Mike Clark

Consulting Actuary

At the very outset of their mission to return home from Troy, the Greeks in Homer’s The Odyssey encounter a significant obstacle, albeit a very pleasant one, on the island of the lotus-eaters.

The fruit of the lotus trees was sweet and delicious, so much so that anyone eating it instantly forgot about their lives, families, and objectives. Their only desire was to stay forever on the island snacking in a euphoric haze, destroying any motivation to complete their ultimate quest.

Pension income lotus

The accounting rules for defined benefit (DB) pension plans have created a similarly pleasant trap for unwary plan sponsors of well-funded frozen plans. For years, positive accounting results have become the lotus of many, causing them to linger in a dreamlike state even when assets are sufficient to terminate. Most CFOs would love to end their termination voyage if given the chance, but the sweet taste of annual pension accounting income is just too beguiling. Why make difficult risk transfer decisions when the accounting results feel so good?

(Note: Opening with epic poems and pivoting to pension accounting is what we bloggers call a hook!)

This seems to be particularly true for financial services plan sponsors. Banks and credit unions are usually flush with cash, so funding obligations are not typically the core problem. Their challenge is sensitivity to booking expenses related to the DB plans in their accounting results, so a significant number may have unknowingly fallen under the spell of the pension income lotus.

Expected returns?

There are several elements of US pension accounting that contribute to this dilemma. The first is that plan sponsors are permitted to take credit for “expected” asset returns to offset interest growth on their liabilities. Besides giving incentives for unnecessary risk-taking, expected returns also allow sponsors to enjoy pension-related income even when it’s hypothetical. Return assumptions are often higher than the interest applied to liabilities, so the results can be intoxicating even if a plan isn’t significantly overfunded.

For example, a plan with $100 million of assets and liabilities may expense 5% interest on their obligation, but 6% on the expected return of the portfolio, resulting in an easy $1 million income. Sit under a shady tree and enjoy!

Lack of recognition

Perhaps more impactful is the concept of unrecognized net losses (usually the most significant component of “accumulated other comprehensive income” or AOCI). AOCI incorporates the compilation of gains and losses over time from several sources including actual investment performance different from expected, movement of the discount rates, and other changes in actuarial assumptions and demographic experience.

Most US plans are carrying around a significant reservoir of unrecognized losses, which must eventually be offset with future gains or recognized as expenses. Only the latter is fully under a plan sponsor’s control.

Time to settle up

Theoretically, pension income lotus-eating could continue indefinitely if not for US pension accounting settlement charge rules, which require expensing of unrecognized loss proportional to the percentage of plan liabilities settled through lump sums or annuity purchases.

Since termination settles 100% of plan obligations, the final settlement charge is equal to the entire outstanding AOCI plus the difference between the actual price of termination and the accounting liability being carried on the books. This could be a painful shock to those not accustomed to recognizing any pension-related expenses.

Changing one’s diet

Instead of feasting on empty calories of tasty pension income, plan sponsors may need to begin choking down higher annual expenses each fiscal year. Like a yucky green smoothie, it may not taste as good now but could provide long-term accounting health benefits.

To that end, I present these four dietary tips to assist with your AOCI escape.

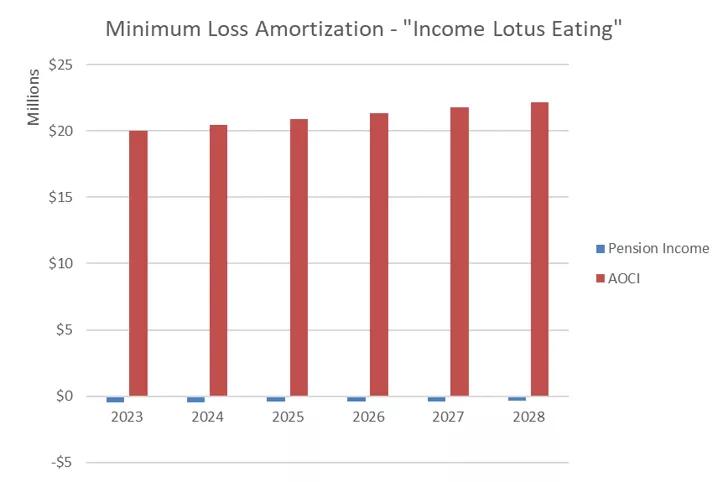

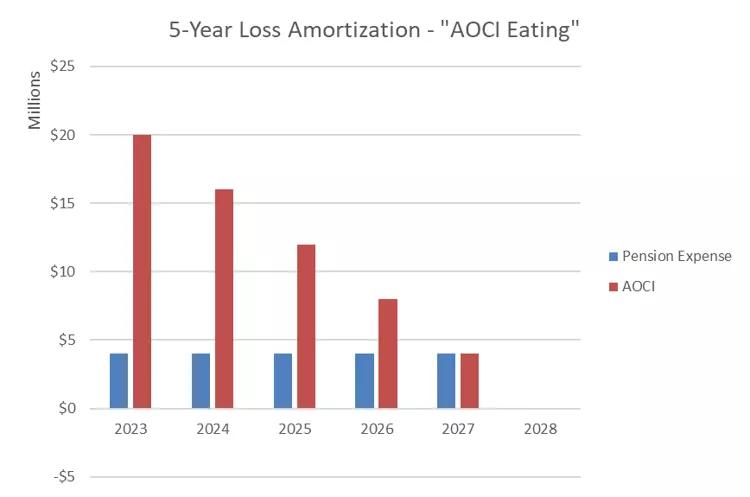

1. Accelerate recognition of AOCI – Most plans recognize only a small portion of net loss above the 10% corridor (that is 10% of the greater of plan assets or liabilities) each year, which has little effect on outstanding AOCI. A shorter amortization schedule, such as a decreasing five-year period, evenly spreads cost over a known time to leave a much more manageable settlement charge at termination. See the example below.

2. Interim settlements – Accepting smaller settlement charges on the way toward termination through interim lump sum payments or annuity purchases leaves less AOCI at the end of the road.

3. Expect less – Using a more conservative expected return assumption increases the probability that actual returns clear the hurdle and generate gains instead of losses.

4. Don’t lowball the accounting liability – The true cost of termination needs to be booked eventually through settlement, so plan sponsors may want to start recognizing that liability now and booking the charge through annual expenses.

These are admittedly difficult steps for those who’ve gotten used to pension accounting bliss and their implementation may cause discomfort. Much like how Odysseus’ crew likely complained as they were dragged back to their ships. But if the voyage to termination is ever to be completed, the first step must be to escape the land of the pension accounting lotus-eaters!

Mike Clark is a fellow of the Society of Actuaries (SOA) and a member of the American Academy of Actuaries (AAA) who specializes in guiding plan sponsors through their pension risk odysseys.