Mike Clark

Consulting Actuary

It’s been only eight years, but 2013 feels like a lifetime ago in some respects. A quick internet news check for that innocent year reveals a refreshing lack of crises. Headlines include such topics as Duck Dynasty, the rise of “selfies”, and the birth of royal baby Prince George. Nowhere is there any mention of viruses, masks, quarantines, remote work, vaccines, or unemployment.

Over the time it took an exiting middle schooler to graduate from college, the world seems permanently altered. Virtually nothing from 2021 resembled 2013…except for generally spectacular net returns for pension investors!

Driven by easy money government policies and the economic rebound from COVID’s first wave, U.S. equity prices typically soared in 2021; the S&P 500 returned over 28%1 for the year as bond rates edged higher. As a result, risk seeking pension investors generally experienced the largest net returns of assets over liabilities in 57 pension blogs.

2021: A rare outlier

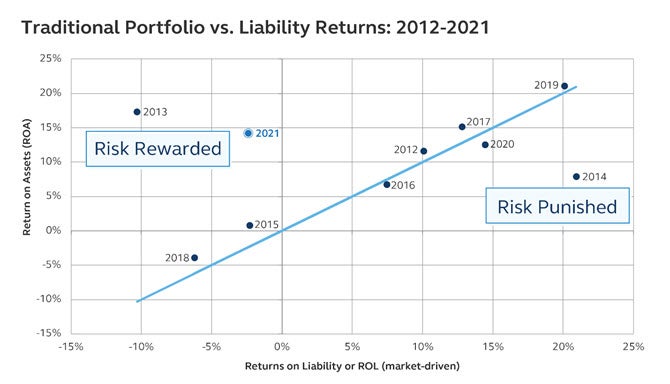

The chart below provided to me by the Principal® actuarial research group shows the annual returns of a typical “traditional” pension investment portfolio made up of 60% equities and 40% core bonds. The vertical distance between each point and the blue line representing liability returns for a typical pension plan reflects the net return for each year (marks above the line represent represent assets outperforming liabilities).

Over the past decade, 2021 traditional allocations experienced the best net return by far (approximately 16%) than any year except 2013. Both years were marked by strong stock returns and rising bond rates (though both were slightly better back in the day of Candy Crush).

Net return game

And net return is the game for pension investors. The highest positive gross return on the chart actually occurs in 2019, but few people may have noticed because sharply dropping interest rates caused liabilities to keep pace and push net returns toward zero. Indeed, risk seeking has produced very little results in seven of the past ten years.

Risk was richly rewarded in 2021. Last year’s positive net returns have quickly increased funding ratios for many plans by 10% (give or take). This generally suggests reducing future net investment risk by increasing long bond holdings, but the uniqueness of the age may drive sponsors to different corners on this question.

Hangover: Part II?

Those happy with their current funding ratios have an opportunity to lock them in now with duration matching bonds (“liability matching investments” or “LMI”). But those still wanting net returns may be reluctant to “go long” due to historically low bond yields, inflation, and Fed commitments to taper bond purchases and increase short term rates.

There are only two ways to generate positive net returns: gross earnings from return seeking investments or leveraging the duration of fixed income holdings against liabilities as rates rise. Unfortunately, both of these come with similar risks of negative net returns should markets move in a less favorable direction.

Today’s swirling uncertainty will make risk management decisions more challenging than usual, but history suggests that sponsors assessing their options in 2022 should do so rather quickly. Funding ratio gains are often fleeting. A final look at the chart shows the net return party of 2013 was immediately followed by the hangover of 2014, quickly erasing half the previous year’s gains.

A repeat of that could really cramp a sponsor’s Gangnam Style!