Explore how employers can turn state-mandate retirement plan requirements into a strategic opportunity. Go beyond minimum compliance to help enhance employee financial well-being and potentially gain advantages in talent retention and recruitment.

Employers are at the center of a retirement benefits challenge—balancing costs, state and plan compliance requirements and employee expectations. State-mandated retirement plans may be a step in the right direction, as many employees, particularly those working for a small employer, still lack access to a retirement plan.

of workers have access to a defined contribution plan

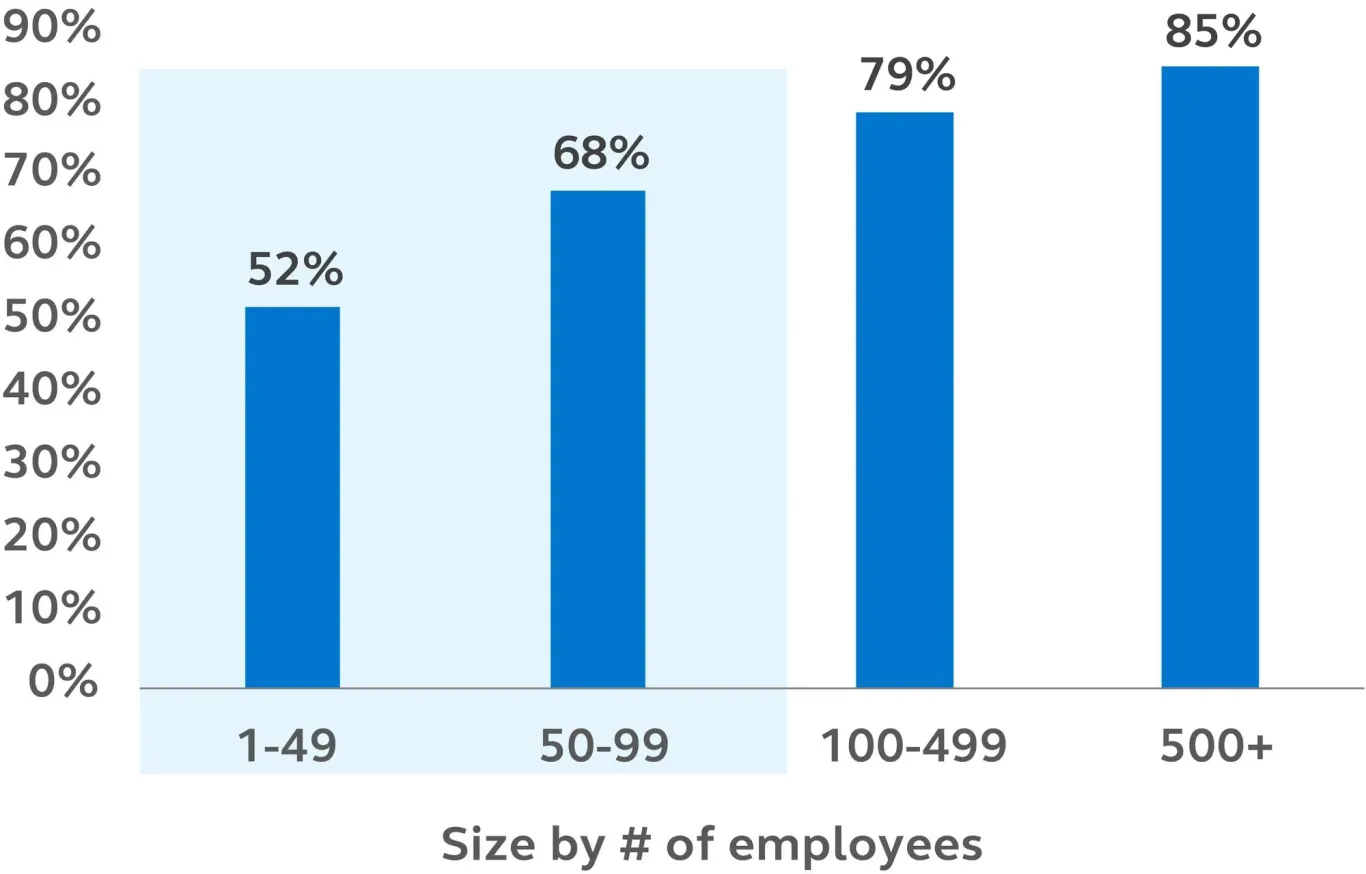

However, access to employer-sponsored retirement plans declines as company size decreases.

