Help boost retirement savings for workers in physically demanding jobs using retirement plan automated features.

When we think about non-desk employees, we typically envision workers engaged in physically demanding jobs: Manufacturing, mining, construction, nursing, cleaning, salons, mechanics, truck drivers, and the list continues. The skillset may vary, but most won’t be found in the traditional office setting.

What we don’t think about is the longevity of their careers and how it can affect their retirement savings. Retirement might come early because of the mere physical toll on their bodies, shortening their timeframe to save. This is why industries with large numbers of non-desk employees are encouraged to focus on designing their retirement plans with automated features.

Opportunity for auto-enrollment

Percent of plans that don’t use auto-enrollment within certain industries:

- 42% Manufacturing—Industrial Products

- 40% Chemicals & Mining

- 54% Building/Construction/Contracting

The 2024 PLANSPONSOR Defined Contribution Survey

For non-desk employees, delaying enrollment in a retirement plan can have a significant long-term impact. Because many of these employees may retire earlier due to the physical demands of their work, they have fewer years to save. Automatic (auto) enrollment is a proactive approach to help employees into the plan and saving as soon as possible.

For employers, helping employees retire on time can play into the workforce management strategy. Delayed retirements possibly lead to increased labor and healthcare costs, potential productivity challenges, and limited career advancement opportunities for younger workers.

