Our digital investment solution recommends and manages a diversified investment mix — so you can feel confident about your retirement goals.

Talk to a financial professional to get started.

We’re here Monday - Friday, 8 a.m. to 5 p.m. CST.

Based on a few inputs from you – such as…

… our automated investor recommends a diversified investment mix of proprietary mutual funds and ETFs. The application is entirely online and typically takes less than 10 minutes. We’ll start actively managing your investments based on your retirement goals.

Everyone's financial goals are different. Our proprietary algorithm puts you at the center of the equation.

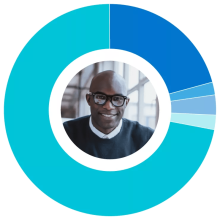

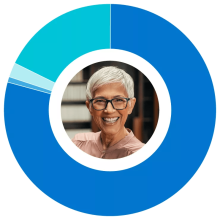

Key for donut charts. Items presented in chart starting at the top and displayed clockwise.

Jordan | 24

Investment model: Risk-based

Retirement age: 63

Goal: Save for retirement

Risk profile: Aggressive

Avery | 41

Investment model: Time-based

Retirement age: 65

Goal: Save for retirement

Risk profile: Balanced

Alex | 60

Investment model: Risk-based

Retirement age: Retired

Goal: Use my retirement savings

Risk profile: Conservative

Choose an investment model that fits your needs.

Time-based investing

- Diversified mix of investments unique to your needs.

- Automatically adjusts asset allocation (aka your mix of investments) to become more conservative over time.

- Minimizes vulnerability to market volatility as you get closer to achieving your goals.

Risk-based investing

- Diversified mix of investments according to your comfort with risk

- Automatically adjusts asset allocation (aka your mix of investments) to maintain your risk level as markets change.

- Your risk level remains constant until you change it, which you can do at any time by retaking the risk questionnaire.

We keep an eye on your account – so when your investment mix needs to be rebalanced, it’s done automatically to help keep you on track.

When your goals change, just update your account and we’ll adjust your investment mix to match. We can do the heavy lifting.

Bonus: Technology and real people.

You’ll have ongoing access to a dedicated team of financial professionals throughout your retirement journey.

They’ll answer questions about your investments and provide guidance on other financial topics life throws your way.

We support you every step of the way.

We help you plan for the future with interactive retirement planning resources, checklists and educational content -- sent right in your inbox. Principal also provides complimentary, ongoing education for your financial needs.

Total annualized program fee is .85% of your account balance. The Principal® SimpleInvest program fee represents both the account management fee and the investment expenses.