Mike Clark

Consulting Actuary

When I’m not writing deep-thinking pension articles, I like to relax by watching ridiculous TV shows like Holey Moley, where eccentric players take on the extreme physical challenges of a miniature golf themed obstacle course, all hosted by NBA superstar Stephen Curry. My favorite hole is Double Dutch, where golfers must putt their balls through two giant windmills, and then run through themselves without getting humiliatingly whacked by a whirling blade into the water below. (Season 3 of Holey Moley really amped this up by adding fire: Double Dutch en fuego!)

In short, the object of Double Dutch is to navigate two fast moving obstacles to time a successful leap to a much safer place. Which of course reminds me of the challenges faced by plan sponsors and financial professionals managing the twin defined benefit (DB) investment challenges of equity and bond rate volatility.

Risk taking has paid off—for now

Plan sponsors playing the risk game have typically done quite well over the past two years, with funding ratios for many plans increasing by 20% or more since the COVID-nadir of March 2020. First, equity bulls thundered through 2021 carrying DB investors to their best year since 2013.

Now 2022 has brought an incredible spike in interest rates, with its associated sharp reduction in pension liabilities. As you can see on the Principal Pension Risk Management Dashboard, bond rates used for pension valuations are up about 1.5% through April, reducing liabilities for a typical plan 12% to 20%. You’d have to go back to mid-2018 to find the last time yields were at current levels.

Unfortunately, the current leap in rates is largely driven by inflation effects, which have also driven significant losses in return-seeking assets. Since DB investing is all about net returns rather than gross, however, funding ratios for many plans have remained relatively steady this year despite historic market volatility.

Timing the leap to LDI

Like a determined yet trepidatious miniature golfer, many sponsors now stand before the huge spinning blades of the bond and equity market windmills trying to determine the optimal time to make the leap away from a past successful return seeking strategy to a more conservative allocation calibrated to their improved funding position. (NOW! … no wait … GO! … oops, not that time … after this next one …)

Granted, not every DB plan is the same. Hard frozen plans with higher funding ratios generally have less need for net returns than lower funded plans with active benefit accruals, so the pace at which risk is reduced will vary by plan circumstances. But the combination of recent improvement and future uncertainty suggests that most plan sponsors should at least be considering a partial jump to the liability driven investing (LDI) side of the obstacles.

Yet many stand transfixed, seemingly hypnotized by the rotating paddles of potential opportunity cost. A poorly timed jump could cause one to miss out on a stock market rally, or suffer gross losses on long bonds, should rates continue to rise. That sounds as embarrassing as getting unceremoniously buffeted off the Double Dutch (en fuego!) platform into the artificially blue mini golf water below, and then having Rob Riggle laugh at your misfortune while running the video replay repeatedly in slow motion.

