A target date fund uses a specific date in the future to allocate assets and spread out risk in order to manage your investment risk.

In your day-to-day, you have all sorts of options to set it and forget it: an alarm to wake you, hints to help you drink water, an automated grocery list so you don’t forget milk. But what about reminders to ensure your retirement savings keep pace with your post-work goals?

One must-do on that list is regularly adjusting your asset allocation (your mix of investments) to match your proposed retirement age and risk tolerance. You can do this yourself, but it’s easy to neglect and may feel complicated. A possible solution? Target date funds: These retirement investment options do the work for you.

What are target date funds?

A target date fund, or TDF, is a fund with investments managed with a future date in mind—the target date when the investor is expected to retire. (You may also hear a TDF referred to as a life cycle fund, and the name of a fund can often be a giveaway for what that date is.) Many employer-offered 401(k) plans include the option to invest your savings in a TDF. For example, if you choose to invest in a 2065 target date fund, the fund is managed with the expectation that you will start withdrawing money around that date.

Most TDFs include different types of investments, and the mix changes over time. The investment manager in charge of the fund uses the target (retirement) date as a guidepost to periodically adjust the diversification. They’ll also rebalance as necessary to maintain the preferred investment mix.

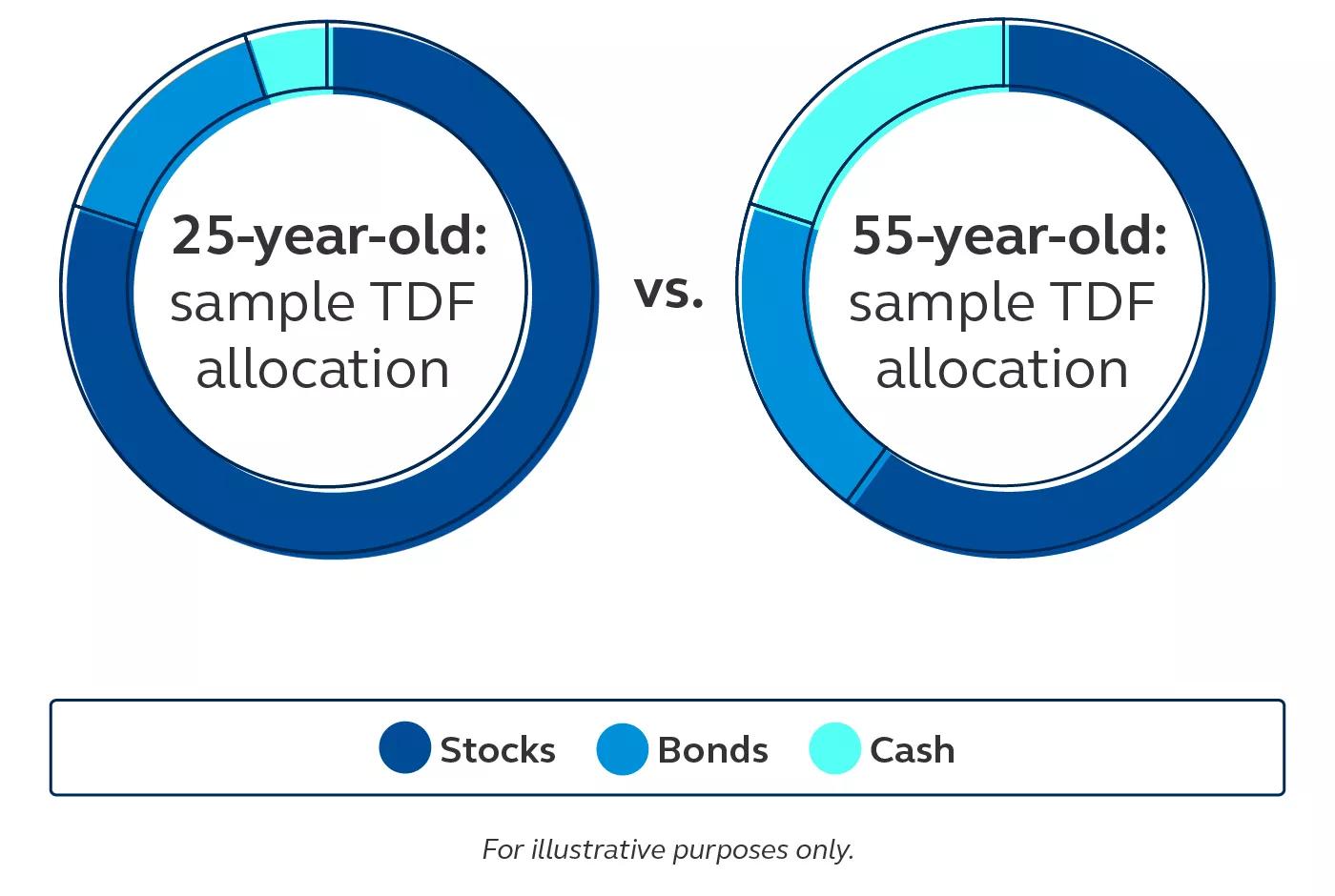

Generally, the further you are from retirement, the more risk you might be able assume. TDF investments reflect that, with generally a greater proportion of more conservative investments and fewer aggressive investments over time. “As you age, a TDF progresses with you,” says Tyler De Haan, director of business development in retirement solutions for Principal®.

