Your unique goals. Our dependable solutions.

Helping you pursue your dreams.

Throughout the last 141 years, we’ve stood alongside our customers through wars, recessions, natural disasters, social unrest, and pandemics. Such challenges are universal, but they affect every business and every person and every nation uniquely. Whatever the circumstances, we’re here to give our customers access to financial resources—because everyone deserves the opportunity to pursue their dreams and make progress toward their goals.

We’re helping customers make progress toward their goals.

Protecting individuals and businesses

Protection and guaranteed income solutions to help avoid setbacks.

Interest in life insurance products and guaranteed lifetime income solutions increases in times of volatility and uncertainty. In 2020, we processed a record number of life insurance applications.

With the passage of the SECURE Act, employers have greater opportunity to provide their employees with lifetime income in retirement through an in-plan annuity. As a diversified insurance company in a strong financial position, we are well-positioned to help employers explore this important benefit, and as of Dec. 31, 2020, nearly 2 million individuals received or had access to our guaranteed income solutions.

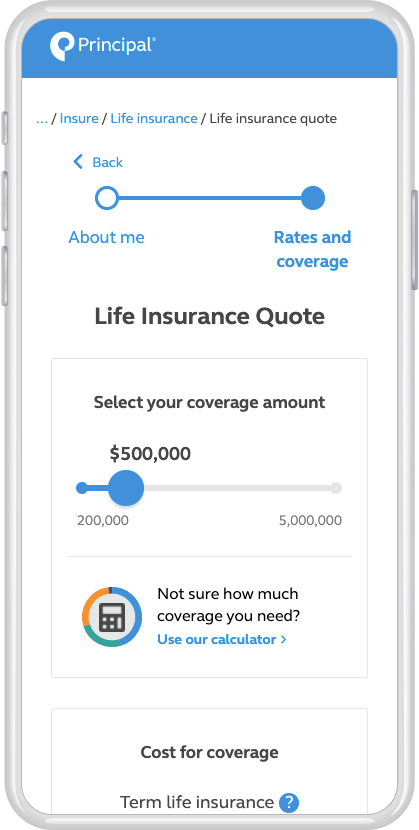

Late in 2019, we introduced Principal Life Online, a solution designed to simplify the term life insurance application process for financial professionals and customers. In 2020, we introduced new tools such as our life insurance and income protection calculators to help customers understand their unique protection needs.

Diversified, distinctive asset management solutions

Helping investors build strong portfolios.

Our investment management engine provides high-value solutions to retirement, retail, and institutional investors. We have the right team, the right tools, and a diversified set of asset classes to create and maintain a portfolio that delivers steady growth in performance.

Among our priorities in 2020:

Our fully active and hybrid target date portfolio offerings help individuals weather market volatility and stay the course for retirement and beyond. They show our commitment to develop, enhance, and deliver a robust set of investment solutions to the retirement market.

Retirement investment solutions have become a differentiator for us in many of our locations outside of the U.S., including markets such as Mexico and Thailand.

We developed our private investment capabilities to meet growing investor demand, including the build-out of private credit capabilities in our fixed income boutique and a Real Estate Operating Company (REOC) capability in our real estate boutique. Attractive returns relative to many public markets and an ability to diversify portfolios and avoid high asset class correlation are just a few of the many benefits.

We accomplished this while staying true to our core values, embedding environmental, social, and governance (ESG) considerations into many of our investment processes, and remaining one of the Best Places to Work in Money Management for the ninth year in a row (Pensions & Investments, December 2020).

Making retirement and long-term savings accessible to more communities around the world.

Increasing access to retirement and long-term savings.

Helping people live comfortably to and through retirement.

We added the Wells Fargo Institutional Retirement & Trust (IRT) business in 2019, doubling our number of plan participants, and in 2020, we met major milestones in the integration of this $1.2 billion acquisition.

We began welcoming IRT customers in October 2020 via Principal® Real Start, our onboarding platform promoting retirement savings best practices. By providing access to new tools, resources, and guidance, we’re helping plan sponsors and participants improve plan outcomes. As we welcome these customers to Principal, the increased scale presents new opportunities and builds our market position as one of the three largest retirement providers in the U.S.

In 2020, we launched the Principal Business Needs Assessment, the latest addition to our expanded suite of digital solutions designed to help employers assess their current financial plan and adjust accordingly, based on both short and long-term goals.

We also unveiled solutions designed to help the 5 million U.S. businesses that are currently without a retirement plan.

We teamed up with other key service leaders to provide Principal® EASE, a uniquely designed pooled employer plan (PEP) launched in January 2021. It combines integrated retirement plan administration, customer service, and investment management capabilities.

Retirement, simplified for small business.

Simply Retirement by Principal® is our digital 401(k) product, making retirement plans more accessible to businesses with fewer than 100 employees. This presents an opportunity for small businesses to expand and differentiate their benefit offerings: Only 55% of workers employed by small businesses have access to a retirement plan.

Connecting people around the world to digital tools.

We also continue to offer digital tools to help the growing middle class, including mobile apps, single sign-on technology, and financial wellness resources. Our products and expertise can have a profound impact on these customers. Our solutions help tailor the experience, supporting personal needs and financial goals. Here are several examples to showcase our commitment around the world:

Chile

Cuprum, our mandatory pension company, has the top-rated savings app in all markets across Ibero-America (Spanish and Portuguese-speaking countries). More than 25% of Cuprum customers use the app to manage their pension savings when and how it’s convenient for them—encouraging greater financial security.

We also launched Principal® SimpleInvest, a mutual fund platform that allows new and current customers to invest on their own or with support from an advisor.

Thailand

In Thailand, clients can now view their retirement statements, calculate their retirement readiness, and modify their contribution plans via the mobile app. Another new app allows investors to conduct transactions, view recommendations based on risk tolerance or investment goals, and manage their portfolios.

Brazil

Brasilprev, our joint venture with Banco do Brasil, improved the claims and benefits payment process with a fully digital solution—reducing the time to request payment from 30 days to nine days, going paperless in the process.

Mexico

Principal Mexico implemented new website features and functionality to accommodate customers during the prolonged COVID-19 pandemic—such as online appointment scheduling and the ability to request unemployment insurance—leading to a significant growth in web traffic and a substantial increase in the number of new registrations.

We’re here to build greater access to financial security for all people.

As a global leader, we invest significant time and resources into our work with industry groups and public policymakers, advocating for systems that improve financial inclusion, security, and long-term pension outcomes.

Chile

In Chile, in the first year of the COVID-19 pandemic, our mobile app made it easy for workers to make hardship withdrawals from their pension accounts. We prioritized the urgent needs of our customers while still advocating for pension policies that safeguard retirement security for current and future generations.

United States

Many U.S. small businesses were hit hard this past year. We advocated for economic relief for those particularly impacted by COVID-19, pushing for Paycheck Protection Program funding and a simplified loan forgiveness process. In a year of political divisiveness and unrest, we stood up for policies and legislation that would help more people save for and protect their financial futures, including implementation of the SECURE Act and the next phase of retirement security legislation.

Mexico

In Mexico, we supported a breakthrough in retirement policy. Collaborating with Mexico’s largest chamber of commerce and major labor unions, we worked with the pension industry to contribute to legislation reforming Mexico’s mandatory pension system. The new law, which passed the Mexican Congress in early December and takes effect in 2021, will expand access to pensions and more than double the retirement savings rate—from 6.5% today to 15% in 2030.