There’s an inventive way to look at getting travel nurse costs under control that can also help full-time team members save more for retirement one shift at a time. It’s called the retirement shift.

Help improve retirement account balances while reducing travel nurse costs

It’s been nearly two years since the end of the global pandemic and hospital administrators are still trying to get control of their travel nurse budget.

The average cost of turnover for a bedside registered nurse (RN) is $52,350, leading to an average cost to hospitals between $6.6M-$10.5M per year.

How a retirement shift might impact the bottom line

It pays to be creative when considering the budget. A possible way to reduce the number of shifts travel nurses fill is to encourage full-time nursing staff to take one extra shift a month. Though administratively it’s meant to help the hospital’s bottom line by reducing travel nurse costs, to team members, this extra shift has a more personal meaning. It signifies a way to build a larger retirement account balance and a path to a successful retirement.

This extra shift could be referred to as the retirement shift. Naming it as such could be a way to build a retirement savings culture and educate employees on the retirement plan. And if they’re not a plan participant, the hype around the extra shift might encourage them to sign up.

How could a retirement shift work?

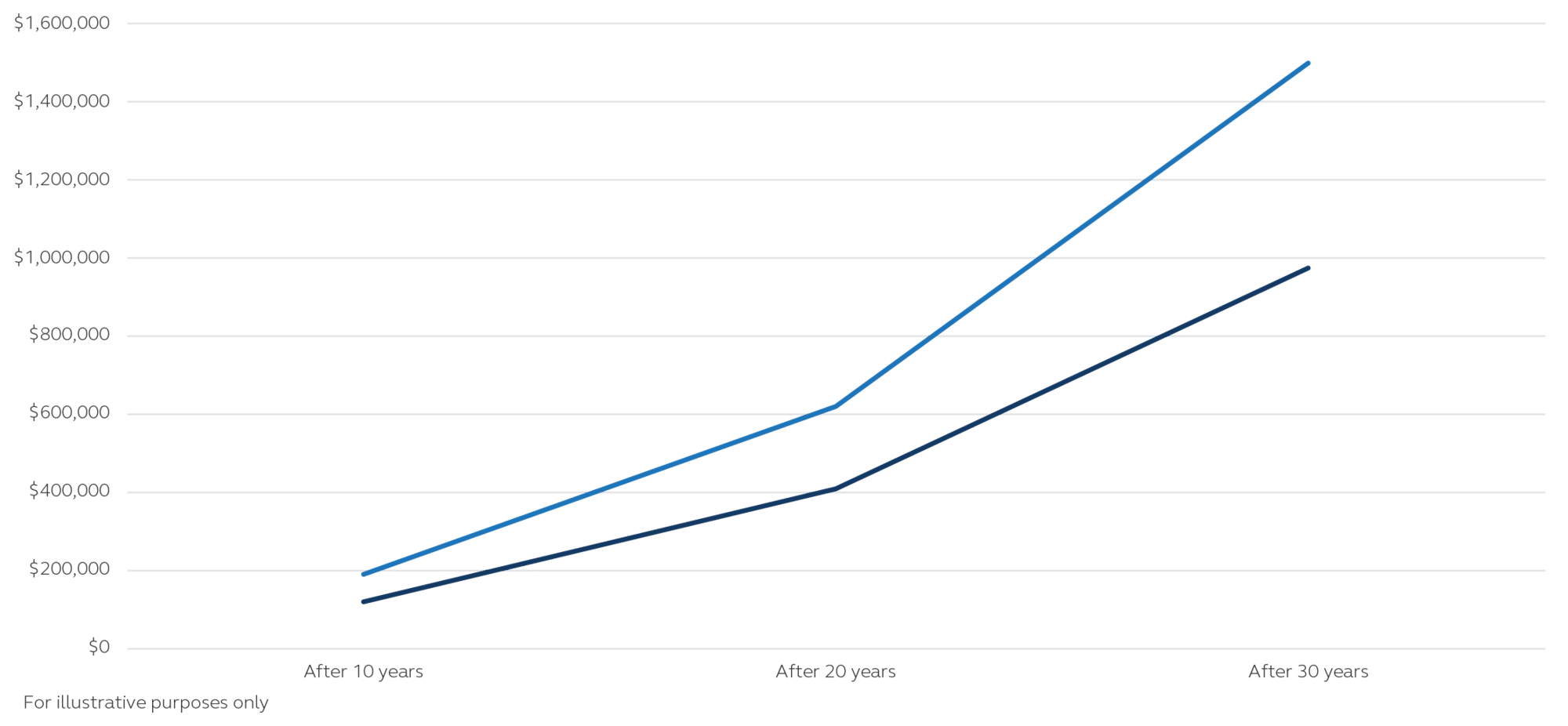

Nurses schedule one extra shift a month (the retirement shift) and defer that extra money and employer contributions into their retirement account. With just one extra shift a month, the nurse may achieve a retirement account balance up to 40% higher. Our scenario shows account balances could reach well over $1 million after 30 years.*

Is it possible to make nurses millionaires one retirement shift at a time?

Top line: following the retirement savings plan set out by the company, plus contributions and earnings from the extra retirement shift.

Bottom line: following the retirement savings plan set out by the company.

Recruit, retain, and improve retirement success

By reigning in travel nurses’ costs, health care administrators may now have the capacity to focus on staff recruitment and retention.

A retirement shift may offer a unique opportunity when recruiting high-demand skill sets. A story that’s different from your competitors. A way for nurses to potentially improve their retirement outcomes, one shift at a time.

And let’s not forget the side effects of consistent staff retention and higher levels of staff morale can produce—increased patient satisfaction. This can lead to better outcomes, and opportunities to maximize revenue.

Discover more retirement research and insights

Find the latest on plan design, retirement legislation, and pension plans from Principal® thought leaders. Uncover additional ways to use the retirement plan as an incentive that works for your business and helps your employees save more. Get more insights

It’s important to work with a retirement service provider who understands and has the expertise to consult on options to help deliver the desired results. If you’re looking for options that could work in building a more robust retirement plan—reach out to your Principal® representative.