As an employer in the U.S., you have a remarkable opportunity to help your employees feel more financially secure, leading to better retention and engagement.

4 min read |

Your employees put in their hours. You pay their wages and salaries. That’s the deal, right?

Not entirely. From workplace benefits to development opportunities to hiring practices, employers have a significant impact on employees feeling financially included, which can bolster greater economic development and community progress.

Financial inclusion means people have access to useful and affordable financial products and services to meet their needs—from savings, credit, and insurance to education and advice.

And people depend on those employer initiatives. In the U.S., employer support is a core driver of financial inclusion for employees.1 In fact, workers cite their employers as their top source of financial support (over the government and financial system).2

Americans feel increasingly financially unprepared

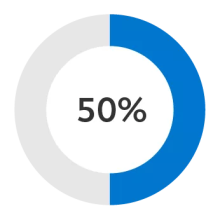

The problem? Americans are feeling less financially prepared for their futures, with 12% fewer saying they feel financially included than in 2022.2 And only half believe they can reach life goals such as buying a house, paying for a wedding, or raising children.2

of Americans feel they can reach financial life goals.2

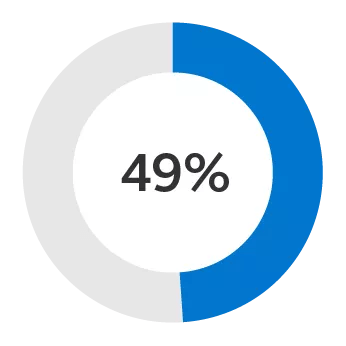

Women are especially feeling left behind by the three main pillars used to measure financial support (government, financial systems, and employers).

Feel financially included in the U.S:2

Feel financially included by employers:2

This is causing worry: More than half of employees are increasingly stressed about money. This jumps to 61% when looking at just women.3 A key driver is the current state of the economy. Employees say inflation/rising cost of living is the top contributor of worsened mental health.4

We know you care about your employees—and that may be enough incentive itself to act. But you may also be interested to know that research shows financial stress impacts employee retention and performance: Financially stressed employees are three times less likely to stay with their current employer and six times more likely to have troubled relationships with coworkers.5

Financially stressed employees are:5

6x

more likely to have troubled relationships with coworkers.

3x

less likely to stay with their current employer.

So, what can you do to start closing the gaps? Explore eight areas where you may be able to move the needle.

1. Offer solid retirement benefits.

Saving for retirement is the foundation of long-term financial security for Americans. Sponsoring a plan like a 401(k) opens doors for people to start saving and reaping tax benefits.

Add auto features. It’s common for businesses to auto-enroll employees and auto-increase their contributions to help them establish healthy savings and investing habits.

Match contributions. Offering an employer match incentivizes employees to save while helping build their balances.

ON A BUDGET?

Take advantage of new policies and tax credits. The SECURE 2.0 Act of 2022 aims to reduce barriers to offering new plans, including tax incentives to defray your initial costs.6

of Americans feel they have good access to high-quality investment products, like a 401(k).2

No. 1 workplace benefit employers plan to increase to retain employees: retirement plan contribution matches.3

Employees cite retirement plans as the No. 2 most important workplace benefit (after health care benefits).7

Explore retirement plans

2. Educate employees via a financial wellness program.

Well-informed financial choices depend on education. Whether your employees seek basic financial literacy skills or detailed investment advice, a financial wellness program can help.

Fill employee needs. Some programs focus on access to valuable content and resources. Others incorporate financial advice. Survey your employees to determine what they need most.

Spread the word. Your employees may have different learning styles, work schedules, and levels of expertise. Tailor your program based on employee input.

ON A BUDGET?

Add a program for free. A basic financial wellness program may come packaged with your retirement plan at no additional charge.

A gender gap exists between people who feel they have good access to financial education:2

Don’t know where to start? Ask.

Rather than making assumptions, ask your employees what workplace benefits would be meaningful to them—either through discussions or surveys that are representative of your employee base (in ages, genders, types of roles, family situations, etc.).

Initiatives like this demonstrate a commitment to creating a workplace where employees are positioned to do their best work.

3. Keep the paychecks coming in times of change.

Nothing interrupts someone’s financial trajectory like suddenly leaving the workforce to care for themselves or a loved one. Sometimes circumstances are beyond an employer’s control. But the right workplace benefits can make all the difference.

Offer parental leave. Paid maternity and paternity leave supports families who can’t afford unpaid time off and eases the transition to parenthood, helping retain employees.

Prepare for the unexpected. Supplementing paid family and medical leave and state disability insurance with group disability insurance, group critical illness insurance,* and group accident insurance can help protect employees’ income.

Protect employees’ families. Offering life insurance gives employees an opportunity to protect their families and manage expenses if something were to happen to them.

ON A BUDGET?

Share some of the costs. Employers can pay for all, part, or none of an insurance premium.

When it comes to ethical responsibility, business owners say disability insurance and critical illness and accident insurance are the top 2 most important benefits, respectively.3

Explore group insurance benefits.

4. Know how your employees’ wages stack up.

Offering competitive, livable wages is easier said than done, we know. But it’s arguably the most direct driver of financial inclusion.

Identify gaps. Whether or not you can adjust wages now, assess where you stand using industry benchmarks. Make a plan to help close any gaps.

Add it up. Compare your employees’ wages to your local living wage. Note that a living wage covers housing, health care, food, education, regular savings, and other necessities.