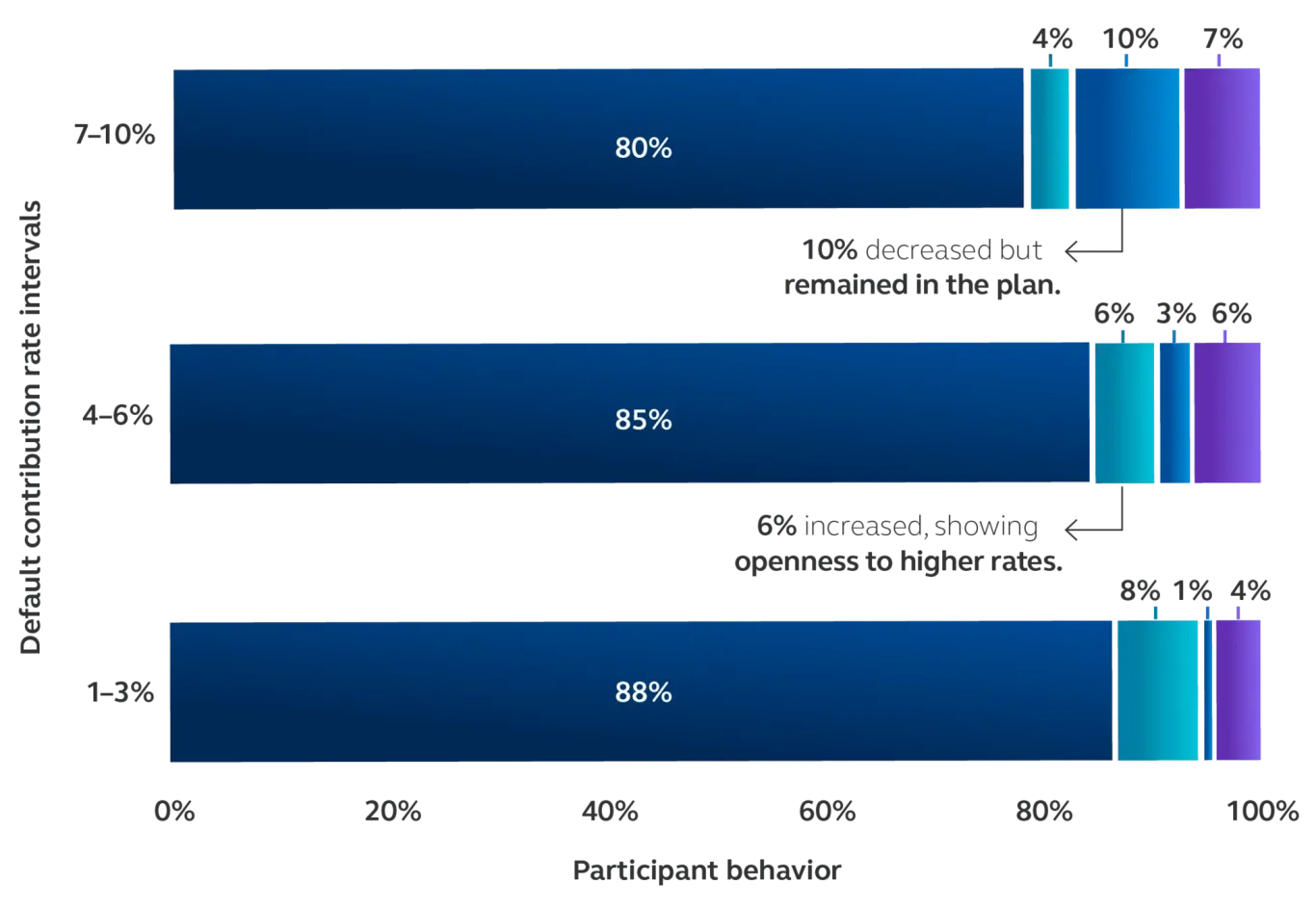

The default contribution rate is extremely important as many participants stay where they start. Low default contribution rates can be particularly problematic for non-desk employees. With potentially less time to save, a 3% default contribution, for example, may not be enough to help them build adequate retirement savings.

It’s important for plan sponsors to work with the recordkeeper to find the optimal default contribution that works for their employee base. Typically, it’s higher than what employers think. Data shows that over 93% of those enrolled remain in the plan even at the higher default rates.

- Remain at default

- Increase deferral

- Decrease deferral

- Opt out to zero

Percent of plans without auto-increase within certain industries:

- 66% Manufacturing—Industrial Products

- 63% Chemicals & Mining

- 76% Building/Construction/Contracting

The 2024 PLANSPONSOR Defined Contribution Survey

While auto-enrollment and the default contribution rate are starting points, they’re only part of the equation. Another component is auto-increase.

Auto-increase is raising an employee’s contribution rate each year, typically by 1%, up to a set amount. Such strategy helps counteract anchoring – where employees don’t move off their default contribution rate.

To get employees saving enough for a secure retirement, Principal® suggests employees save 15% of their income annually, which includes the employee contribution and the employer match or other employer contribution.

For non-desk employees, the intent is to get them to 15% sooner because of the possibility of early retirement. Employees in these jobs typically don’t have the flexibility to work a few extra years to build up their retirement account or increase their Social Security earnings. That’s why it’s important for employers with non-desk employees to consider annual auto-increase of at least 1% to help employees increase their contributions to reach 15%.

98% of participants continue to participate after an auto-increase.

While some plan sponsors believe auto-increase will result in more opting-out of the plan, data proves otherwise. Data shows that after the contribution rate automatically increases, 90% of participants do nothing and only 2% opt out of contributing altogether.

Overall, Principal best practice plan design suggests a 6% default contribution rate along with an annual auto-increase of at least 1%.

We all understand that life happens and saving for retirement can sometimes take a back seat during financially challenging times. That’s when an annual re- enrollment can help get employees ...

- Into the plan if they opted-out of auto-enrollment

- Back into the plan if they stopped contributing, and

- To increase their contribution rate if they decreased it below the default rate

Like auto-enrollment and auto-increase, an annual automatic re-enrollment can serve as a powerful strategy, requiring employees to make an active decision to opt-out of the plan each year.

Implementing automatic enrollment and escalation can be customized to fit an employer’s needs and budget. Using these automated features in retirement plans with a significant number of non-desk employees help employees who can face shorter careers, potentially build a secure financial future.

It’s important to work with a retirement service provider who understands and has the expertise to consult on options that seek to deliver the desired results for both employers and employees. If you’re looking for help implementing automated features, reach out to your Principal® representative. They’ll consult on creating a tailored retirement plan that matches workforce needs using these powerful features. A plan that helps drive participation and improves savings behavior with the goal to facilitate timely retirements.

Get more data-driven insights: The power of automated 401(k) plan features.