The financial industry is big and complicated and full of lots of terms many of us may never hear (or understand). But plenty of people have heard of stocks (and the stock market). What is a stock and how does it work?

A stock, explained

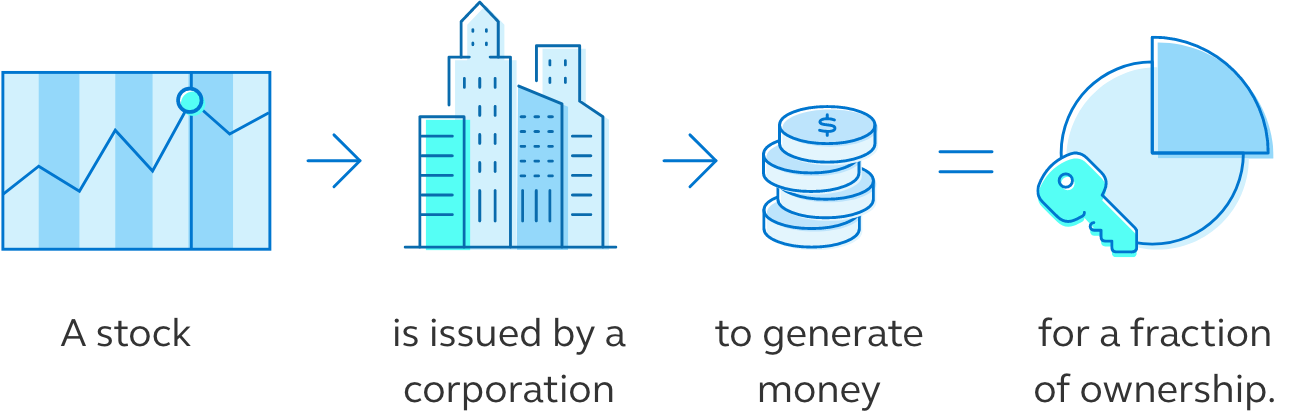

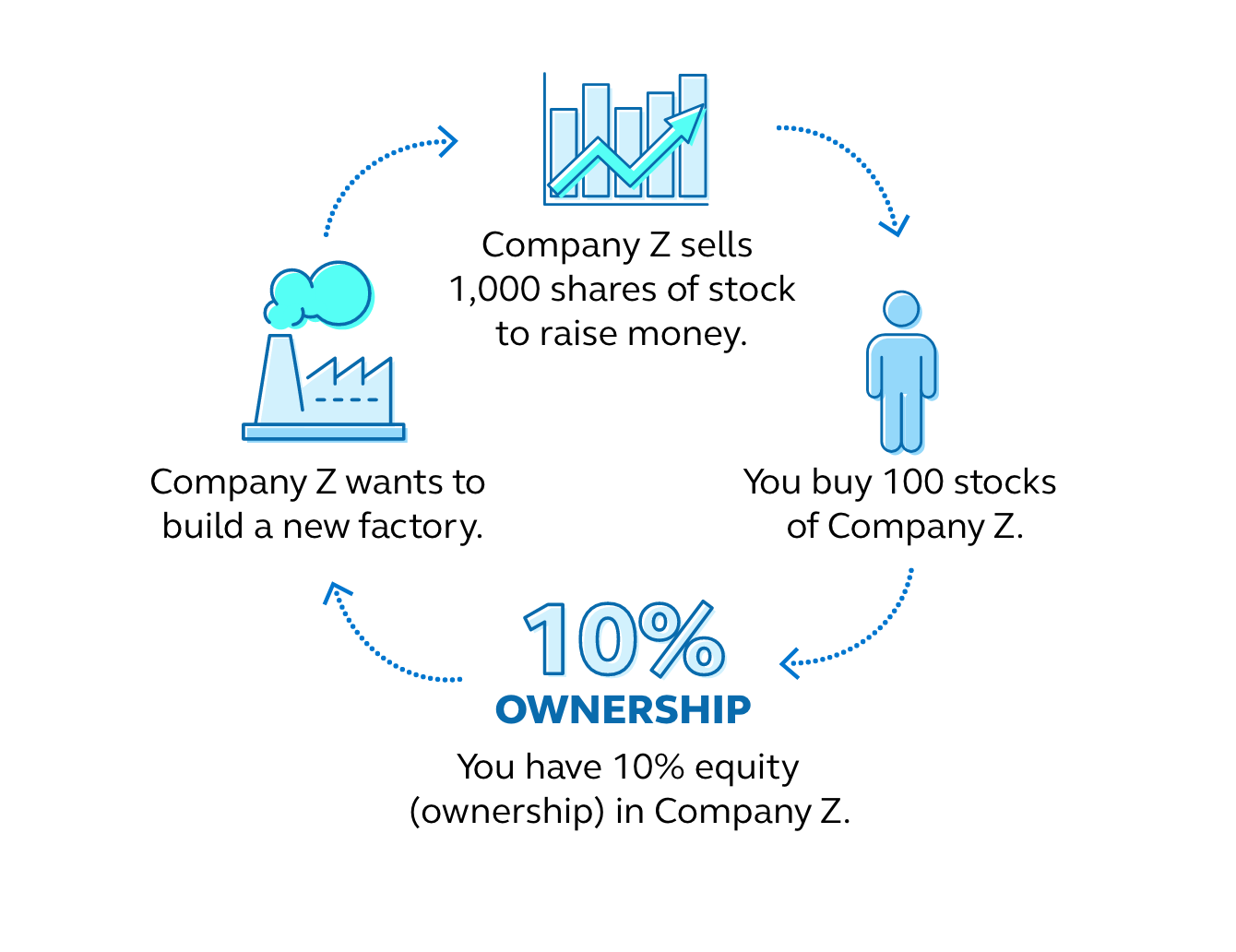

A stock is essentially a share of a company. Companies issue (sell) stocks to generate money. As an investor you can typically buy and sell stocks from a company at any time. You can also buy previously issued stocks on a stock exchange.

