Discover how de-risking can help DB plans better withstand market volatility and protect funded status, using a recent market event as a case study.

Recent equity and bond market volatility reminds us that the market cycle persists. But so do the benefits that defined benefit (DB) plans offer to employers and their workforce, including tax advantages, risk pooling, investment quality, and cost structure. One key to maintaining these valuable benefits is to be prepared for a market cycle. Plans that are fully funded, close to fully funded, or even overfunded should consider re-allocating before the next time assets sink and liabilities surge.

When markets move sharply, the gap between assets and liabilities can widen quickly—especially for plans not aligned in terms of asset duration and related liability exposure. One effective way to help protect the DB plan funding is to de-risk—re-allocate the investment strategy to better reflect plan liabilities.

Here’s an example using the recent market volatility to illustrate the difference a de-risking strategy can potentially make.

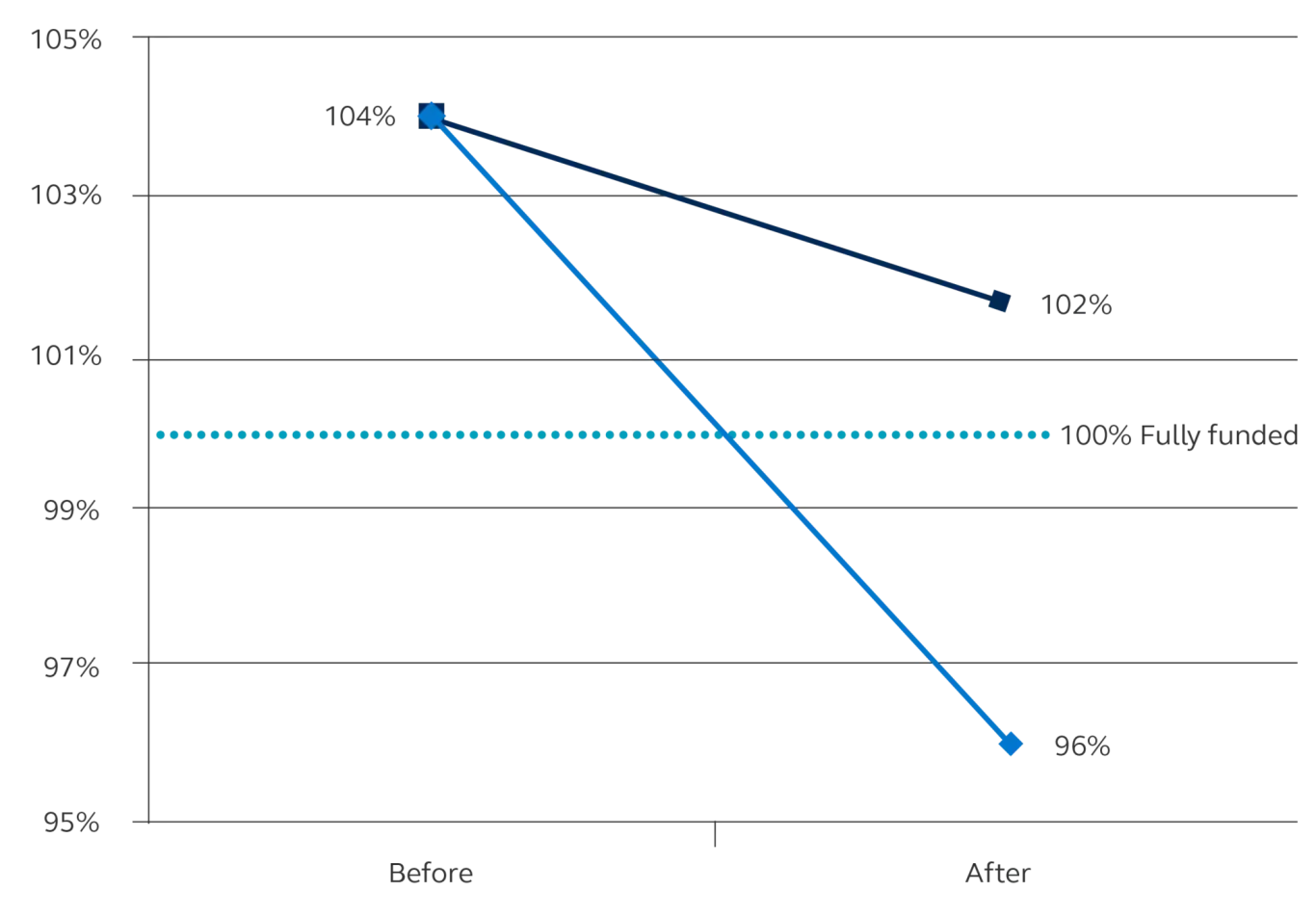

In early April 2025, global equity markets experienced significant volatility. Over just three trading days starting April 2, the S&P Index fell by 10.5%. Simultaneously, U.S. Treasury yields dropped, with the 10-year falling nearly 20 basis points (bps) and the 30-year down 13 bps, pushing liabilities higher for many DB plans.

Consider a hypothetical DB plan with:

- A 104% funded status (mirroring the corporate plan average at the time)

- $104M in plan assets

- A 60/40 equity-to-fixed income allocations

- A liability duration of 12 years

During this short period, the plan’s funding status deteriorated sharply losing over $5 million in assets and dropping its funded status into a deficit of 96%.

What if instead, the plan implemented a de-risked allocation prior to April 2: shifting to a 20/80 stock/bond portfolio, using duration-matching fixed income?

