Retirement that’s personal

Putting your employees at the heart of what we do

An approach that goes beyond

The robust Principal® participant experience helps people figure out how to build retirement savings and strengthen financial wellness so they can feel more certain about their tomorrow, right now.

Our approach is designed with real people in mind and goes beyond simple personalization, including:

Easy, outcome-focused, personalized experiences

Campaign | Timing | Audience |

|---|---|---|

Eligibility and enrollment reminders Newly eligible participants in existing, start up, or transition plans

|

| All newly DC eligible, including all eligible participants in transition plans, receive the get started communication Reminders only go to eligible participants not subject to automatic enrollment who have not yet enrolled |

Welcome campaign to introduce Principal and the new plan benefits and services including investment options, beneficiaries, and Principal® Milestones | Begins the day after a participant enrolls and is out of onboarding. Or the day after plan entry, contract effective, or automatic enrollment date when the contract is out of onboarding | Transitioned and newly enrolled participants |

| Enrollment promotion | Annually on the participant's birthday and seasonally throughout the year | DC active participants who have not enrolled and have been eligible for at least 90 days |

| Account security | For those without web credentials: 3, 6, and 9 months after plan entry, enrollment, or contract effective date. Additional trigger sent every 12 months to those who still do not have web credentials or who have not logged in in 12 months | DC active participants without web credentials, or who have not logged in for 12 months |

| Mobile app | 3 days after a participant creates web credentials | DC active participants who have created web credentials |

Campaign | Timing | Audience |

|---|---|---|

| Annual retirement planning | Annual (personalized timing) | Active DC participants with an account balance |

| Birthday deferral review | Annual (around birth date) | Active DC participants with an account balance |

Managed Account journeys | Multiple email touches beginning when a plan adds a service. Ongoing journeys begin after new-to-plan emails end | Active DC participants who are not enrolled in the managed account service available in their account |

| Beneficiary review | Annual (personalized timing) | Active DC participants with an account balance |

| Account consolidation journey | Personalized timing | Active DC participants with an account balance in a plan that allows roll-ins |

| Retirement transition program | Annual (personalized timing) | Participants ages 55 to 73 |

| Benefit event journey | Automatically | Participants who have an employment change or retire |

Campaign | Timing | Audience |

|---|---|---|

| Monthly | DC and DB participants, including eligible nonparticipants, who have been eligible for at least 90 days | |

| Spanish participant newsletter and webinar | Quarterly | DC participants with Spanish as their preferred language |

| Participant webinars | Monthly | Targeted based on topic with reminders sent to those who don't register and replays sent to those who sign up |

See the experience

Principal offers a seamless experience, starting with an easy enrollment process. As individuals become eligible, they’ll encounter Principal® Real Start. Through principal.com/welcome, they’ll set up their online access and get started in the plan. The experience is available on the web (mobile-friendly), in the Principal® app, and in English or Spanish—making it easy to enroll the way they prefer.