The four phases of DB economics

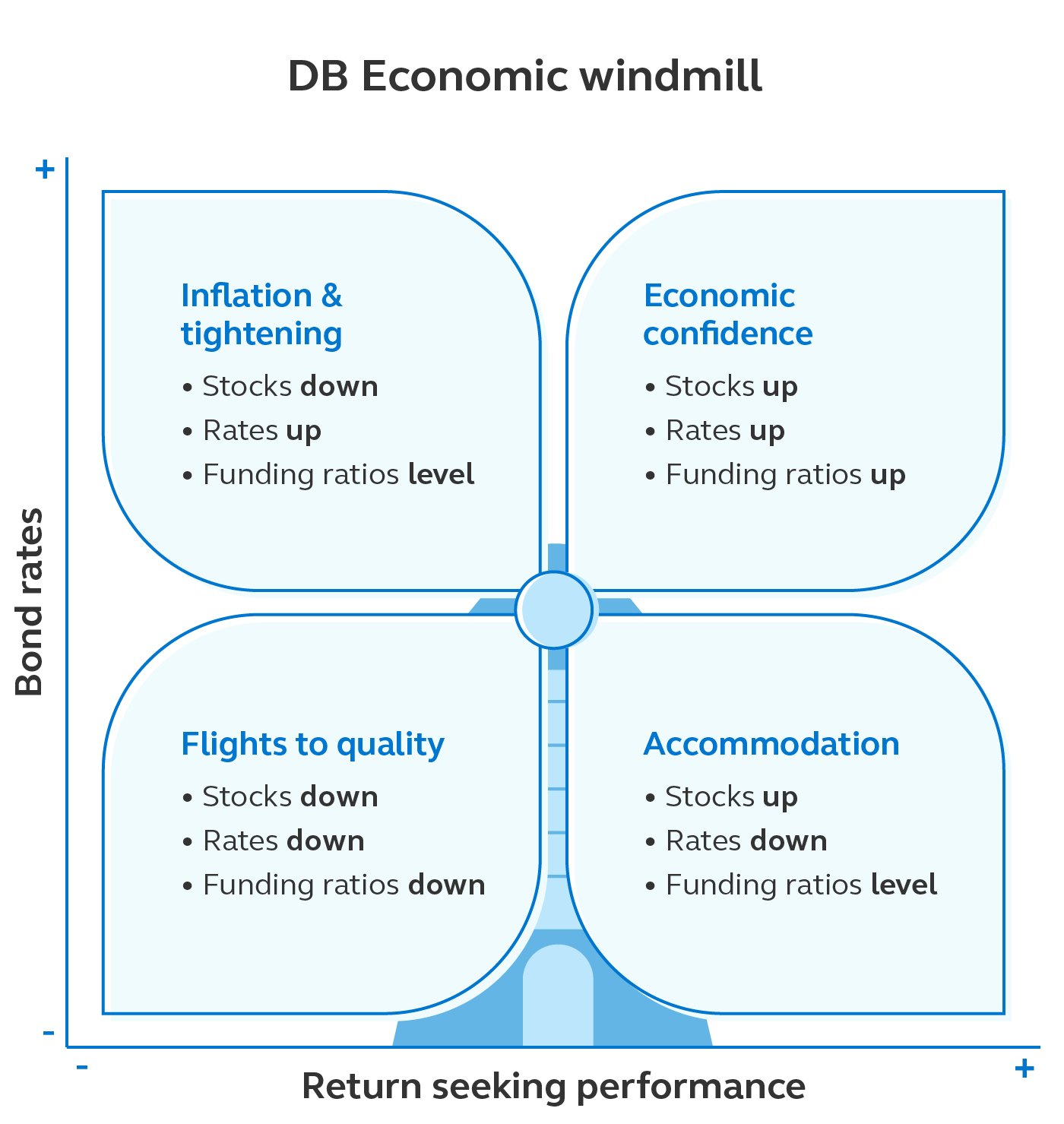

While you towel off, I’ll do a little blogging oversimplification to define four economic phases of DB plans (one for each windmill blade). Like the golf obstacle, every phase comes around periodically, though unlike the windmill, they don’t necessarily come in any particular order. Each of the four is defined by bond rate and equity price movement, with the expected impact on pension funding ratios in parentheses.

- Accommodation – Access to government money drives stocks up and rates down (neutral)

- Flight to quality – Fear drives both stocks and bond rates down (negative)

- Inflation and tightening – Rising rates lead to dropping stock prices (neutral)

- Economic confidence – Growth causes both stocks and rates to rise (positive)

Reality is obviously more complex than this model, but it does help explain certain periods and their effects on pension funding. The financial crisis of 2008 was a classic Flight to Quality. Most of the time afterward through 2020 can be classified as Accommodation as intentional government action kept rates low and equity markets went on decade long run (with little funding ratio improvement). 2021 mostly fell into the Economic Confidence phase, with some remnants of Accommodation.

This volatile year has exhibited symptoms of Inflation and Tightening with an occasional small Flight to Quality (though lately it feels like a different blade is whipping around almost daily to confound investors). The relatively good news for most DB plans is that, so far at least, delayed decision making has not resulted in material funding ratio losses.

Better to miss this flight

The future is certainly uncertain; the only thing we know for sure is that the windmill will keep turning. Any move to lock in recent gains should probably be made soon, lest the next blade knock funding ratios off their platforms in a disastrous flight to quality, face-first into the fake blue pond below.

The only person who would enjoy that is Rob Riggle.