Many investors like stocks because of the potential for growth, especially over time.

How a stock works

What are the types of stocks?

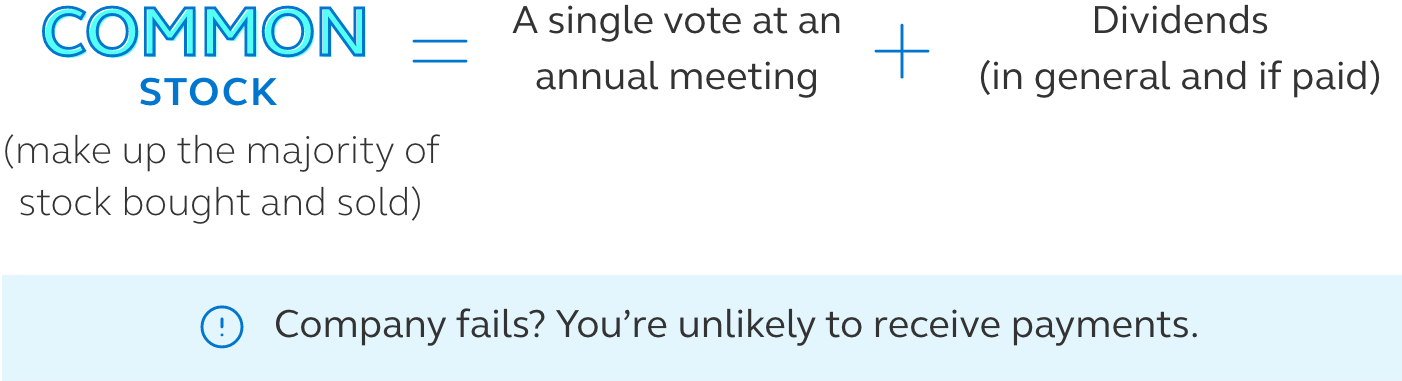

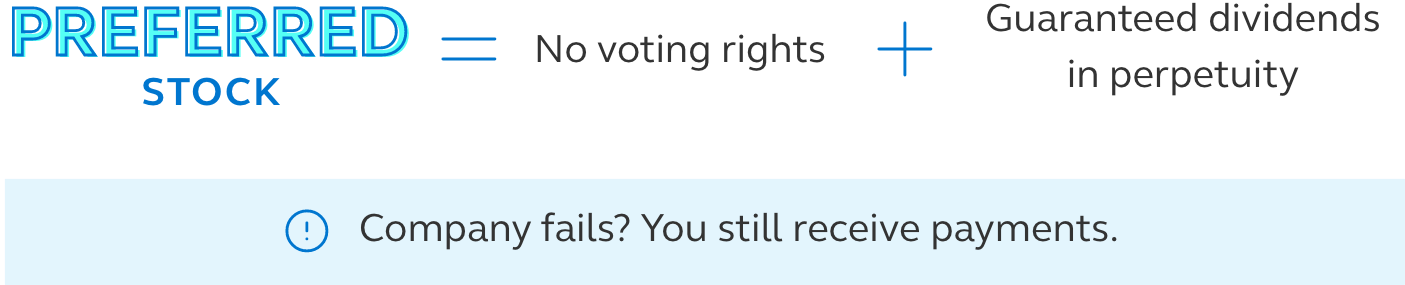

The type of stock you have determines if you can vote at shareholder meetings, receive dividends, and get your money back if the business fails.

You may also hear stock referred to as:

- class A, B, or C, which indicates voting rights or ownership control.

- blue chip, which refers to stock in well-known, relatively stable companies.

- large-cap, mid-cap, small-cap, and microcap, which indicates company size.

- growth, income, or value, which points to companies poised for future returns, dividends, or stock price increases, respectively.

How do you buy a stock?

Only about 15% of people buy stocks directly.1 But most Americans are already invested in stocks, typically through indirect purchases made when they saved in retirement accounts. You can buy a stock:

- through your retirement account in transactions made by the investment manager.

- directly from a company, which is often reserved for employees or existing shareholders.

- by reinvesting dividends, which is typically for existing stock owners.

- through a financial professional who does the research on your behalf and may charge a fee.

Why are stocks included in retirement investment accounts?

Lots of different kinds of assets, including stocks, typically make up your retirement accounts. The portion held in stocks includes shares in small and large companies of all kinds. An investment manager chooses what’s in an individual fund or which collection of stocks in different markets drive the potential for growth. That’s diversification at work, which may help to balance risk and reward.

Next steps

- What does your asset allocation look like? Log in to principal.com. First time logging in? Get started by creating an account. Don’t have retirement savings through your employer? We can help you set up your own retirement account.