Target date funds may be a good match for you, helping balance growth opportunities with risk tolerance as you age and your goals change.

In your day-to-day, you have all sorts of options to help you reach your goals: an alarm to wake you, hints to help you drink water, an automated grocery list so you don’t forget milk. But what about reminders to help ensure your retirement savings keep pace with your future plans?

Those can feel more complicated. How do you make sure you have the right mix of investments to match your risk tolerance and your goal retirement date? It’s doable, but can involve time and more than a little uncertainty. One alternative could be a target date fund.

What’s different about these types of investment options, and when might they fit into your retirement saving strategy? Here are some insights.

A target date fund, or TDF, is a mix of investments grouped together in an investment fund to align with a date, which may be your retirement date.

Think of it this way: The further you are from retirement, the more opportunity you have for your retirement savings to grow or weather any market downturns. As you get closer to retirement, you may prefer a mix of investments that are typically more conservative and perhaps have slower growth. A target date fund is managed to mimic that same transition, moving from growth to more conservative. (TDFs are sometimes referred to as life cycle funds.)

If you see a TDF referred to as “TDF2065” that number is the date when the investor is expected to retire and/or begin drawing from the investment fund. (You may hear it referred to as a vintage.) Generally, you’ll find TDFs spread out in five-year increments—2050, 2055, 2060, 2065 for example.

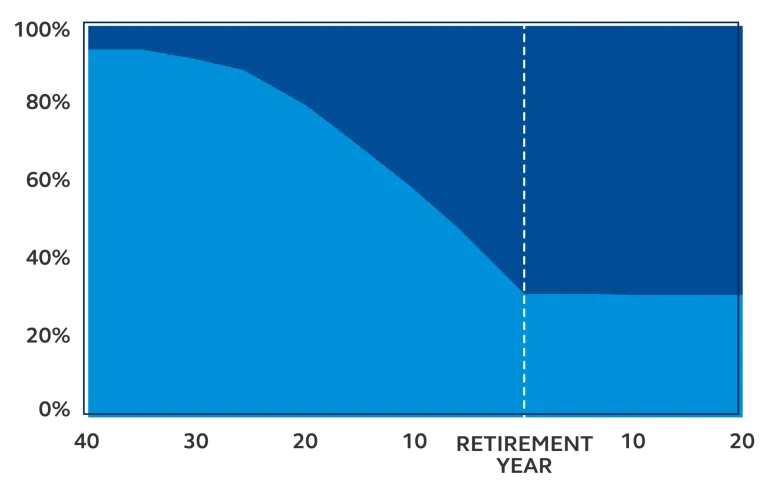

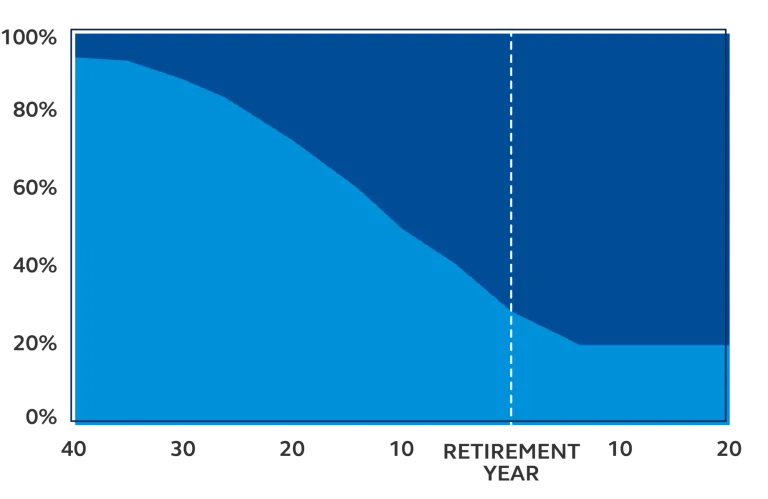

Most funds—TDF or not—include a mix of investments (called diversification) designed to help achieve as much growth as possible, or to reach a particular goal. In a TDF, in general, the proportion of more aggressive to more conservative shifts over time. (This is called a glide path.) The investment manager in charge of the TDF uses the target date as a guidepost to periodically adjust the TDF’s diversification. They’ll also rebalance as necessary to maintain the preferred investment mix.

For example, a 2065 sample TDF allocation may be made up of mostly stocks, with a smaller percentage of bonds, then cash; this potentially has a greater opportunity for growth. A 2025 sample TDF allocation, on the other hand, may have fewer stocks than a 2065 TDF and greater percentages of typically of risk-averse bonds and cash investments (when you have fewer years to work and build savings).

For illustrative purposes only.

Many employers that offer employer-sponsored retirement savings, or a 401(k), may have a TDF series (e.g., 2025 through 2065) as investment options. In addition, an IRA may offer a TDF as an investment option.

If you prefer to manage your own investment allocation, a TDF may not be a good match for all (or any) of your retirement savings.

But if you want to pick a date in the future and let professional investment managers work for you, a TDF may be a good match. It's a good idea to periodically review the option you've chosen to be sure the mix of investments continues to align with your investment risk.

You may hear TDFs referred to as both “to” and “through.”

A “to” TDF reaches its most conservative investment mix on the date of the TDF. For example, a 2055 target date fund equals the TDF's most conservative mix “to” or at the year 2055. At that point, assets are no longer re-allocated.

- Stocks

- Bonds

For illustrative purposes only.

A “through” TDF reaches its most conservative investment mix 10-15 years after the target date. For example, a 2055 target date fund equals its most conservative mix around the year 2065 or 2070.

- Stocks

- Bonds

For illustrative purposes only.

You don’t have to choose a TDF that aligns exactly with the date you want to retire. You can, as with the example above, choose one that continues a conservative investment trend (and rebalancing) after your retirement which may be your need date.

All investments have fees, and TDFs are no different. If a TDF is more actively managed, it may have higher fees than those TDFs that simply mimic the investment mix of a stock index.

What’s next?

Is a TDF available through your workplace retirement plan? Log in to principal.com to see your options.