The recent market downturn is a stark reminder of the importance of using a strategy that seeks to lock in gains and reduces investment risk when the timing is right.

Key Takeaways:

Over the past two years, DB plan sponsors have typically continued to benefit from a decline in liabilities driven by higher long-term interest rates. Despite this improvement, many have been reluctant to de-risk their pension portfolios. Instead, they have maintained significant allocations to return-seeking equity investments, experiencing asset growth alongside falling liabilities. As a result, the average funded ratio of pension plans reached 105% as of December 31, 2024, according to the Milliman Pension Index.

These gains have been beneficial to the funding health of pensions, however the market volatility to start the second quarter of 2025 has highlighted the potential risks in high allocations to equities. Plan sponsors might want to consider improvements in funded status as an opportunity to reduce investment risk by reallocating equity-like exposure to fixed-income assets aligned with long term interest rates. This strategy can help secure funded status gains and mitigate asset-liability mismatch risk.

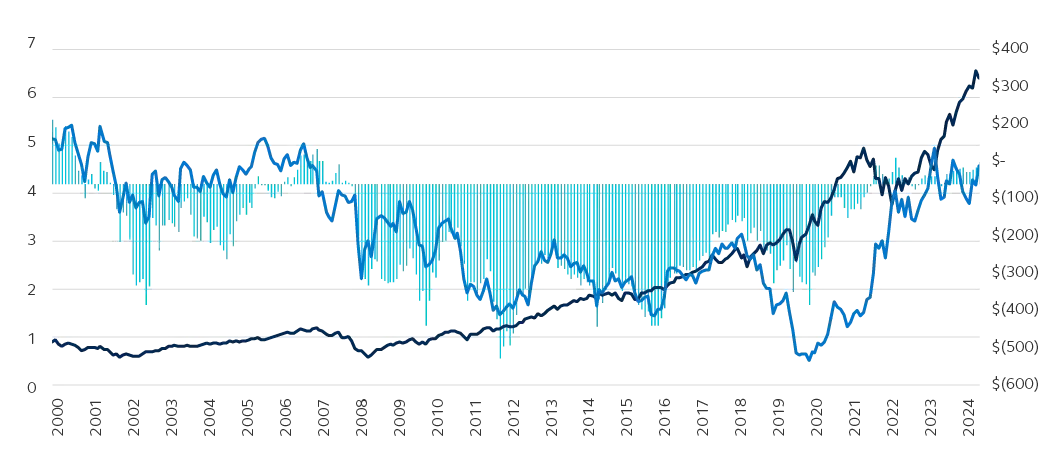

The key driver of funding improvements over the past three years has been rising long-term interest rates rather than asset returns alone. Consider that before this recent period, pension plan sponsors endured 15 years without higher average funded ratios. This was despite a number of record bull markets that resulted in better than average returns on investments. The reason was the persistently low-interest rate environment that continued to raise liability valuations at a greater rate than asset returns.

When designing pension investment strategies, it’s crucial for plan sponsors to recognize that long-term interest rates are a primary investment-based risk factor influencing liability values. Even small fluctuations in these rates can result in significant changes to pension liabilities. We view this as an uncompensated risk, much of which we believe should be hedged within an asset allocation strategy.

- Milliman pension surplus/deficit (RHS, $ billions)

- S&P (LHS, $)

- 10-year rate (LHS, %)

As of December 31, 2024. Source: Principal Asset Management, S&P 500, Milliman Pension Surplus/Deficit.

