Mike Clark

Consulting Actuary

When the latest round of pension relief was signed into law in late 2021, many thought they’d seen the last of minimum funding concerns for a while as liability volatility was effectively neutralized for a full decade.

But there are two sides to every story—and pension funding valuation. As liabilities continually hogged the spotlight over the years, assets sat forgotten in the wings as portfolios cranked out mostly positive returns, but that could be about to change.

Return of negative asset volatility

Through June this year, a typical traditional pension asset allocation of 60% equities and 40% core bonds has shed about 16%, a tough hangover after posting positive returns around 13% in each of the prior two years1. If things don’t improve soon, pension investors are likely on their way to the worst gross returns since 2008.

To protect against asset volatility like this, single employer defined benefit (DB) pension plan sponsors are permitted to use “smoothed” assets instead of market values in their annual funding valuations (to “smooth” market value gains and losses over two years).

This smoothed asset value is often referred to as an “actuarial” value of assets. Read on to see why many pension actuaries may be distancing themselves from this association come next year.

Anatomy of a smoothing

Here’s a rough idea of how smoothing works. (See what I did there?)

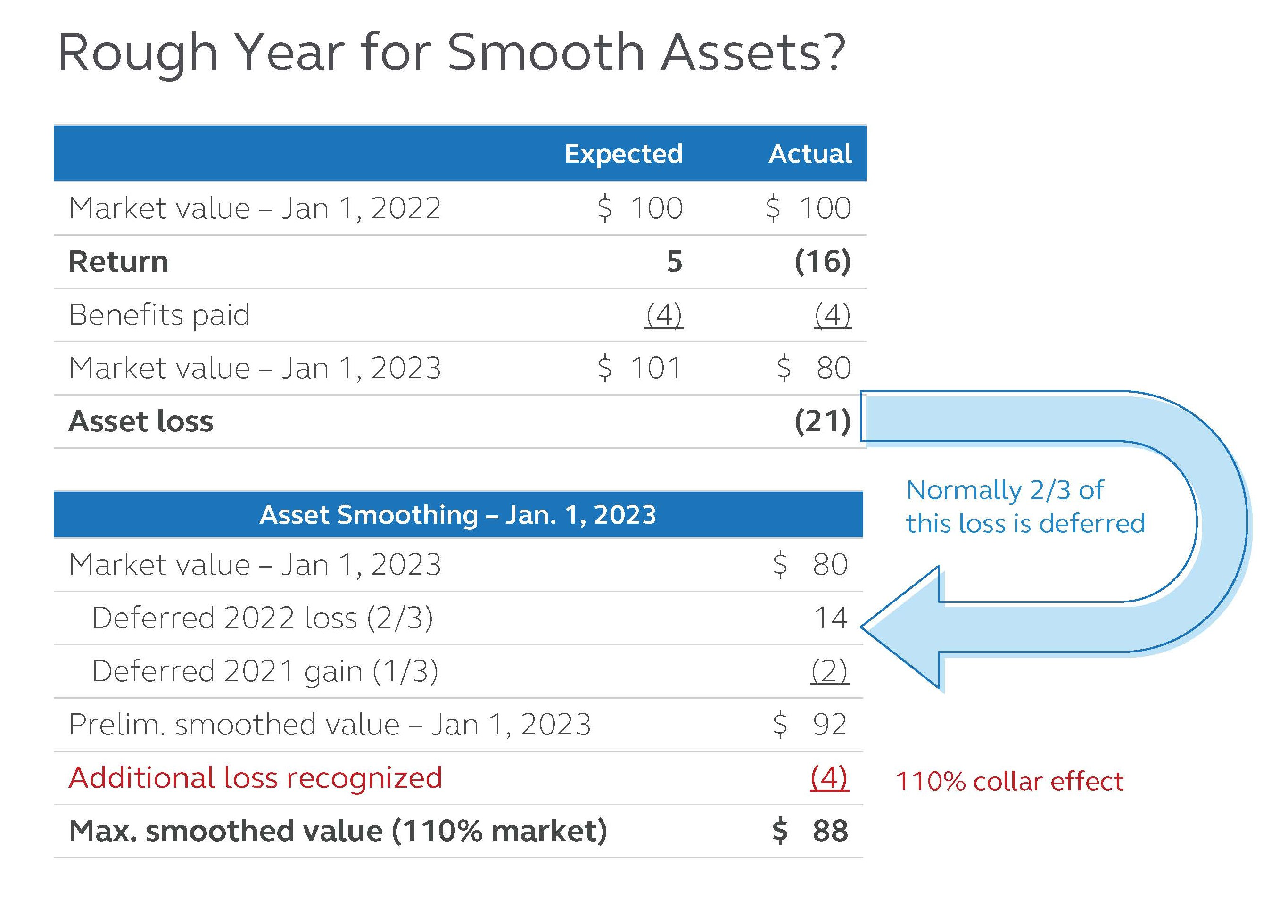

Each annual valuation, the plan actuary calculates an expected asset return based on the prior year’s market value and assumed return rate. (A maximum rate is set by law: 6.11% for 2022.) The difference between this expected return and the actual market return is recorded as a gain or loss, which is recognized gradually over two years. One-third is recognized immediately, and an additional one-third in each of the following two valuations.

The smoothed value is equal to the market value adjusted for unrecognized gains and losses from the past two years. Unrecognized gains are subtracted from market, and unrecognized losses are added back. The end result is a general dampening of market value peaks and troughs, usually keeping the smoothed asset relatively close to market but with less volatility. That could be good news for 2023, but there is a significant catch.

Collared!

An important legal detail left out until now is that smoothed assets must fall between 90% and 110% of market, effectively applying a 10% collar around the smoothing math. (This collar was 20% under pre-PPA law.) The collar only arises when gains or losses are very large, so it hasn’t been in play recently. Indeed, its very existence may have slipped out of people’s consciousness, but the example below shows why it may come roaring back to life in 2023.

The plan in our example starts 2022 with $100 in assets and an assumed return of 5%. If the plan actually returns -16%, the 2022 asset loss would be $21 (-$16 vs. +$5). Under normal circumstances only $7 of this loss would be immediately recognized in the 2023 smoothed value.

Adding the remaining $14 of deferred 2022 losses back to the 2023 market value of $80, and subtracting the final $2 of deferred 2021 gains, produces a preliminary 2023 smoothed asset value of $92.

However, the application of the 10% collar sets the maximum smoothed value at $88 (110% of the 2023 market value of $80), forcing an extra immediate loss of $4.

Smoothed assets get actuarial

This additional unanticipated loss could be significant as the smoothed (aka actuarial) value of assets drives several critical valuation measurements including:

- Funding target shortfall used to determine minimum contribution for the year

- Adjusted Funding Target Attainment Percentage (AFTAP) used to determine restrictions on lump sum payments

- Designation by the Pension Benefit Guaranty Corporation (PBGC) as a “significantly underfunded plan” triggering costly and inconvenient reporting

Smooth no more

The truth of the matter is, once the 10% collar kicks in actuarial assets aren’t very smooth at all. Market value gains and losses for plans like those in our example are currently hitting the “smoothed” value dollar-for-dollar (as opposed to 33 cents).

And if things don’t turn around soon, 2023 could bring some rough results for unsuspecting plan sponsors, including a possible sudden reemergence of minimum required contributions.