investors are conditioned to wait for diminished assets to recover before selling.

But from the net return Upside Down, most portfolios actually performed well last year. Though painful and counterintuitive to “Rightside Up” minds, selling some assets low to reduce net risk through a liability driven investment (LDI) strategy may warrant immediate consideration in the face of current market uncertainty. Cheaper fixed income with higher gross yields offer some consolation for those seeking decent gross returns with lower risk.

Of course, back in the real world many pension fiduciaries would still prefer to recoup some gross losses before reducing risk. This is easily achieved through a “Spell of Financial Certainty” cast by a level 12 wizard. In absence of that, daily tracking of funding positions and close coordination between actuaries, advisors and plan sponsors offer the best chance for a positive risk management outcome in what’s looking to be a stranger, Upside Down year.

Mike Clark is a fellow of the Society of Actuaries (SOA) and a member of the American Academy of Actuaries who only lasted three weeks in the Greenway Middle School Dungeons & Dragons Club before moving on to marginally cooler actuarial pursuits.