Mike Clark

Consulting Actuary

The fondest wish of every three-eyed, green alien populating the Pizza Planet Rocket Ship Crane Game in the 1995 animated classic Toy Story was to be the lucky one selected by “The Claw” and lifted out of the prize mosh pit. (“I have been chosen! Farewell, my friends. I go on to a better place!”)

Lifting Out PBGC Premiums

Participants in defined benefit (DB) pension plans may not be as excited about this prospect (or even aware of its possibility), but many sponsoring employers certainly are. For them reducing the headcount of their pension plan through a “lift-out” annuity purchase can significantly cut their annual premium from the Pension Benefit Guaranty Corporation (PBGC). (Particularly so for plans whose PBGC variable rate premiums are “capped” making their entire levy based on participant count.)

The problem up to now has been that historically low bond rates have made annuities seem cost prohibitive to some. For years some sponsors have looked longingly through the glass, dreaming of maneuvering their claw over just the right pensioners and plucking them from their plans. Sadly, after crunching the numbers most realized they didn’t have enough quarters in their pockets to make the lift-out worthwhile.

Time for a New Look

That has all changed over the past 15 months. First, funding ratios jumped during 2021 as pension investments experienced their strongest net returns in almost a decade. The higher perch offered a new perspective to many fiduciaries regarding pension risk, increasing their openness to hedging and transfer thoughts.

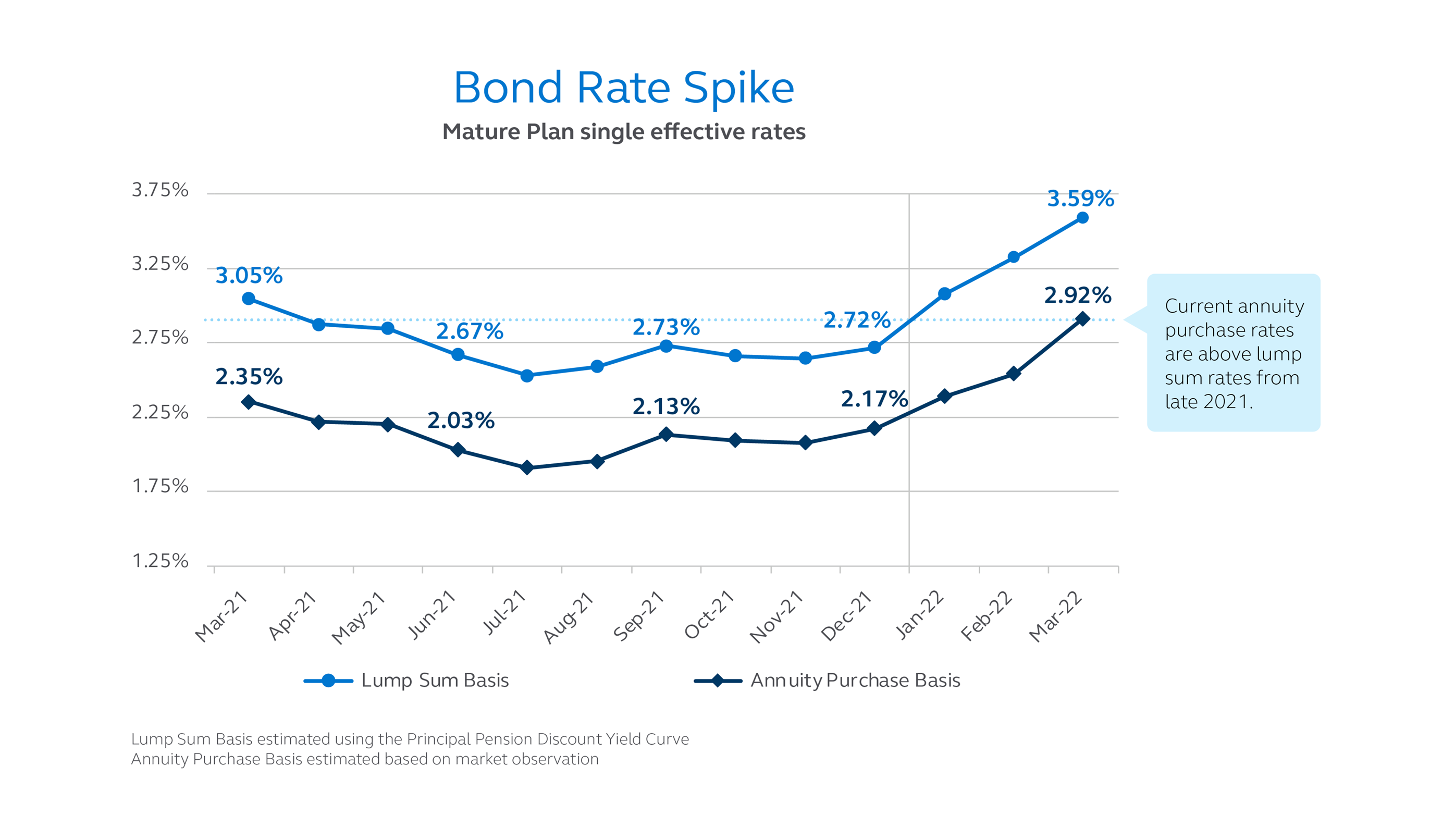

Then the new year brought rocketing bond rates. As I write this, high quality bond yields are up over 80 basis points since January 1, which has pushed pensioner annuity purchase premiums down about 6% to 8%1. In just over a year, underfunded plans considering expensive risk transfer bids have become well-funded plans in a much more moderate annuity pricing environment. It may be time to consider dropping a quarter and getting the claw in motion.

2022: Year of the Lift-Out!

Lump sum offerings to terminated vested participants have long been the first course of action in risk transfer strategies. However, 2022 may be the year where lift-out annuity purchases are actually more attractive.

Lump sum rates can lock for up to a year based on months preceding the current interest rate spike. So deferring additional cashout offers until rates reset at a hopefully higher level (2023 for many) could make financial sense. In addition, sponsors who have already offered lump sums (often more than once) may find retiree lift-outs to be a more tempting target on a cost-per-person basis.

Creativity and Control

Annuity rates typically follow the market, so rate driven savings are in play now. Lifting out a block of low benefit retirees can drive large headcount reductions relative to the assets required. Indeed, current annuity purchase rates (which are usually lower than lump sum rates) are actually comparable to lump sum rates from the fourth quarter of 2021. Beyond retirees, lifting out terminated vested or even frozen active employee benefits may offer intriguing opportunities. Though sponsors should consult with professionals to select a mix of participants that would be attractive to insurers.

Unlike a lump sum offering, sponsors are in complete control of size and make-up of lift-outs. Transfers can be calibrated to maximize PBGC savings within the funding and accounting allowances of each sponsor. Lift-outs take less administration and turnaround time since they don’t require participant elections, and the liability transfer success rate is always 100%.

Or as Alien #2 said so eloquently, “The claw chooses who will go, and who will stay!” The claw also chooses when, and 2022 may be the time.

| Before | Lift-out | After | |

|---|---|---|---|

| Liability | $100 million | $20 million | $80 million |

| Asset | $90 million | $20 million | $70 million |

| Shortfall | $10 million | $0 | $10 million |

| Shortfall based premium (5%)* | $500,000 | $0 | $500,000 |

| Headcount | 800 | 400 | 400 |

| Capped premium ($625 per person)* | $500,000 | $250,000 | $250,000 |

For illustrative purposes only. *Estimated 2023 PBGC premium rates.