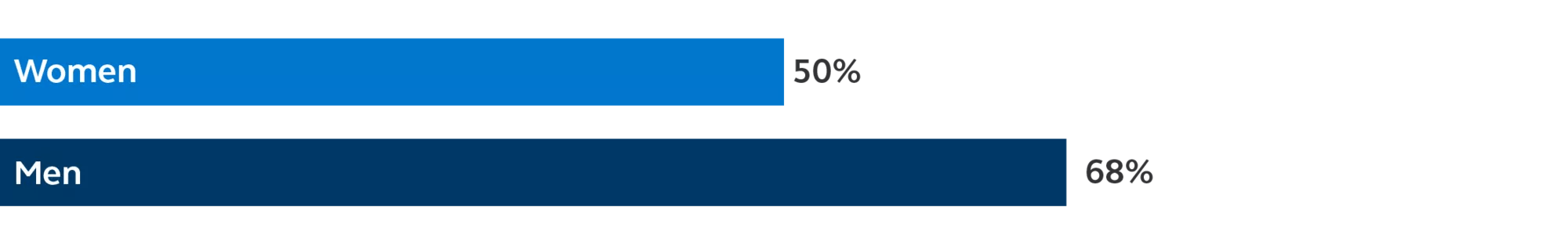

Perceived income opportunity differs by gender. People who think there’s an opportunity to earn a fair wage:2

Find your local living wage.

5. Prioritize inclusive, equitable employment practices.

The Global Financial Inclusion Index shines a light on the barriers women and people of color encounter in our financial system. While you can’t fix the system alone, you can prioritize diversity, equity, and inclusion throughout your workplace, which can make a significant difference.

Promote diversity. If your business lacks diverse talent at all levels, consider how recruiting practices—such as relying on referrals—may limit your candidate pool.

Assess equitability. Ensure not just salaries but also opportunities and promotion tracks are equitable.

Include all. Inclusion goes a step further. Outfit your workplace and train leaders to help all employees feel physically, emotionally, and professionally supported.

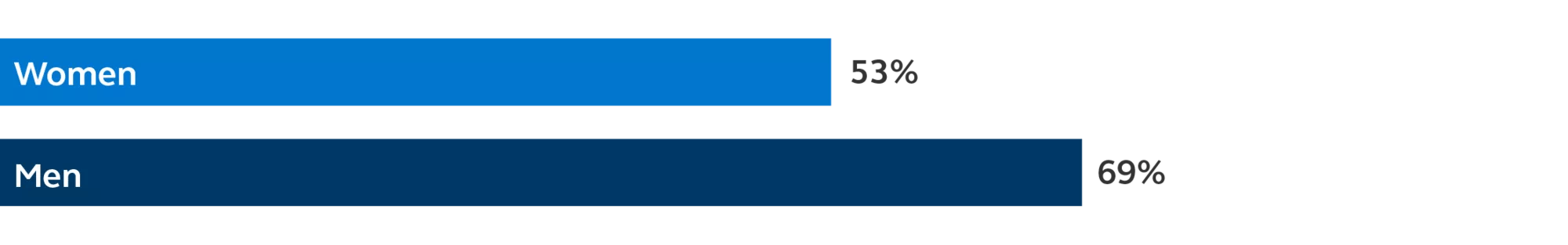

Perceived job opportunity differs by gender.2 People who are confident in their ability to get a job:

6. Champion employee education.

An employee’s qualifications, proficiency, and long-term earnings potential are—generally—tied to their resume. Contributing to the costs of education and training is an investment in talent.

Assist with student debt. Offer relief to employees burdened with student debt by contributing to their payments. Or—starting in 2024—plan sponsors can match loan payments in the form of retirement savings contributions.6

Grow existing talent. Employee development not only helps workers advance in their current roles and keep skills sharp (upskilling) but can also help expand their skill sets to take on different work to fill a business need (reskilling).

ON A BUDGET?

Use available tax credits. Private employers can help employees pay off up to $5,250 in student loans per year tax free.8

7. Support employees’ physical well-being, too.

In the U.S., physical well-being and financial well-being tend to depend on one another. Sponsoring health insurance for employees can help them get the care they deserve without suffering financially.

Think beyond mandates. Even if your business is exempt from health coverage mandates, consider the impact health benefits can have on full- and part-time employees.

Go all the way. Don’t discount the importance of dental and vision insurance, too.

ON A BUDGET?

Use available tax credits. You may be able to deduct up to half of what you pay for a qualified health plan.9

No. 1 workplace benefit employers and employees alike say contributes to financial security: health care benefits.3

Explore group insurance benefits, including vision and dental.

8. Take advantage of public-sector resources and initiatives.

You don’t have to do it alone. Championing greater financial inclusion requires the public sector—federal, state, and local levels of government—to help solve the many gaps identified. There’s work to be done, but many small business resources already exist.

Use available tax credits. Digging through business tax credits available to you may pay off big. Building a retirement plan? Offering health benefits? Credits could cover a good deal of what you pay.10

Apply for grants. Small business grants can also go a long way to supporting research and development, community organizations, and more.11

Providing greater access to financial security will take time.

But the efforts of businesses like yours—together with government initiatives and shifts within the financial system—is the ticket to a more inclusive future and economic progress for society.

What's next?

Visit principal.com/businesses for tools and insights to help solve business challenges.