Our enrollment experience helps drive better outcomes:1

1 Principal reporting Jan. 1-June 30, 2025.

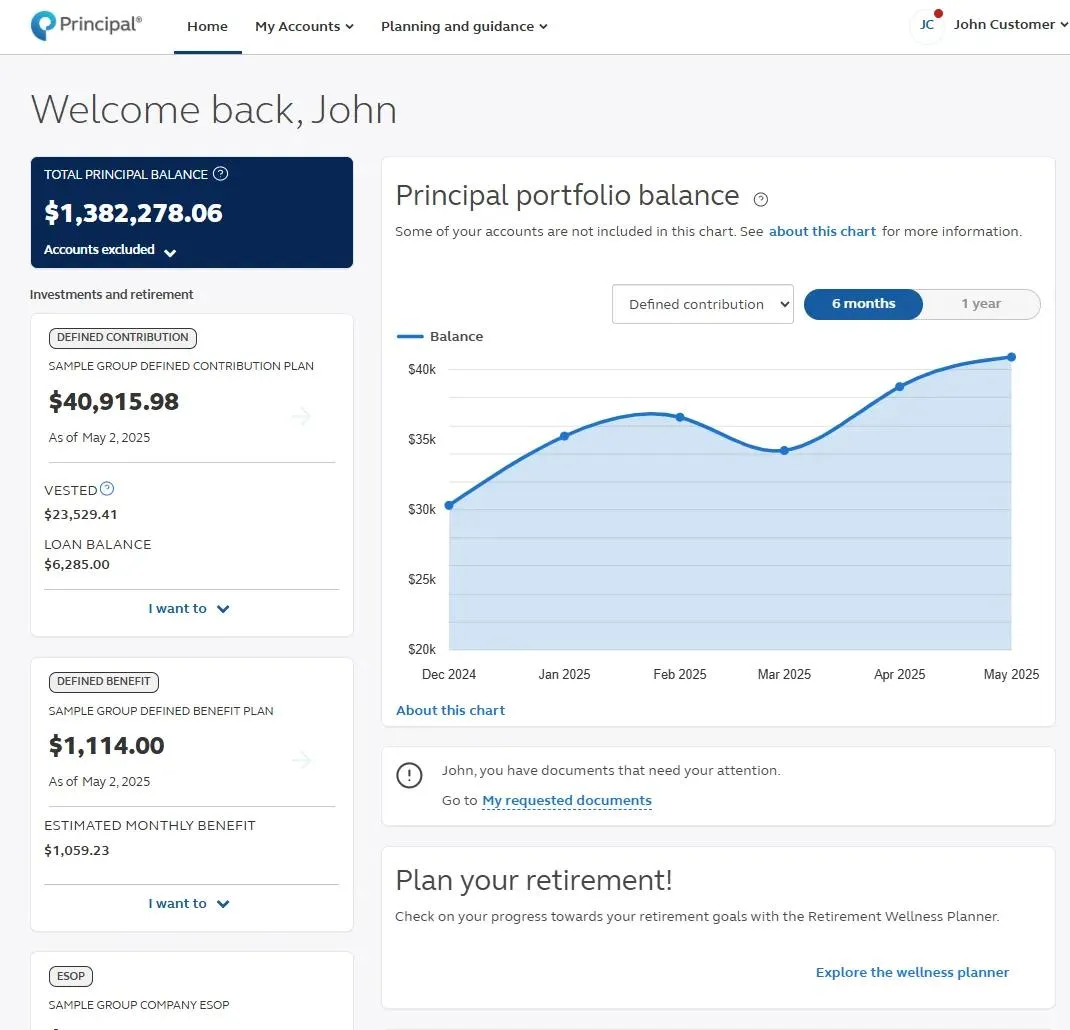

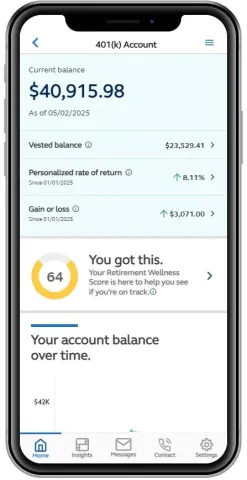

When a participant logs into their account, they’ll see a consolidated view of their accounts all in one spot.

For illustrative purposes only.

1 2024 PLANADVISER Retirement Plan Adviser Survey, February 2025.

2 DALBAR’s 2025 Pyramid of Communications Excellence, August 2025.

Our intuitive messaging approach makes it easy for participants to learn about new ways to plan and save. We cover a variety of important topics:

We continue nurturing your participants to keep them engaged and motivated. Through ongoing trigger-based deferral campaigns, beneficiary reviews, and newsletters, we connect with your participants along their unique path.

For illustrative purposes only.

Support Hispanic workers with distinct tools and transcreated resources—not just translated—that reach and educate participants in a matter that’s culturally relevant.