- LDI Hedging

- Traditional

For illustrative purposes only

Assumptions:

- Starting asset: $104 million

- Starting liability: $100 million

- Liability duration: 12

- LDI Hedging: 20% equity/80% duration matched bond

- Traditional: 60% equity/40% core bond

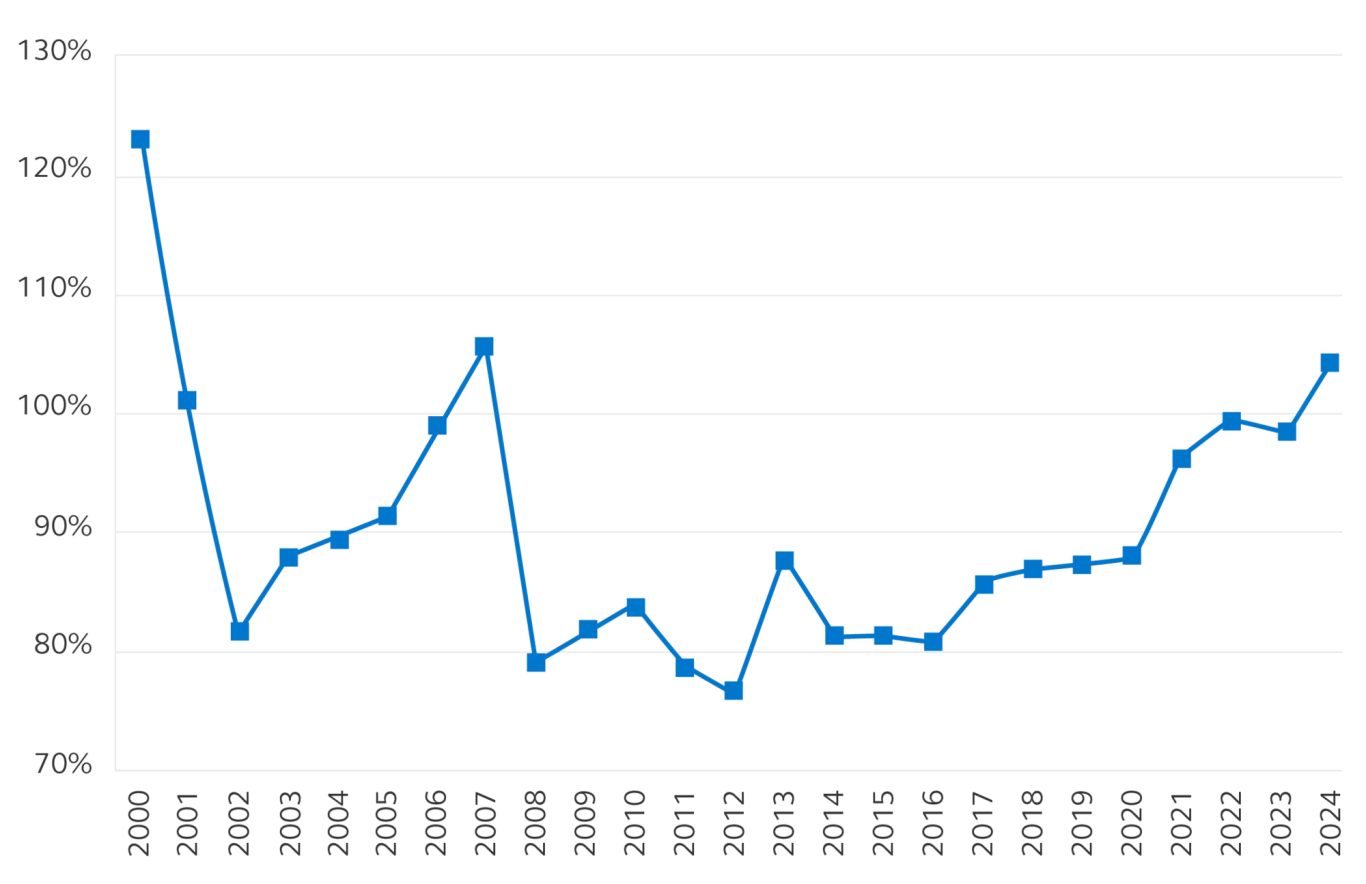

More than 15 years have passed since the financial crisis shocked capital markets, which was particularly hard for DB pension plans. Asset values had dropped, the era of ultra-low interest rates began, liabilities increased, and funding ratios suffered. Since then, strong equity returns, and rising bond yields helped many plans get back to fully funded status. The average corporate plan in the U.S. is now overfunded at 104% (Figure 2).

Defined benefit plans may offer the most efficient way to deliver a retirement dollar, but the most efficient way to invest these assets may be to de-risk so that assets better reflect plan liabilities. There’s no single de-risking blueprint for every DB plan, but it will likely include some level of customization that can:

- Reflect the plan’s specific funded status

- Consider participant demographics and expected benefit payouts

- Align asset duration with liability characteristics

- Account for broader business and risk tolerance

It’s anyone’s guess as to when markets will turn. Timing may not be everything when it comes to adopting liability-driven strategies, but it is important. As markets recover, the expectation is that there will be opportunities again to de-risk.

Taking steps now, while your plan may be fully funded or in surplus, can help protect those funding gains and help ensure your pension remains a strategic asset for your organization.

It’s important to work with a qualified consultant who can help navigate the complexities of a de-risking strategy. Reach out to your Principal representative if you’re considering the next step in a de-risking strategy or want to understand your options. We’re here to help support your plan’s long-term financial health.