There’s a lot of buzz about investing these days. Should it be part of your plan? How will you know you’re ready to start investing? Maybe you already are and didn’t even know it.

“There’s an old adage that says time in the market is more important than timing the market,” says Heather Winston, assistant director of financial advice and planning at Principal®. “And starting investing as early as possible—even with seemingly small dollar amounts—may put you on a path to success in the future.”

Here are four signals that may help you decide.

1. You're building a strong emergency fund.

Life throws curveballs. It’s good to have an emergency fund with at least three months’ worth of expenses to give yourself the stability that investing can require. Your emergency fund will give you a buffer if anything unexpected happens, so you won’t have to tap into investments devoted to longer-term goals. Once you have a good start on your emergency fund, you can balance investing and saving by funneling money to both.

Learn more about building a reserve of money for emergencies.

2. You end each month with extra money.

Your emergency fund is looking good. You pay all the bills and any high-interest debt. You have enough to cover your expenses. Still some left over? It doesn’t have to be a lot. Investing is all about starting small and growing those dollars over time (more on that below). The key is to stick with it so the money invested can work for you.

Having trouble balancing your budget? Read “3 steps to allocate a paycheck when you want to get ahead with your money.”

3. You're ready to commit to some financial goals.

Investing is a journey that’s more successful if you know where you’re headed. That’s where goals come in, giving you direction and focus.

“Start with shorter-term goals, like saving for a big vacation or a wedding or even a down payment on a house,” says Winston. “Once you’ve proven to yourself that you can achieve a shorter-term goal, longer-term needs, like saving for retirement, can become a bit more approachable.”

4. You have access to a retirement plan.

A 401(k). A 403(b). If you can contribute to an employer-sponsored retirement plan like these, you may have already taken a big step toward investing. With most employer-sponsored retirement plans, you can elect to have money invested from each paycheck. That makes it easier to contribute to your retirement goals. Some employers even offer to match employee contributions up to a certain level. That’s essentially free money, and those extra contributions can help a lot over time.

If you don’t have access to an employer-sponsored retirement plan, or if you’re able to set even more aside than just your company plan, look at opening an individual retirement account (IRA).

The signs say you're ready to start investing? You can go in small.

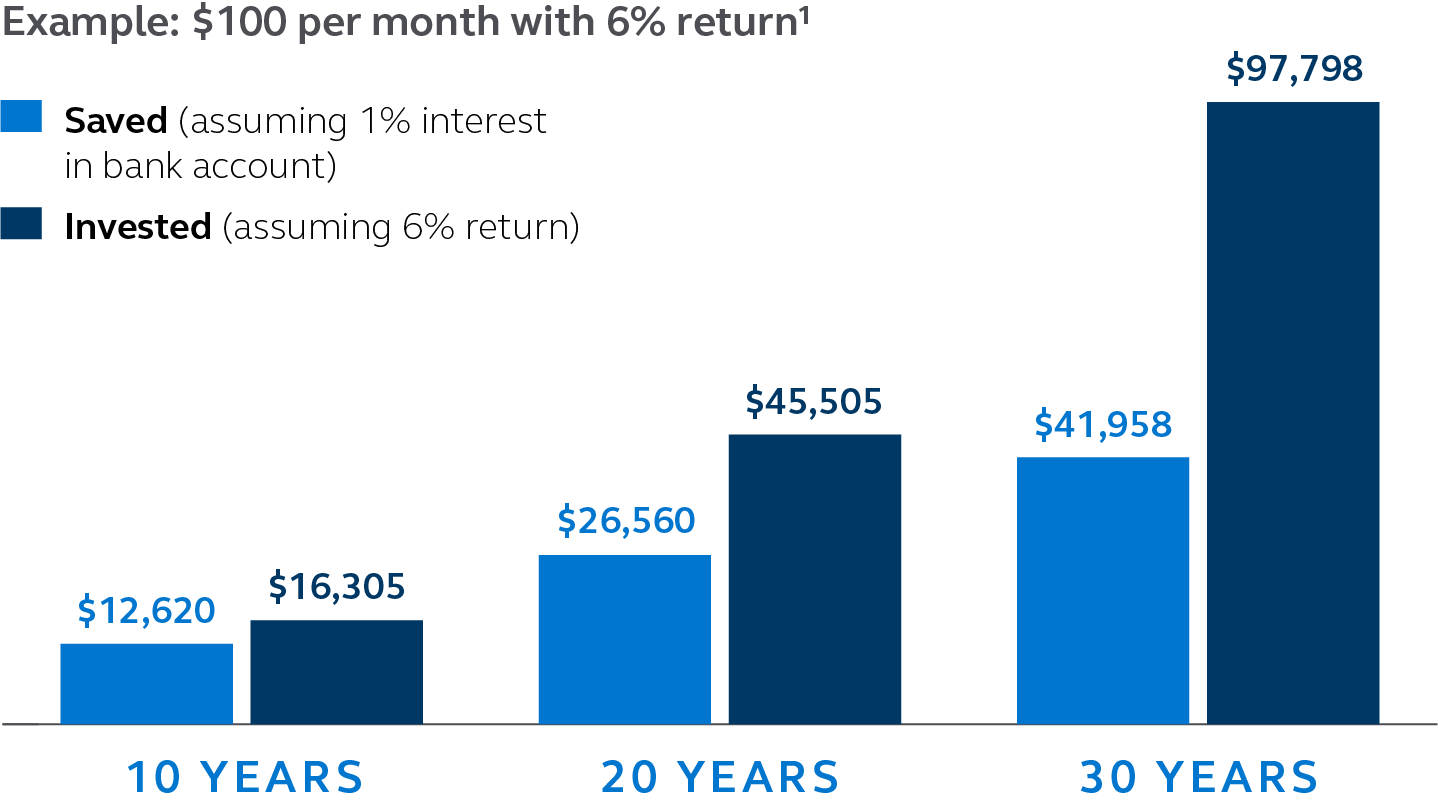

Can you invest an extra $100 a month? Even small amounts can add up over time.

In fact, your investments have the potential to multiply. Stuffing $100 a month in a jar for 30 years would get you $36,000. Invest that same amount at a 6% annual rate of return, and through the power of compounding, that investment could grow to nearly $100,000 in the same time.1

Let’s say you invest through a retirement account, such as a 401(k) or IRA. There’s big opportunity there, too. If you had a $35,000 annual income and bumped your pre-tax contributions up just 1%, that’s only about $10 off your bi-weekly take-home pay.

Later, in retirement, that could add up to another $150 per month to spend.2

The most important thing to remember? Success doesn't require major cash. Let time and compound earnings work for you to help achieve your goals.

Next steps

- Log in to principal.com to check your progress toward your retirement goals. First time logging in? Get started.