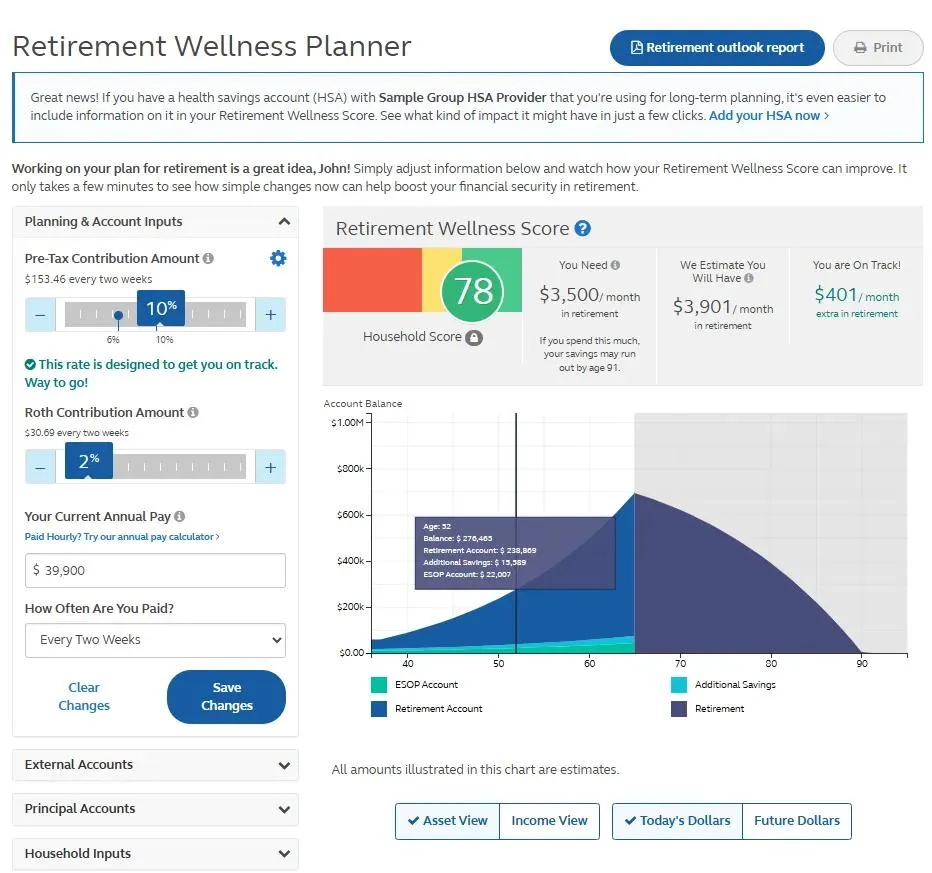

Through a simple red, yellow, or green category, participants quickly see their Retirement Wellness Score when they log in to their account on principal.com, indicating how well they’re tracking toward their retirement goals.

Using the Retirement Wellness Planner, participants get a holistic picture of their retirement readiness with interactive sliders, nudges, and a real-time savings graph that estimates a percentage of their pre-retirement monthly income in retirement and how long it may last. The planner also lets participants take immediate action, like increasing deferrals. Participants can also bring in information from other external accounts or an HSA account.

For illustrative purposes only.

1 Principal reporting as of June 30, 2025. Compares participants who used the resources with those who did not.

The Retirement Wellness Planner information and Retirement Wellness Score are limited only to the inputs and other financial assumptions and is not intended to be a financial plan or investment advice from any company of the Principal Financial Group® or plan sponsor. This calculator only provides education which may be helpful in making personal financial decisions. Responsibility for those decisions is assumed by the participant, not the plan sponsor and not by any member of Principal®. Individual results will vary. Participants should regularly review their savings progress and post-retirement needs.

Our mobile app puts your participants in control, getting them the answers they want quickly and letting them make changes within their accounts efficiently.

For illustrative purposes only.

1 2024 PLANADVISER Retirement Plan Adviser Survey, February 2025.