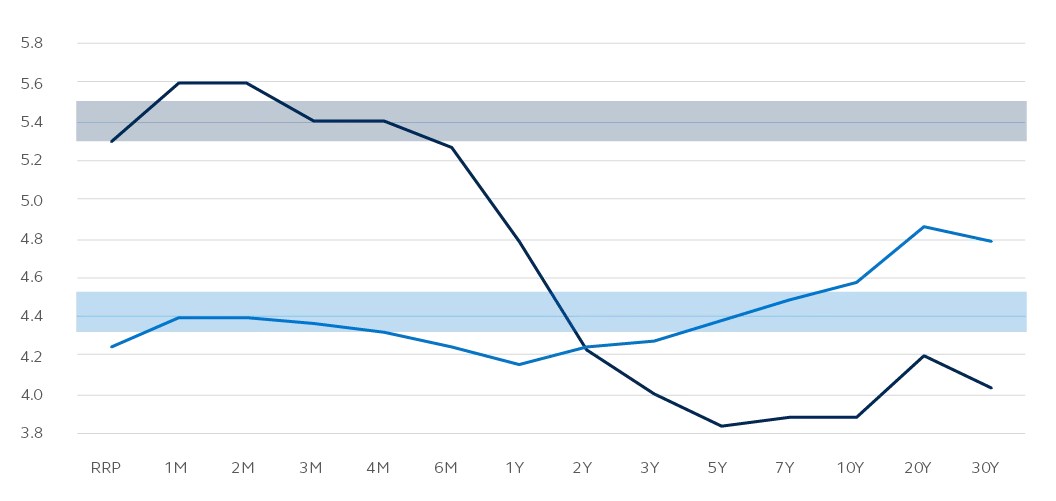

The graph below compares the U.S. Treasury yield curve at the end of 2024 (blue) and 2023 (black). While Fed rate cuts last year are evident on the short end, the long end remained less responsive, resulting in higher long-term rates. This shift, which impacts pension discount rates, pushed year-end 2024 rates over 60 basis points above 2023 levels.

- Interest Rates 12/31/2024

- Interest Rates 12/29/2023

Source: U.S. Treasury Yield Curve. The data on this website is a compilation of figures from various publicly available sources. Treasury yield curve data from 1990 to present is collected from the Treasury Department website and represent market rates as calculated by the US Treasury Department at the end of day.

As of January 2025, the Federal Reserve has kept the federal funds rate unchanged while signaling the possibility of at least two rate cuts during the year. However, short-term rate cuts have not impacted long-term bond rates as much as one would think, so uncertainty remains.

Several factors suggest that rates could decline as investors increase their allocations to long-term bonds. To safeguard funding gains, pension plan sponsors should consider taking preemptive measures. Several key factors could influence long-term rates in 2025:

- Shifting Investor preferences toward long-term bonds: Investors have focused on short-term bonds due to their higher yields, but as the yield curve normalizes, higher long-term bond yields could drive pension investors to extend the duration of their fixed-income holdings.

- Recession risk and a flight to safety: Historical patterns indicate that recessions have followed the return of a non-inverted yield curve, as seen in 2008 and 2020. If a downturn occurs, investors may pivot toward lower-risk assets like long-term bonds.

- Equity market uncertainty and Increased Interest in de-risking: Equity market uncertainty has persisted since the start of 2025, which may encourage more investors to seek less investment risk, exerting downward pressure on long-term interest rates.

Recognizing that pension plans vary in liability structures, risk appetites, investment objectives, and governance, it is essential to develop a customized LDI strategy tailored to specific needs.

A well-structured LDI strategy typically starts with high-quality public market credit and low-risk assets such as Treasury bonds, STRIPS, and interest rate derivatives. These instruments can be optimized to align with the liability term structure, helping to effectively mitigate risk and ensure long-term financial stability.

As the investment environment evolves, plan sponsors must remain proactive in assessing risks and opportunities, helping ensure that their strategies remain aligned with long-term objectives.

Short-term economic forecasts can be unpredictable, making it essential for pension plan sponsors to approach risk management decisions with careful analysis rather than relying solely on market sentiment. A strategy tailored to their specific circumstances and long-term objectives is key to helping navigate uncertainty effectively.

Successful de-risking requires multiple pension functions working together across a highly coordinated sequence of events where timing is critical. As plan sponsors look to de-risk pensions by coordinating investment strategies with liability calculations, it’s imperative that actuarial and investment resources are aligned.

With current market and interest rates threatening DB plan funding gains of recent years, plan sponsors should reassess investment risk profiles and look for an opportune time to reduce risk with strategy that seeks to lock in their funded status moving forward.

Reach out to your Principal® representative to learn more about derisking a defined benefit plan.