A wise man once said, “You can lead a horse to water but you can’t make him drink.”

Mike Clark

Consulting Actuary

A wise man once said, “You can lead a horse to water but you can’t make him drink.”

He also reportedly said, “You can lead terminated vested defined benefit (DB) pension participants to a lump sum window, but you can’t make them jump through.” Sadly, that second nugget of wisdom didn’t make it through the wise man’s compliance department and is lost to the ages.

Make no mistake, though, conditions in 2023 may be ideal for plan sponsors to open temporary lump sum “window” offerings to former employees in hopes they agree to go through, taking their future pension risk with them. The question is whether those participants will agree to do so.

Rate Leverage Opens Window

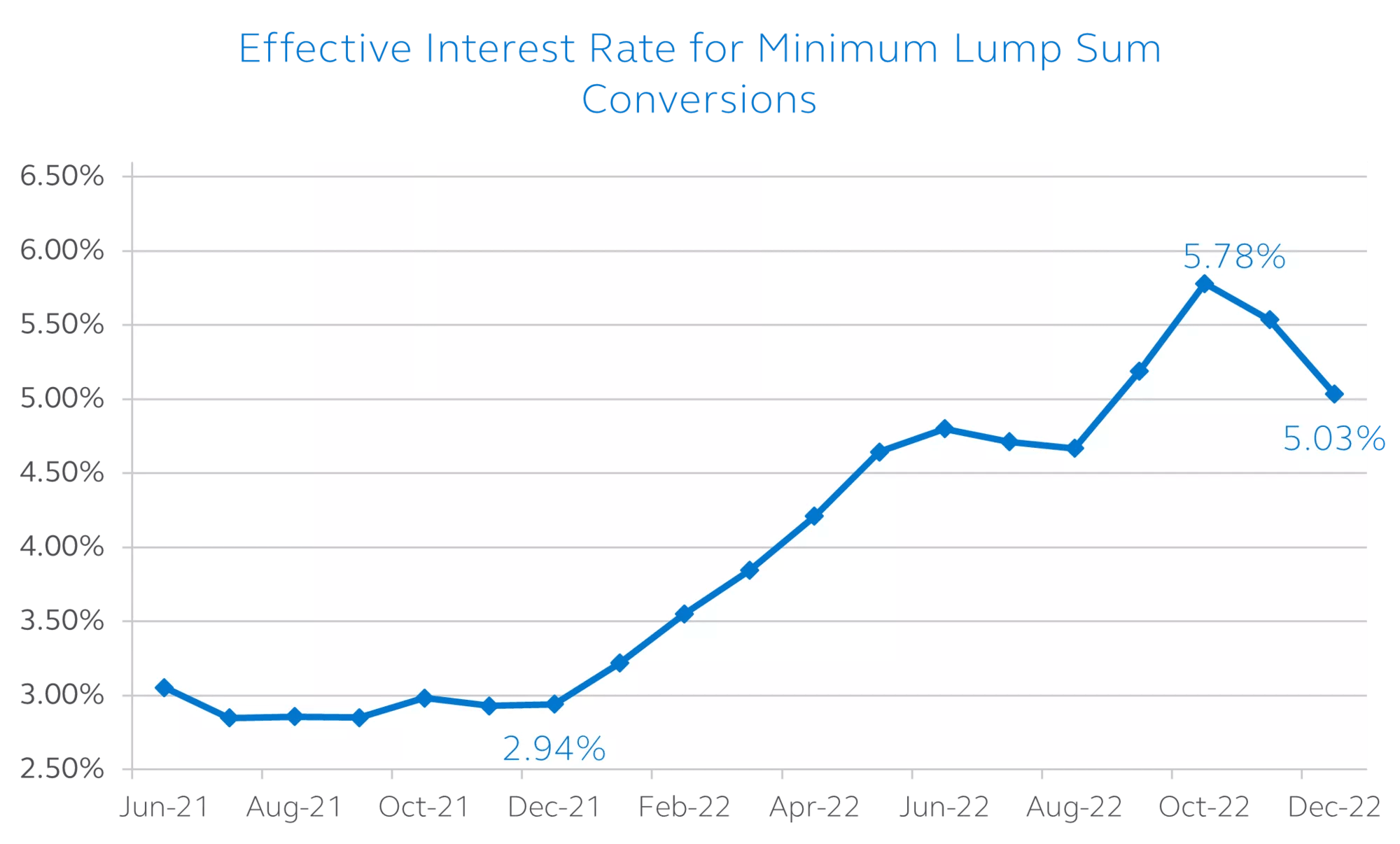

The lever prying open the window for 2023 is a spike in bond rates toward the end of 2022. The chart below shows that the rates for calculating minimum lump sums under IRS rules peaked in October around 5.8%, almost 3% higher than a year prior!

Source: December 2022 Principal Pension Market Monitor

Since lump sum equivalents of monthly pensions are very sensitive to interest rate changes, this historic increase has reduced expected payouts by 25% to 50%. See my previous blog, 2023 Pension Lump Sums Dropping Like the New Year’s Ball. For sponsors, cash payments are suddenly much less expensive, facilitating more participant transfers to shrink balance sheets and reduce PBGC premiums. Unfortunately, long bonds featured in many plans’ liability driven investment (LDI) strategies were similarly impacted by this spike, at least temporarily.

Stability Period Arbitrage

What makes lump sum windows particularly attractive for 2023, however, is that bond rates have reversed themselves since reaching their apex. Rates are down approximately 75 basis points from October as I write this, which translates to a 8% to 15% increase in the value of a typical market value pension liability. The effect on longer duration bonds is similar.

Lump sums, on the other hand, may not be increasing at all. Many pension plans lock in lump sum rates for their entire plan year, and many of those plan years begin on January 1. This lock-in is called an “annual stability period”. (Quarterly and monthly stability periods are other permissible options.)

Interest rates used throughout each stability period are pulled from one of the prior five “lookback” months. So a calendar year pension plan offering new lump sums can choose an annual stability period and a lookback month from August through December (with October providing the least expensive option.)

By locking in higher rates for actual payments, the plan is likely to experience financial gains as lump sums are paid out. In our scenario where market value liabilities are 8% to 15% above October based lump sums, a $100,000 cashout would settle $108,000 to $115,000 of the plan’s market value liability, closing the unfunded amount by $8,000 to $15,000. Multiplied by dozens, hundreds or even thousands of payouts, the impact can be meaningful.

Perfect Weather for Open Windows?

These potential financial gains combined with PBGC premium reductions and improved funding ratios may make 2023 an ideal year for sponsors to throw open lump sum windows, but there is a significant sticking point.

With legal minimum payouts running 25% to 50% lower than this time last year for the same monthly pension, fewer people may be inclined to jump after them. The same bond rates making windows attractive to sponsors could be viewed as downright ugly by the participants who have final say on whether a payment occurs.

With that in mind, sponsors will need to either sweeten cash out offers or prepare for lower take-up rates. Because no matter how economically beneficial terminated vested lump sum risk transfers are to plan sponsors, you just can’t make ‘em jump!