2 Principal reporting as of June 30, 2025. Compares participants who used the resources with those who did not.

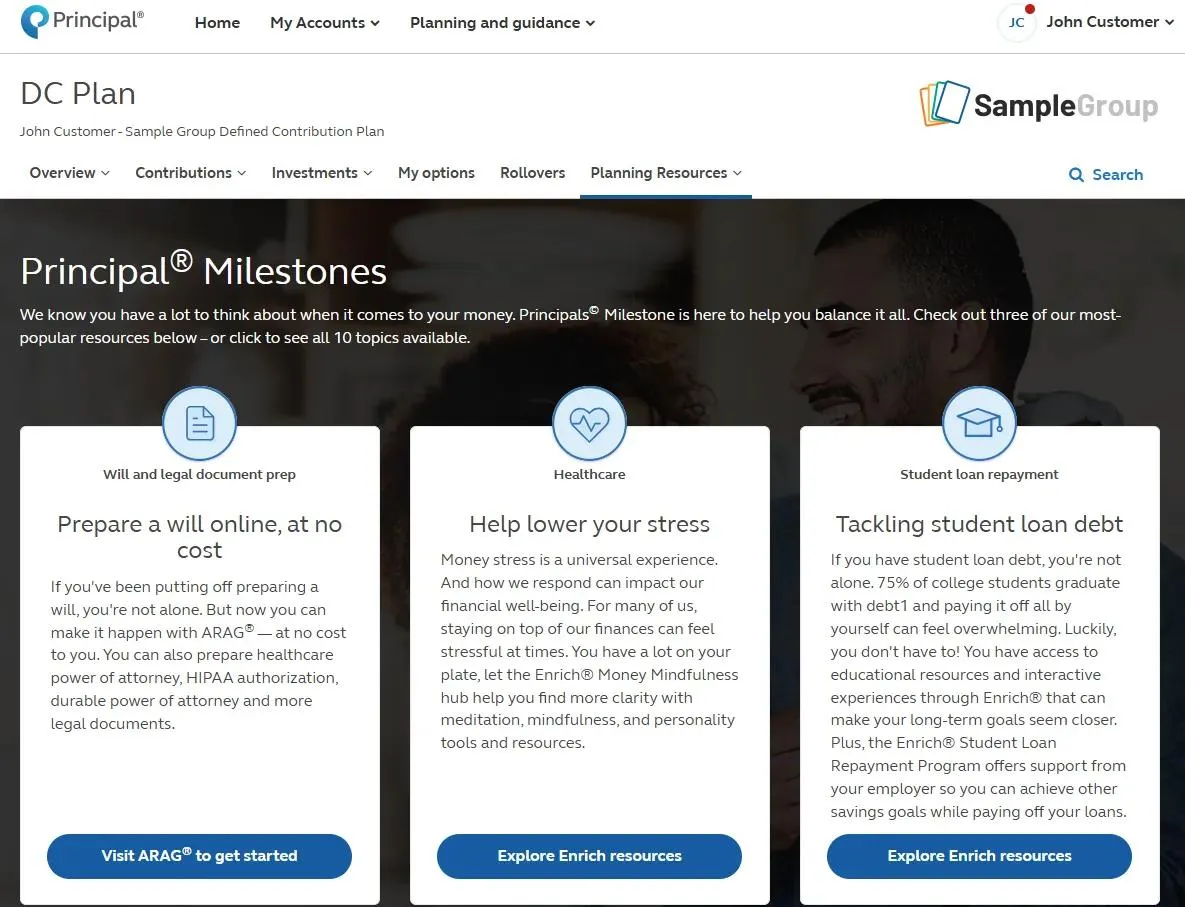

Through Principal® Milestones, participants can expand their knowledge beyond retirement planning with personalized education and financial wellness experiences, building confidence in financial topics that matter most to them.

Enrich®: A financial wellness platform offering engaging, effective, and unbiased financial education—all designed to help individuals take control of their finances.

ARAG®: Access to prepare a standard will and other legal documents at no additional cost.

Webinar series: Participants can learn about the topics that are most important to them in 30 minutes or less. Every month there’s a new topic to learn about, like investing for women, health care near retirement, money smarts as you start, and more. Plus, replays are available on demand—so participants can watch when it works best for them.

1 Principal reporting as of June 30, 2025. Compares participants who used the resources with those who did not.

2 ARAG® reporting as of Aug. 31, 2025.

As participants get closer to or transition into retirement, they may have new questions and needs. Through our Retirement Transition Program, we begin an automated communication journey when a participant reaches age 55—starting with a retirement readiness mailer, followed by annual planning messages.

Participants also have convenient access to:

For illustrative purposes only.

Elevating financial wellness

Our monthly webinar series—30 minutes with live Q&A, plus on-demand replays—helps individuals elevate their financial wellness with helpful tips and strategies on important financial topics.

2026 topics

January

Goal setting for 2026 and beyond

February

Social Security basics

March

Financial foundations in your 20s and 30s

April

Retirement readiness at any age

May

Market volatility and inflation survival guide

June

Planning for health care in retirement

July

Maximize your 401(k) account

August

Which comes first, debt or saving?

September

Retirement strategies for more investment options

October

Estate planning essentials

November

Changing landscape of Social Security

December

End-of-year assessment

Quarterly Spanish videos

Q1 Saving for college and teaching kids smart money moves

Q2 Banking basics

Q3 Understanding retirement accounts

Q4 Social Security benefits