Percent of employers that provide a defined contribution plan

However, the mission should be about more than just meeting the minimum requirements. We believe the real opportunity sits with employers who look beyond these state retirement mandates and see the advantage of giving employees a more comprehensive path to building long-term financial well-being. It can also give the business a strategic advantage in terms of recruitment, retention, and potential tax benefits.

States are passing legislation requiring employers to offer retirement savings plans in response to the large number of workers without access to one through their employer. In most cases, if an employer doesn’t sponsor its own plan, it must automatically enroll employees into the state-facilitated retirement program.

State mandates are a new baseline for employer-sponsored benefits. But according to our Principal Financial Well-Being Index, there seems to be a communication gap—only one in four employers know whether they operate in a state requiring that they offer a retirement plan.

- “It doesn’t apply to my business.” Many employers assume their state mandate only applies to large companies, but the minimums are often quite low—typically five or more employees. While rollouts may be staged by employer size, even small businesses are likely to be affected at some point.

- “State plans are free and easy.” Employer costs may be low, but state-run plans often have limited investment options, sparce service offerings, and weak educational programs. Lower engagement levels (compared with private plans) typically mean little impact on retirement readiness and the value employees place on their benefits.

- “There’s no rush—nothing’s being enforced yet.” Some employers delay action assuming enforcement is lax, or deadlines are flexible. But California, Illinois and other states have issued penalties, which can result in fines and reputational risk.

- “Employees don’t care about the type of retirement plan we offer.” Employers may underestimate how much workers compare benefits across companies. A limited state plan can feel impersonal or insufficient—a well-designed private plan with educational tools, resources and matching contribution options can drive engagement and loyalty.

- “Employers only have to inform employees of the availability of the state plan.” State mandates typically require employers to automatically enroll employees into a qualifying plan. Employees may opt out of the state plan but only after they’ve been enrolled by their employer.

Eighty-one percent of employees consider retirement benefits extremely valuable. They rank second in importance only to health care benefits.

Employers operating in a state with a retirement mandate have a choice—they can select to auto-enroll employees into their state’s IRA program or offer their own qualified private plan. Both are intended to help employees save more for retirement, but they have key differences. Overall, private plans offer more flexibility and more benefits to employers and their employees.

| State retirement plan | Private retirement plan | |

|---|---|---|

| Plan type | Roth IRA or Traditional IRA | 401(k), 403(b), SIMPLE IRA, SEP IRA |

| Annual contribution limit | $7,000 (under age 50) | $23,500 (under age 50), SIMPLE $16,600, SEP 25% of comp. up to $70K |

| Annual additions limit (employer and employee) | $7,000 (under age 50) | $70,000 |

| Customizable | No | Yes |

| Tax credit for the employer | No | All but 403(b) |

| Employer matching or profit-sharing | No | Optional |

| Employee contributions are pre-tax | Most state plans require Roth after-tax | Yes (Roth after-tax may also be offered as a choice) |

| Monitors contributions for IRS rules | No | Yes |

| Investment options | Limited | Customizable |

| Plan administration | Overseen by state | Employer or third-party |

| Fees | Employee typically pays | Customizable |

| Financial wellness tools | No | Optional |

| Compliance requirements | Yes | Yes |

Limits as indexed by the IRS for 2025 calendar year.

On the surface, state-run retirement programs may look like an easy and low-cost option. But these programs generally miss out on important benefits for the employer and their employees. With a private retirement plan, employers have the opportunity to offer more investment options, with higher contribution limits on a pre-tax basis that typically lowers employees’ taxable income.

For small business owners, certain plan types—including Safe Harbor and SIMPLE 401(k) plans—address administrative, regulatory and cost concerns. Safe Harbor plans, for example, satisfy IRS requirements for annual testing and employer contributions, reducing the compliance burden and helping make plan administration easier and more cost effective. Pooled employer plans (PEPs) allow employers to join a pre-established plan with other employers, reducing administrative burdens and outsourcing some fiduciary duties.

Employers offering 401(k) plans can enjoy several tax advantages, including deductions for contributions, a potential tax credit to offset startup costs, and the ability to deduct plan administrative expenses.

What’s next?

State-mandated retirement plans have reset the baseline for employer-sponsored benefits. While compliance with the laws is necessary, it shouldn’t be the only goal. Forward-thinking organizations can use mandates as a starting point to modernize the benefits package with a private retirement plan. The strategic advantage will likely go to employers who invest in the long-term well-being and satisfaction of employees—attracting and retaining top talent to help operate and grow the business.

Connect with a Principal® retirement specialist to get started with a plan that can benefit your business and your employees.