Mike Clark

Consulting Actuary

In the 1967 cinematic masterpiece, Cool Hand Luke, the enigmatic protagonist played by Paul Newman bluffs his way to victory in a hand of prison poker, prompting barracks boss Dragline (played by George Kennedy who won an Oscar for his performance) to declare, “Nothin’! A handful of nothin’! … He beat you with nothin’!”

As Luke rakishly raked in his winnings, he shook his head and replied, “Yeah, well … sometimes nothin’ can be a real cool hand!” (That line obviously stuck with him all the way through to the film’s title.)

As defined benefit (DB) plan sponsors watch the gyrations of financial markets, they may be inclined to agree. So far this year, equities have shed about 12% of their value on average and long duration bonds have averaged losses of nearly 20%. (“Wipin’ it off, boss!”) From a gross return perspective, there’s been scant place to hide.

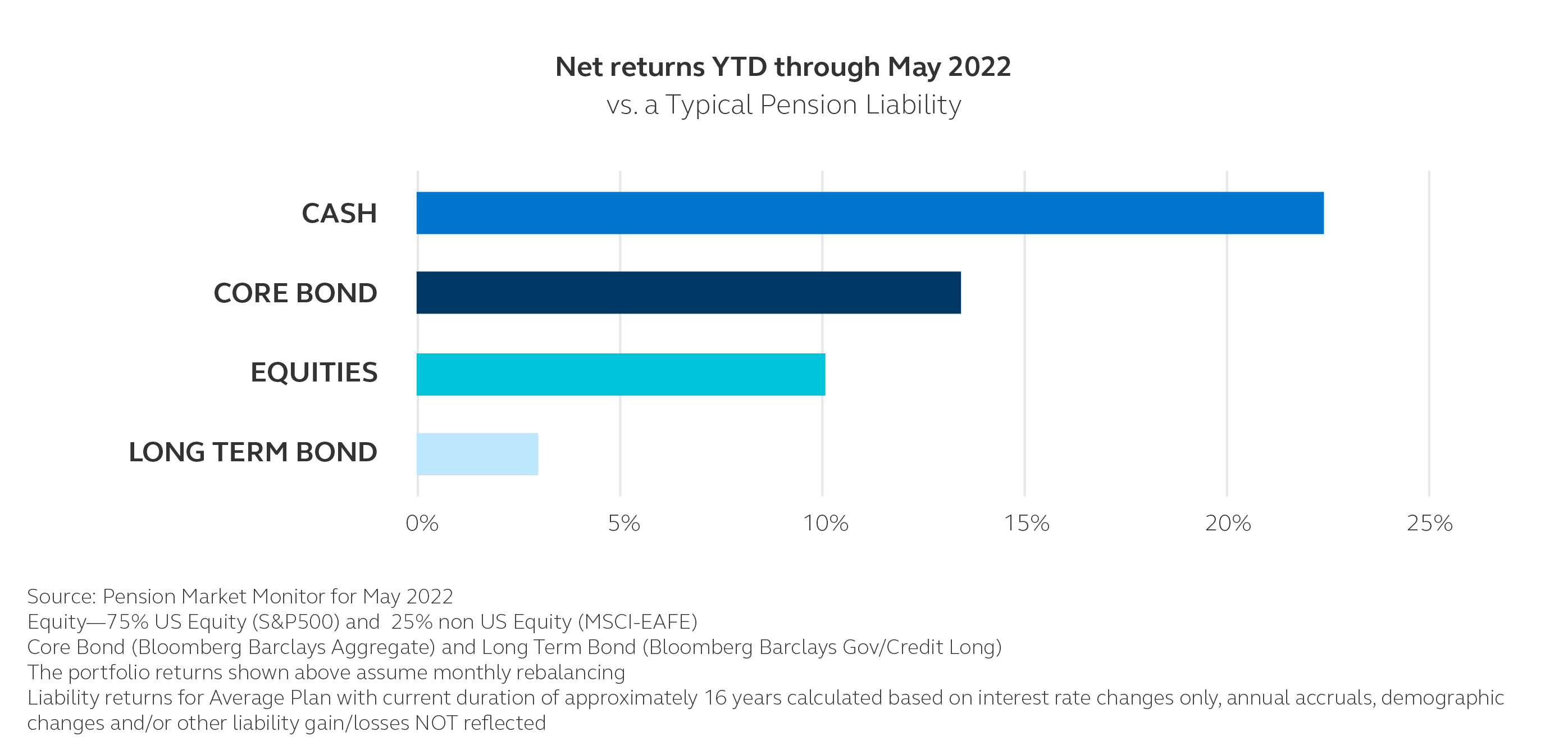

Fortunately, DB investors get to consider the net performance of their portfolios against liabilities, and the great interest rate spike of 2022 (up over 1.5% so far) has reduced liabilities for a typical pension plan between 12% and 25%. As a result, funding ratios have remained surprisingly stable despite amazing volatility.

Paradoxically, one of the best ways to generate net investment returns against liabilities so far this year has been … nothin’. A pension portfolio of 100% cash generating a return of 0% would have typically generated net returns of 12% to 25%. Short duration bonds would have fared somewhat worse, but still delivered strong positive net returns as shown on the Principal Pension Risk Management Dashboard.

Of course this is an extreme example not to be taken as investment advice. (That could be construed as “Failure to communicate!”) Obviously, fiduciaries of pension funds would have a difficult time taking such an extreme position. If rates were falling and equities rising, as they did for much of the past decade, cash under the mattress would be an indefensible position.

But if the current interest rate trend and equity struggles continue, the oft overlooked asset classes of short duration bonds and cash may start catching DB investors’ attention. Avoiding risk asset losses while allowing rising rates to close funding gaps could pay off.

Because from a DB gross investment return perspective, when interest rates rise and stock markets fall nothin’ can indeed be a really cool hand!