Are all target date funds the same?

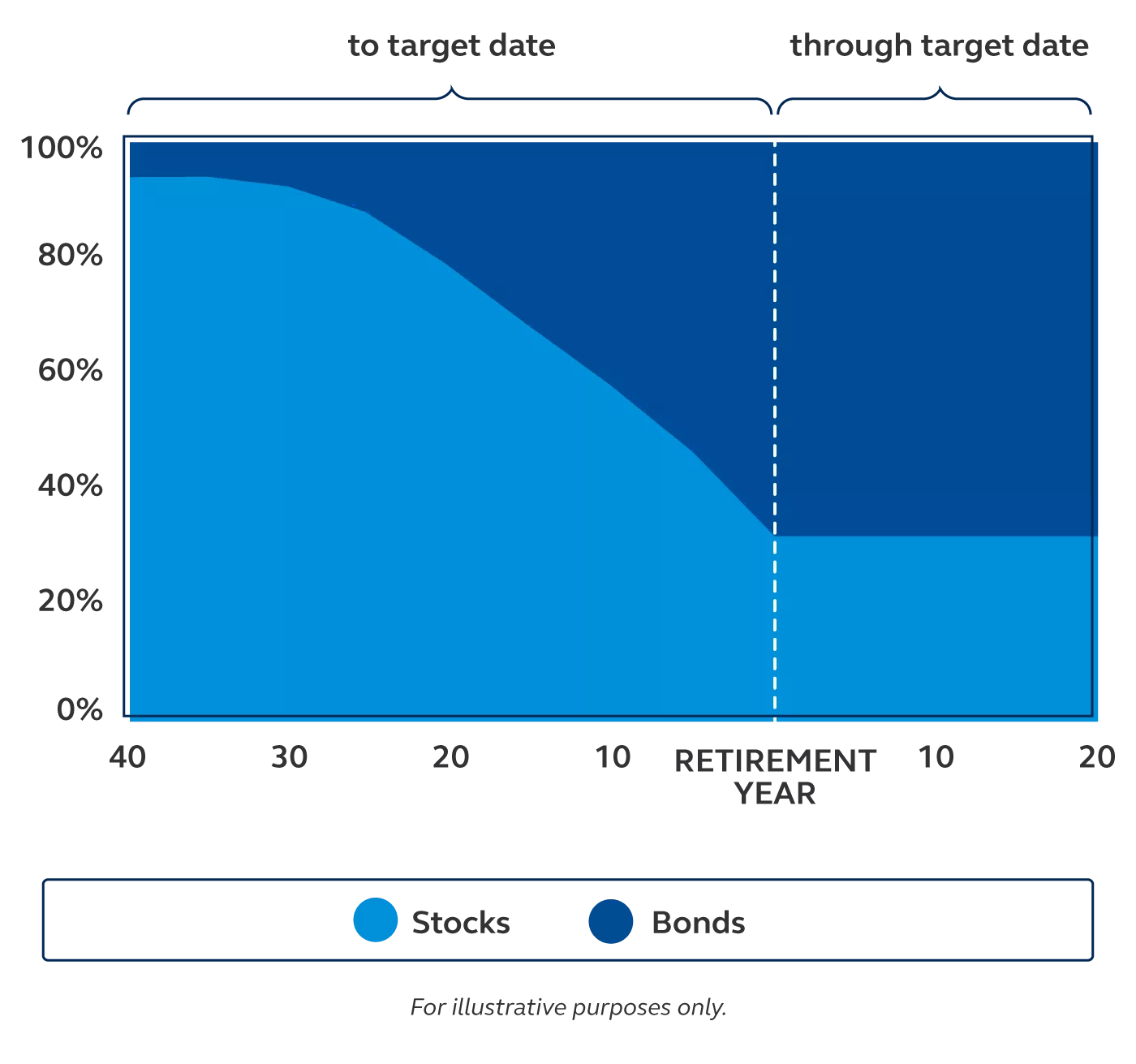

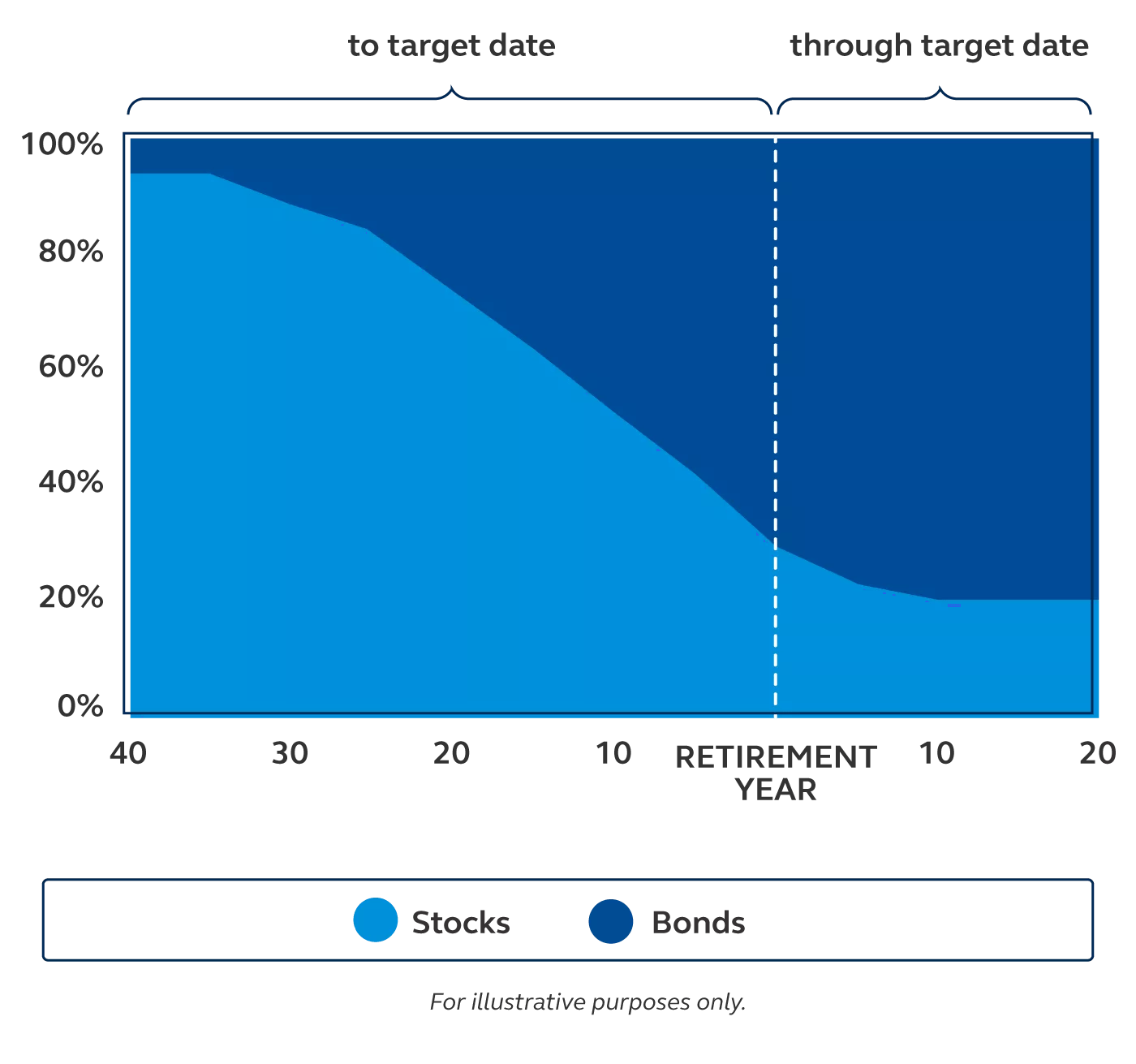

No—and even target date funds with the same date may have different strategies and investment mixes over time. How the investment mix changes over time is called a glide path.

Why do some people like target date funds?

If you spend a lot of time digging into the specifics of your personal risk tolerance and the investment choices offered by your company’s retirement plan, then you may prefer to manage your own investment allocation and a TDF may not be for you.

But if you want to pick a date in the future and let the team of professional investment managers work for you, a TDF may be a good match. “It’s the ultimate hands-off approach,” De Haan says.

You may hear TDFs referred to as both “to” and “through.”

A “to” TDF reaches its most conservative investment mix on the date of your retirement age. For example, a 2055 target date fund equals a conservative mix “to” or at the year 2055.

A “through” TDF reaches its most conservative investment mix 10-15 years after the target date. For example, a 2055 target date fund equals its most conservative mix around the year 2065 or 2070.

Next steps

- What does your asset allocation look like? Log in to principal.com. First time logging in? Get started by creating an account. Don’t have retirement savings through your employer? We can help you set up your own retirement account.